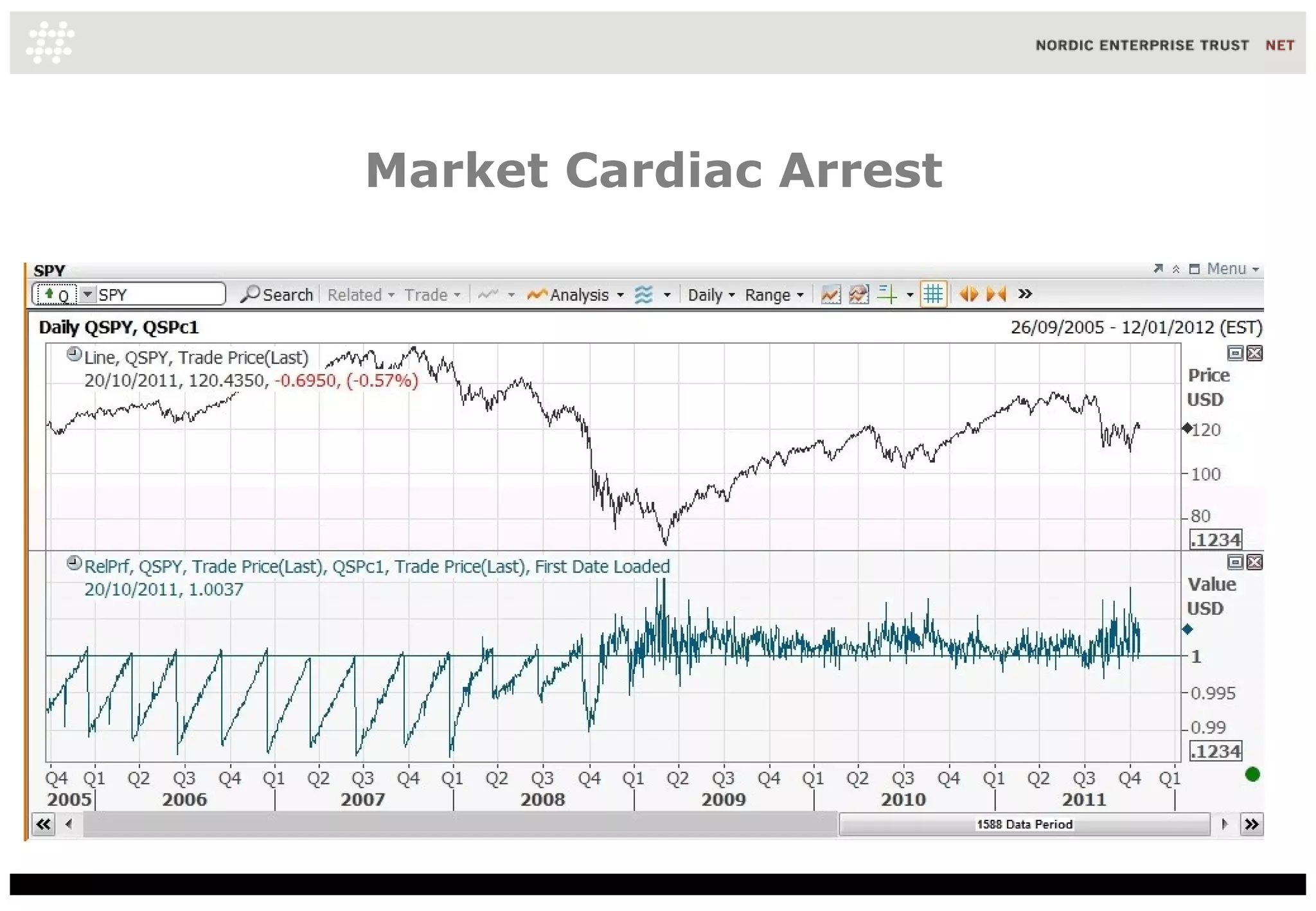

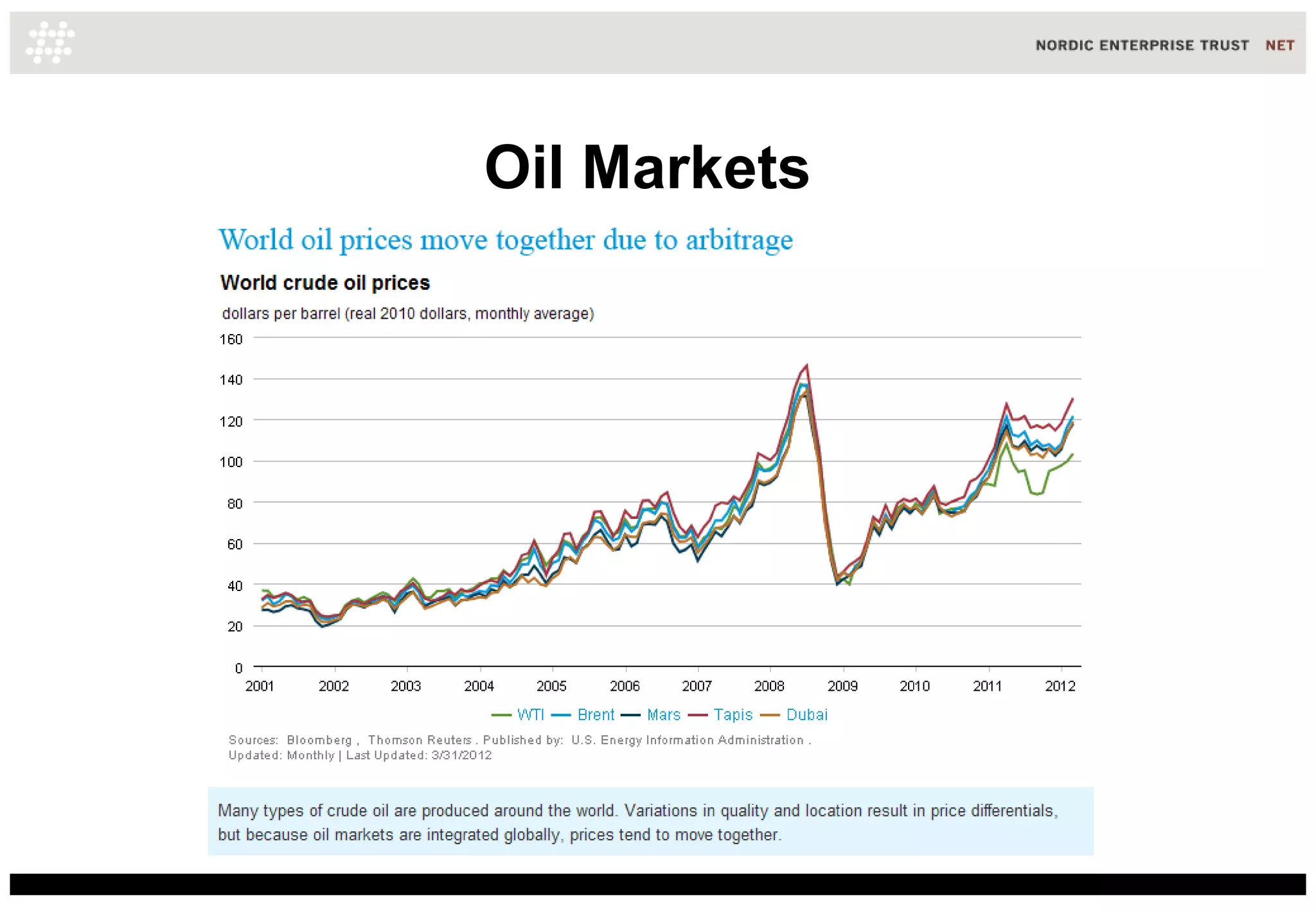

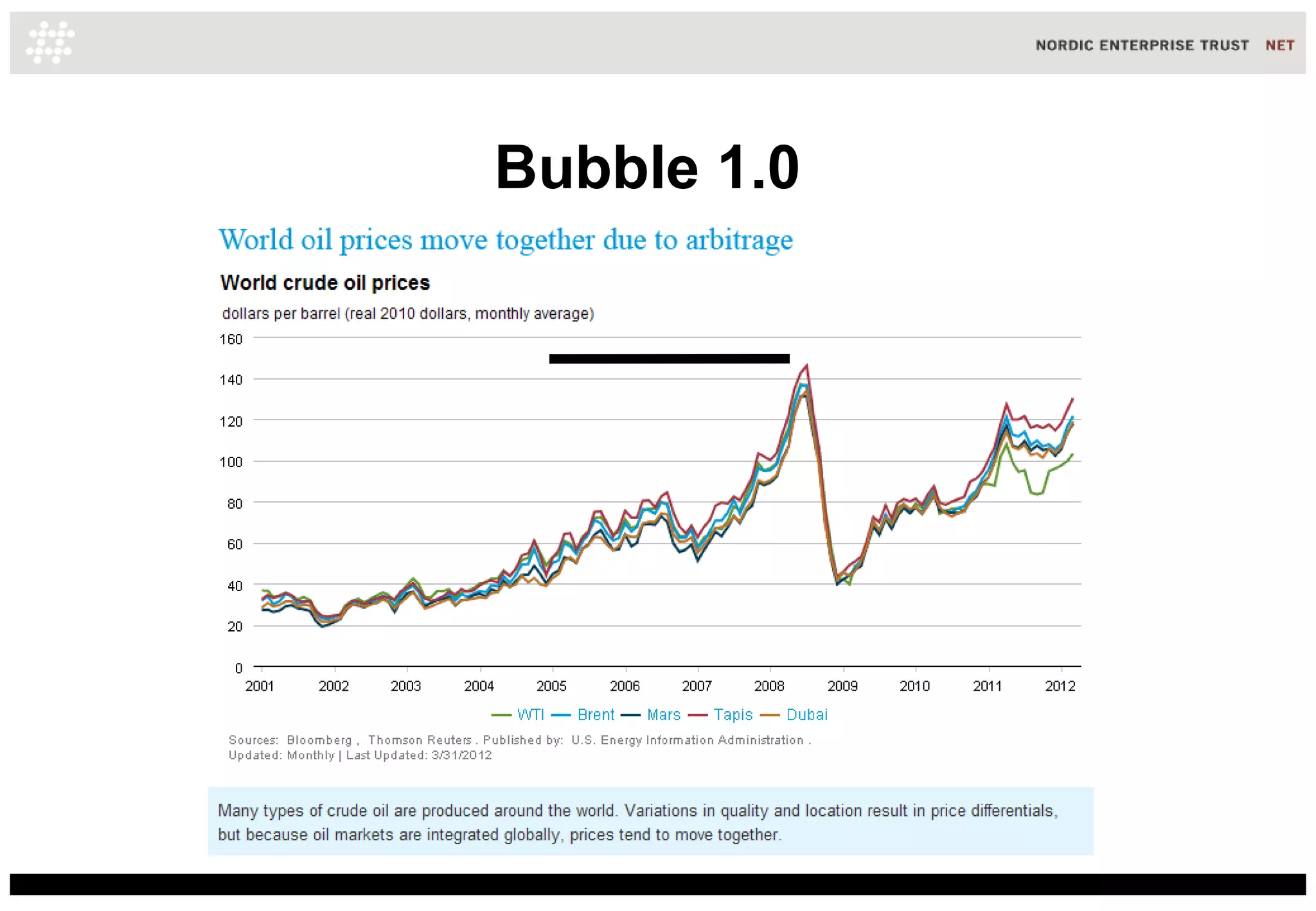

