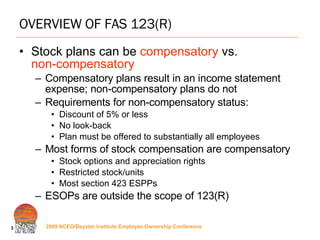

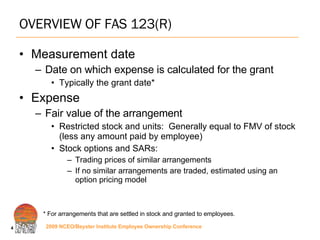

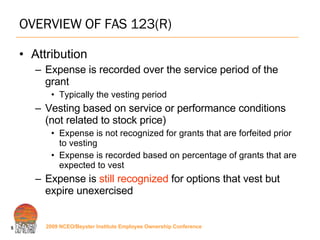

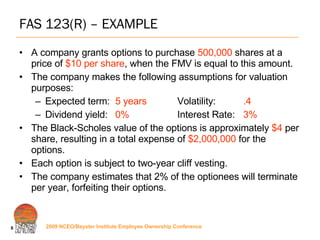

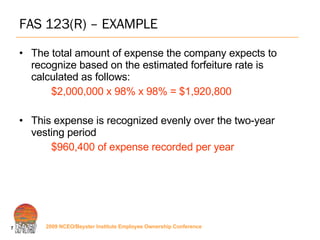

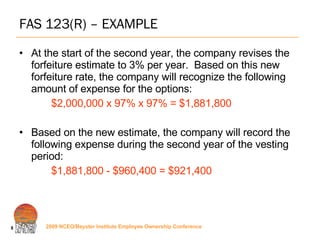

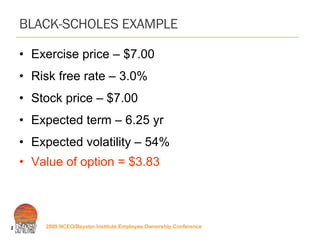

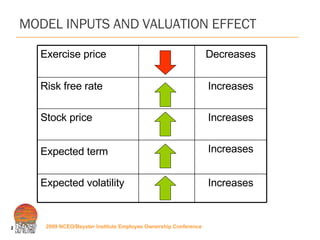

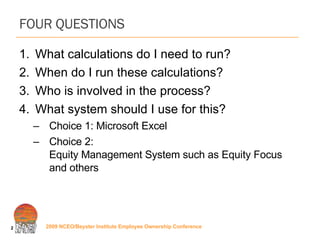

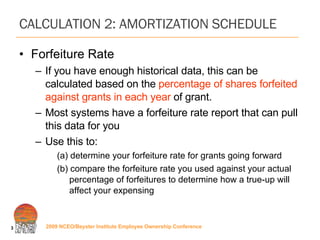

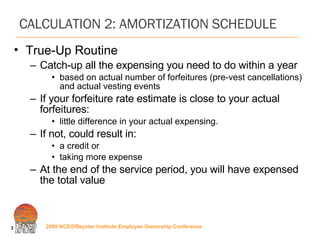

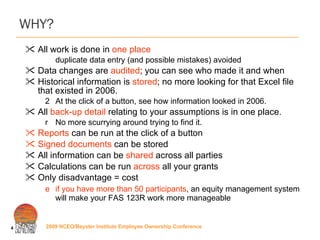

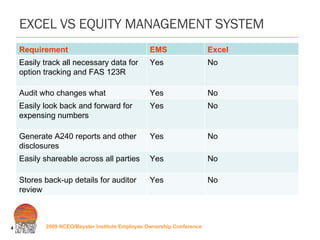

This document provides an overview of FAS 123(R), emphasizing the accounting and reporting of equity compensation for employees and non-employees, detailing how stock options, restricted stock, and other forms of compensation are measured and expensed. It offers specific examples, including the use of the Black-Scholes model for option valuation and the importance of tracking forfeiture rates for accurate expense recognition. Additionally, it discusses best practices for managing these calculations, including the use of equity management systems to streamline processes and improve data accuracy.

![BSM INPUT 3: VOLATILITY Volatility Go to Yahoo finance to download their daily stock prices Two Step provides a spreadsheet that you can feed your peers’ daily closing prices into for historical volatility calculations. Email me at [email_address] and I’ll send you a download link. Back-Up Details A list of your peer companies Any changes in your peers from last year A spreadsheet showing the auditor how you came up with your volatility](https://image.slidesharecdn.com/accountingforequitycompensation-124225553034-phpapp02/85/Accounting-For-Equity-Compensation-28-320.jpg)

![CONTACT INFORMATION Barbara Baksa Email: [email_address] Blog: www.naspp.com/blog Web: www.naspp.com Wil Becker Email: [email_address] Web: www.chartwellcapitalsolutions.com Jeremy Wright Email: [email_address] Twitter: www.twitter.com/jeremyswright Web: www.twostep.com](https://image.slidesharecdn.com/accountingforequitycompensation-124225553034-phpapp02/85/Accounting-For-Equity-Compensation-42-320.jpg)