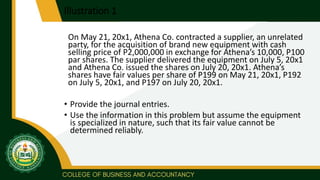

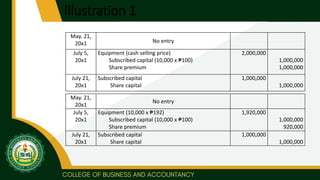

- Athena Co. issued 10,000 shares to a supplier in exchange for equipment worth P2 million. The fair value of the shares was P199 per share on the date of agreement and P192 per share on the delivery date.

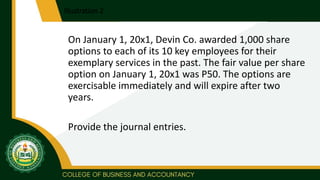

- Devin Co. granted 1,000 share options to each of 10 employees that were exercisable immediately, with a fair value of P50 per option.

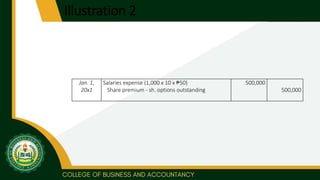

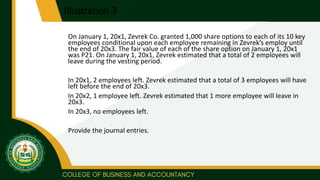

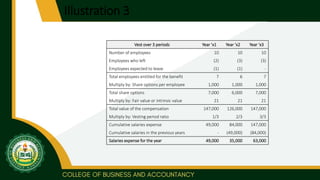

- Zevrek Co. granted share options to employees that vest over 3 years, with salaries expense recognized proportionately over the vesting period based on estimated employee attrition rates.

![Illustration 3

Jan. 1,

20x1

Memo entry

Dec. 31,

20x1

Salaries expense – share options

(10 – 3) x 1,000 x 21 x 1/3

Share premium – sh. options outstanding

49,000

49,000

Dec. 31,

20x2

Salaries expense – share options

[(10 – 2 – 1 - 1) x 1,000 x 21 x 2/3] – 49,000

Share premium – sh. options outstanding

35,000

35,000

Dec. 31,

20x3

Salaries expense – share options

[(10 - 2 - 1 - 0) x 1,000 x 21 x 3/3] - 49K - 35K

Share premium – sh. options outstanding

63,000

63,000](https://image.slidesharecdn.com/sharebasedpayment-230222051821-502146da/85/Share-Based-Payment-pptx-15-320.jpg)

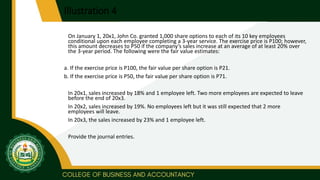

![Illustration 4

Jan. 1,

20x1

Memo entry

Dec. 31,

20x1

Salaries expense – share options

(10 – 1 - 2) x 1,000 x 21 x 1/3

Share premium – sh. options outstanding

49,000

49,000

Dec. 31,

20x2

Salaries expense – share options

[(10 – 1 – 0 - 2) x 1,000 x 21 x 2/3] – 49,000

Share premium – sh. options outstanding

49,000

49,000

Dec. 31,

20x3

Salaries expense – share options

[(10 – 1 – 0 - 1) x 1,000 x 71 x 3/3] – 49K – 49K

Share premium – sh. options outstanding

470,000

470,000](https://image.slidesharecdn.com/sharebasedpayment-230222051821-502146da/85/Share-Based-Payment-pptx-19-320.jpg)

