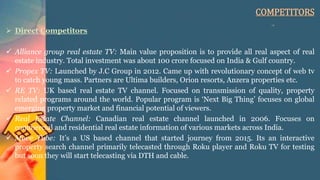

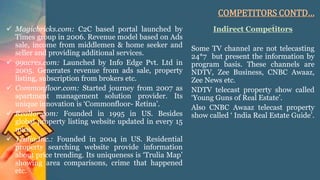

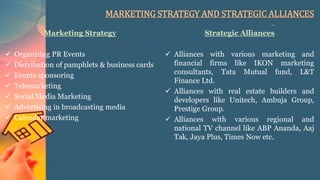

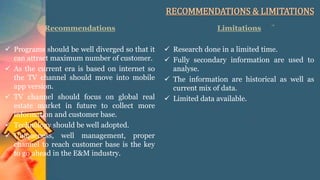

The document analyzes the market and proposes a financial model for a proposed 24/7 real estate TV channel in India. It discusses the company and project background, objectives, value proposition and target market. It also covers the channel's current and proposed programming, competitors in both direct and indirect real estate media, marketing strategy and strategic alliances. The document then outlines potential revenue sources and expenses, provides recommendations, and acknowledges limitations. In conclusion, it finds potential for the channel's growth given trends in India's media and entertainment industry.