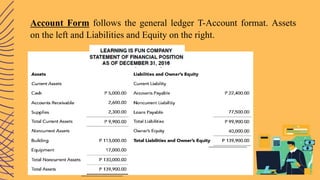

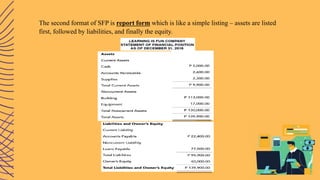

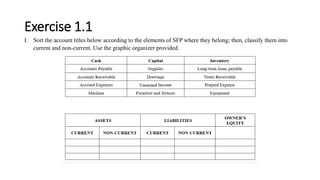

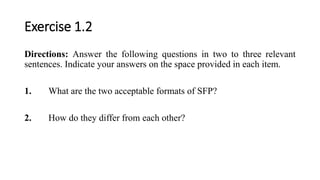

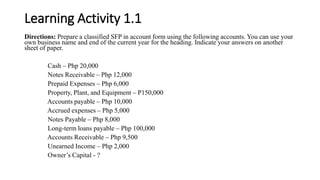

This document provides an overview of the statement of financial position (SFP), previously known as the balance sheet. It defines the SFP and its purpose, which is to present information about a company's assets, liabilities, and equity at a point in time. The learning objectives are to identify the elements of the SFP and prepare it using the report and account forms with proper classification of current and non-current items. The key components of the SFP - assets, liabilities, and equity - are also defined. Finally, exercises are provided to help learners practice preparing an SFP in the account form format.