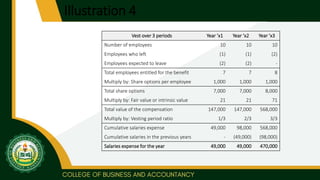

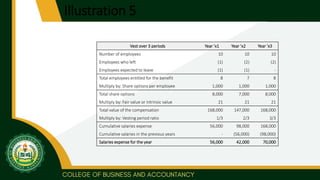

![Illustration 5

Jan. 1, 20x1 Memo entry

Dec. 31,

20x1

Salaries expense – share options

(10 – 1 - 1) x 1,000 x 21 x 1/3

Share premium – sh. options outstanding

56,000

56,000

Dec. 31,

20x2

Salaries expense – share options

[(10 – 3) x 1,000 x 21 x 2/3] – 56,000

Share premium – sh. options outstanding

42,000

42,000

Dec. 31,

20x3

Salaries expense – share options

[(10 – 1 – 1 - 0) x 1,000 x 21 x 3/3] – 56K – 42K

Share premium – sh. options outstanding

70,000

70,000](https://image.slidesharecdn.com/sharebasedpayment-230222051821-502146da/85/Share-Based-Payment-pptx-22-320.jpg)

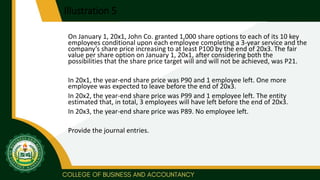

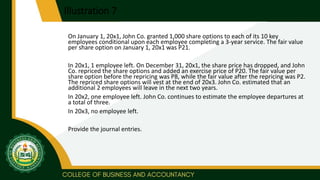

![Illustration 7

Jan. 1,

20x1

Memo entry

Dec. 31,

20x1

Salaries expense – share options

(10 – 1 - 2) x 1,000 x 21 x 1/3

Share premium – sh. options outstanding

49,000

49,000

Dec. 31,

20x2

Salaries expense – share options

[(10 – 3) x 1,000 x 21 x 2/3] – 49,000

Share premium – sh. options outstanding

49,000

49,000

Dec. 31,

20x3

Salaries expense – share options

[(10 – 1 – 1 - 0) x 1,000 x 21 x 3/3] – 49K – 49K

Share premium – sh. options outstanding

70,000

70,000](https://image.slidesharecdn.com/sharebasedpayment-230222051821-502146da/85/Share-Based-Payment-pptx-32-320.jpg)

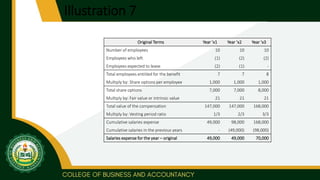

![Illustration 8

Jan. 1,

20x1

Memo entry

Dec. 31,

20x1

Salaries expense – share options

(10 – 0) x 1,000 x 21 x 1/3

Share premium – sh. options outstanding

70,000

70,000

Dec. 31,

20x2

Salaries expense – share options

[(10 – 1) x 1,000 x 21] – 70,000

Share premium – sh. options outstanding

119,000

119,000](https://image.slidesharecdn.com/sharebasedpayment-230222051821-502146da/85/Share-Based-Payment-pptx-34-320.jpg)

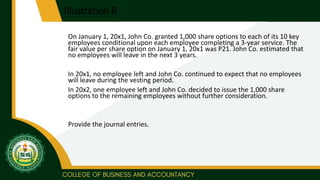

![Illustration 9

Jan. 1, 20x1 Memo entry

Dec. 31,

20x1

Salaries expense – share options

[10 x 1,000 x 70% x (41 – 20) x 1/3]

Share premium – sh. options outstanding

49,000

49,000

Dec. 31,

20x2

Salaries expense – share options

[(10 – 2 – 0 – 1) x 1,000 x (38 – 20) x 2/3] – 49K

Share premium – sh. options outstanding

35,000

35,000

Dec. 31,

20x3

Salaries expense – share options

[(10 – 2 – 0 – 2) x 1,000 x (42 – 20) x 3/3] – 49K – 35K

Share premium – sh. options outstanding

48,000

48,000](https://image.slidesharecdn.com/sharebasedpayment-230222051821-502146da/85/Share-Based-Payment-pptx-36-320.jpg)