This document provides an overview of the Tocqueville Value Europe fund. Some key points:

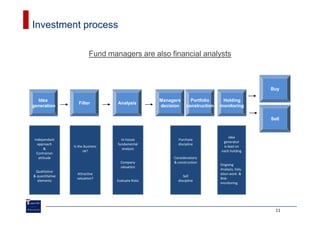

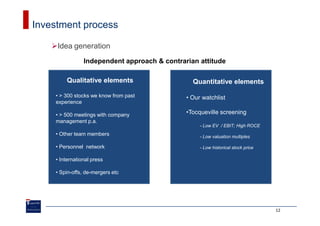

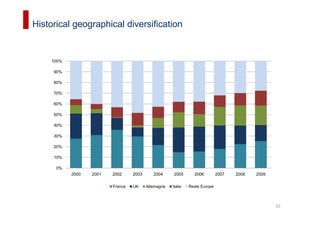

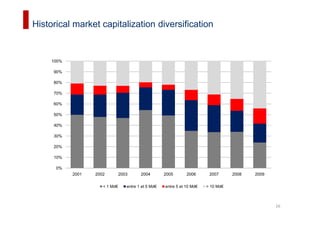

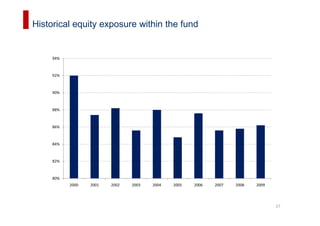

- The fund takes an independent, contrarian approach focused on bottom-up fundamental analysis of European companies across all market caps and sectors.

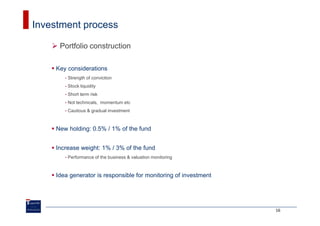

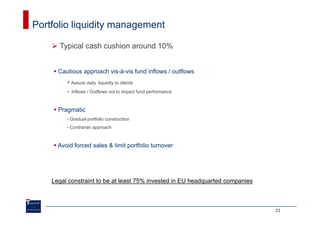

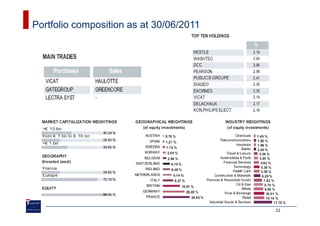

- It aims to construct a diversified portfolio of 50-80 stocks, with no single position over 5% of assets.

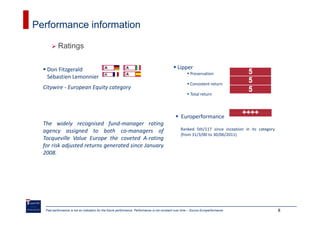

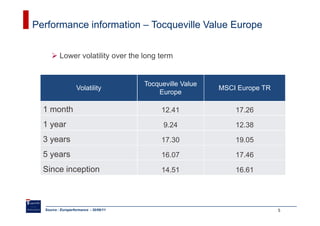

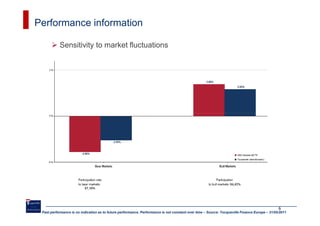

- Performance data shows the fund has achieved lower volatility than its benchmark over various time periods since inception. It has also received positive ratings from analysts.

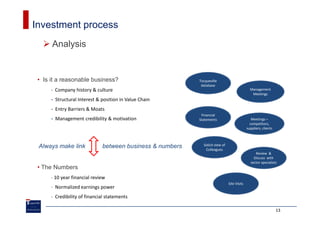

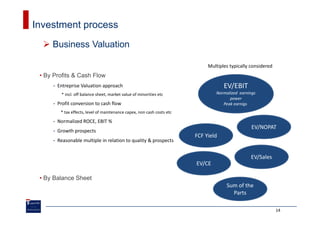

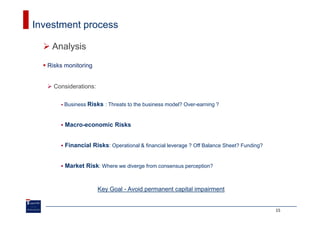

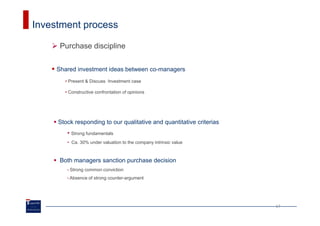

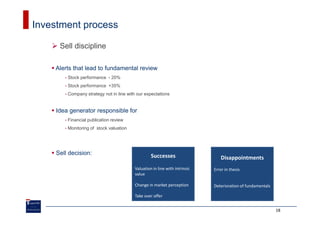

- The investment process emphasizes understanding a company's business quality, evaluating risks, and estimating intrinsic value through financial analysis and management meetings to identify undervalued stocks.

![Performance information

Risk / Reward analysis since inception

Volatility from 31/03/2000 to 30/06/2011 (general or C) [EUR] - Performance from 31/03/2000 to 30/06/2011 (general or C) [EUR]

Past performance is not an indication for the future performance. Performance is not constant over time – Source: Europerformance as at 30/06/11 7](https://image.slidesharecdn.com/fundpresentation-13366617666607-phpapp01-120510095822-phpapp01/85/Fund-Presentation-7-320.jpg)