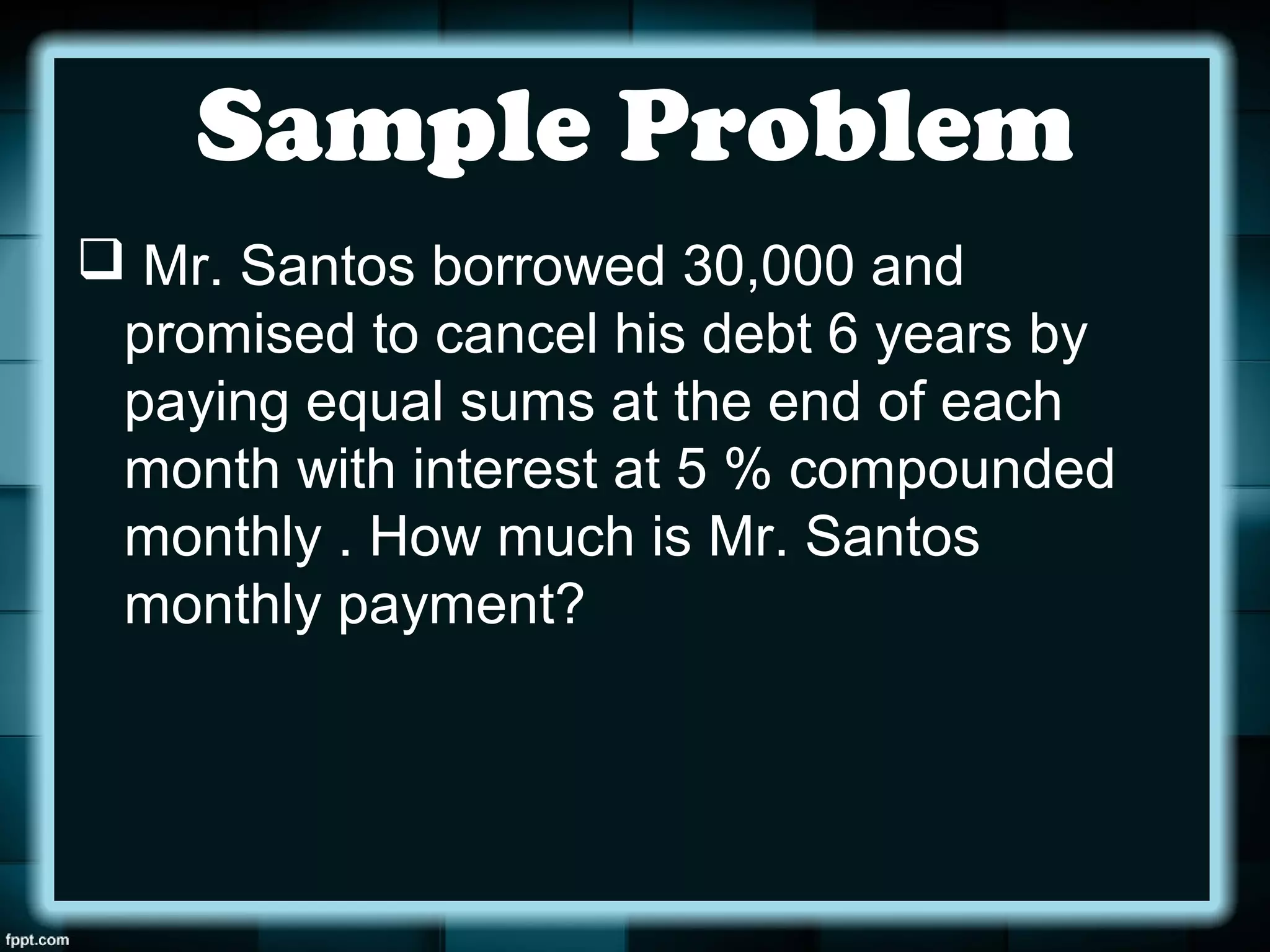

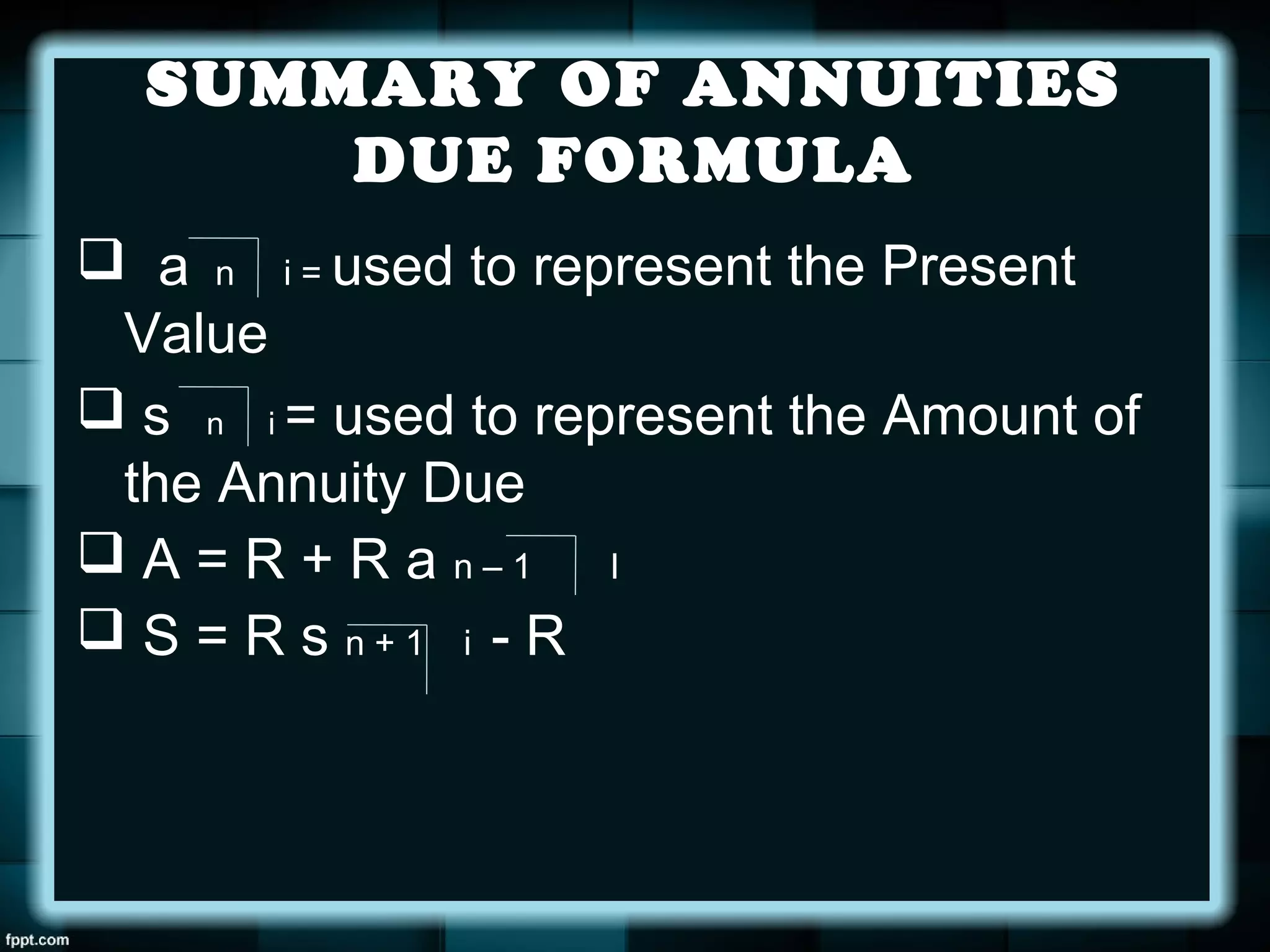

This document discusses annuities and formulas for calculating periodic payments, present value, and accumulated value for different types of annuities. It provides examples of using the annuity formulas to solve problems related to loans, investments, and determining interest rates. Key formulas presented include calculating the periodic payment as the principal divided by the annuity factor, and calculating present value or accumulated value as the periodic payment multiplied by the annuity factor. Interpolation is also described as a method to find unknown interest rates or time periods in annuity calculations.