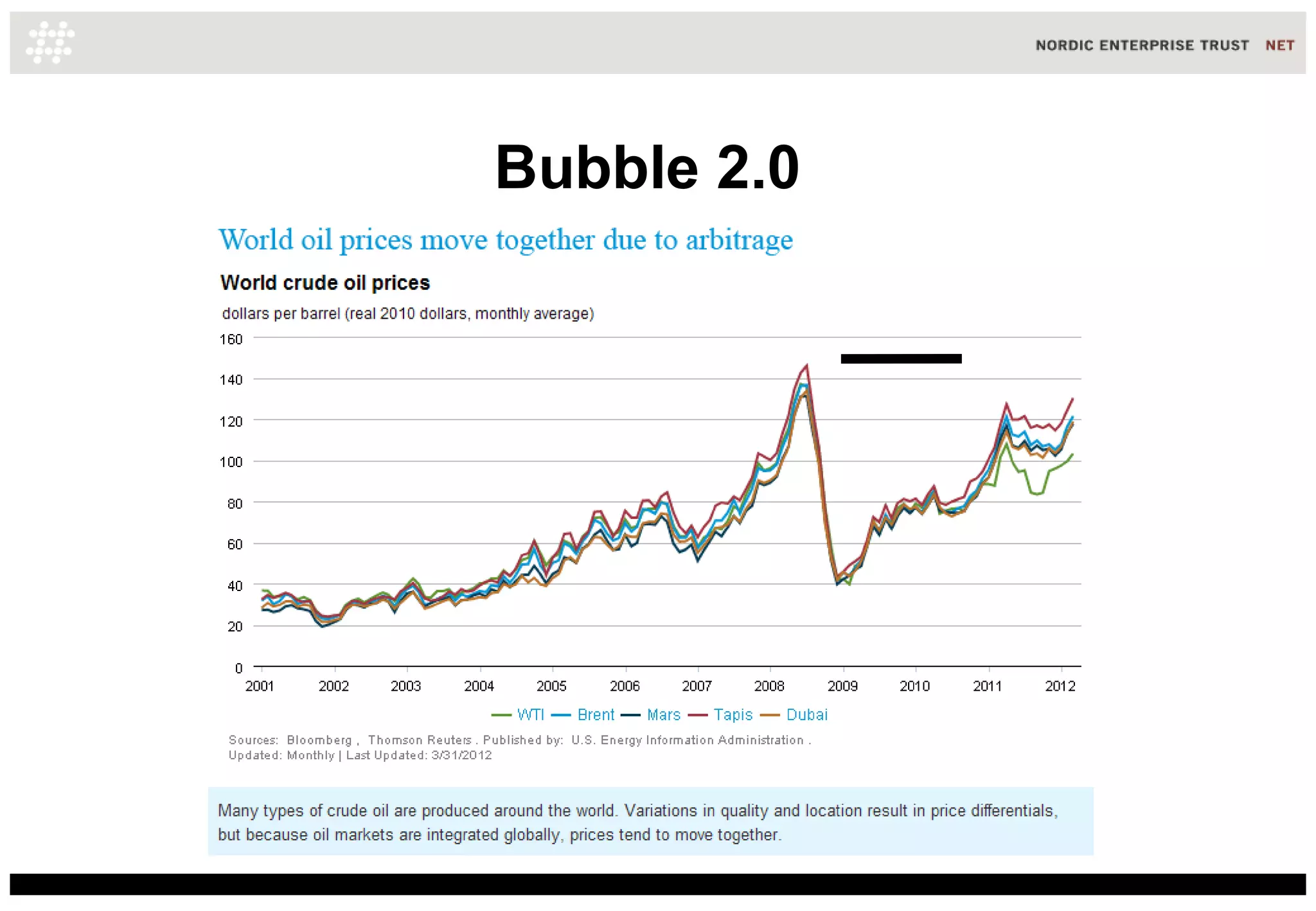

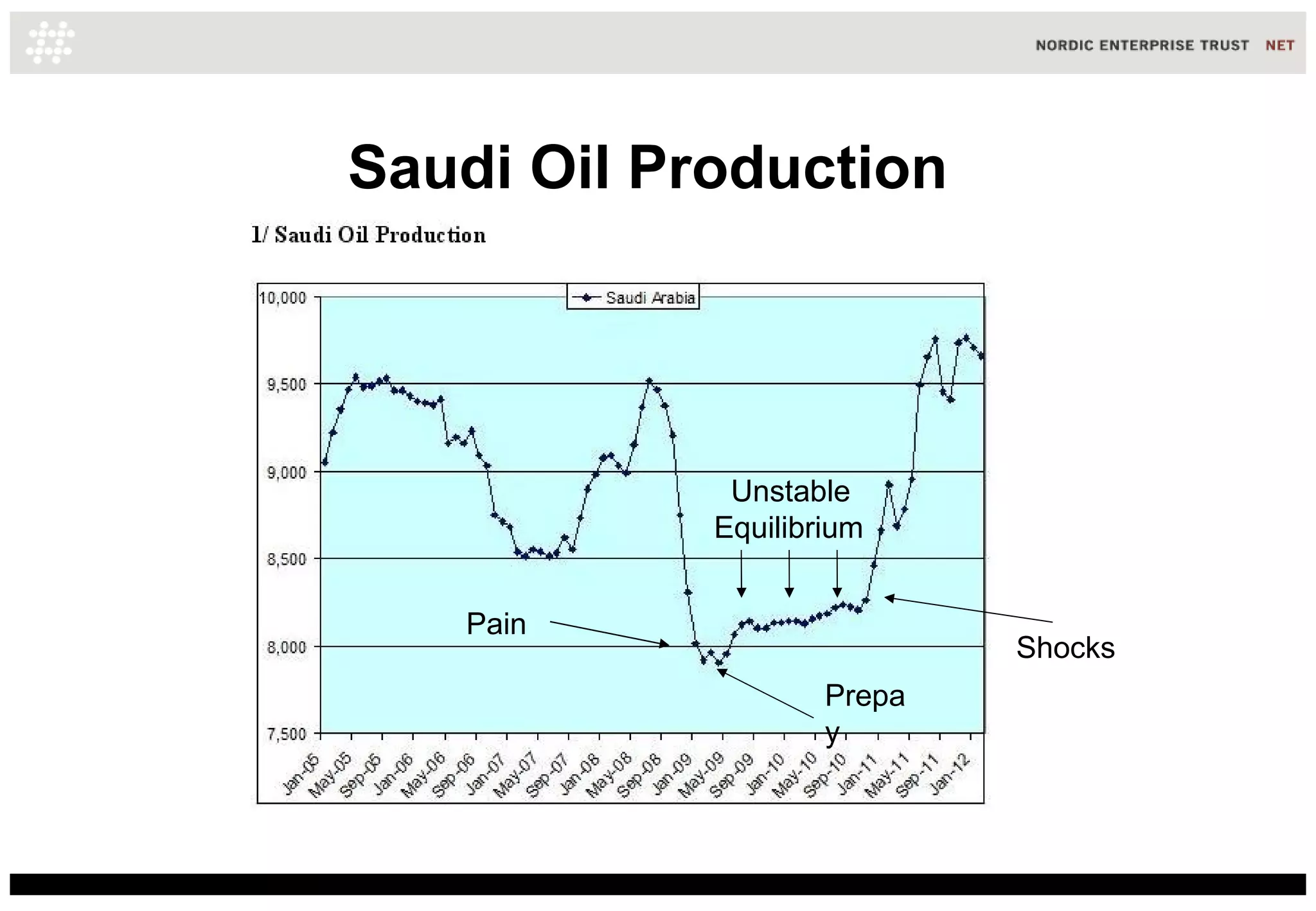

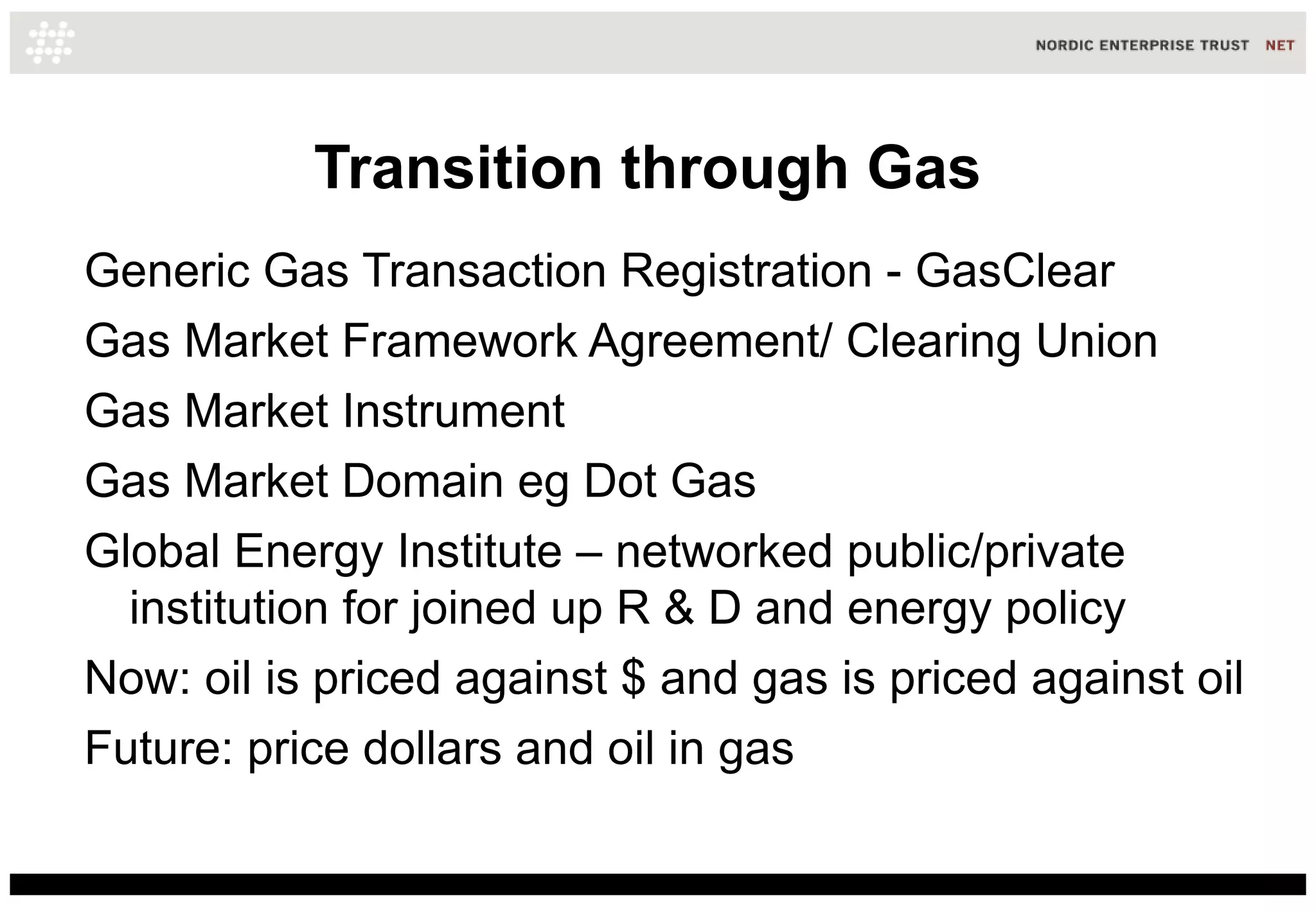

The document discusses the evolution of market systems from Market 1.0 to Market 3.0, highlighting key transitions and crises such as the 2008 credit collapse. It emphasizes the role of financial intermediaries and the impact of quantitative easing and low interest rates on market dynamics, leading to bubbles and price distortions in commodity and equity markets. Future considerations include a shift towards a decentralized and connected market framework, utilizing energy as a metric for investment decisions over traditional currency-based models.