This document discusses economic convergence and divergence in Europe before and after the financial crisis. It makes three main points:

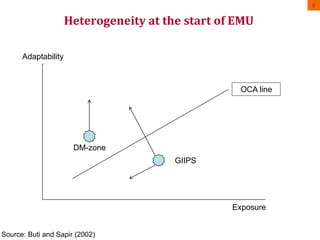

1) Before the crisis, economic diversity within the EU was not seen as a problem, as the EU had successfully enabled convergence among lower-income countries.

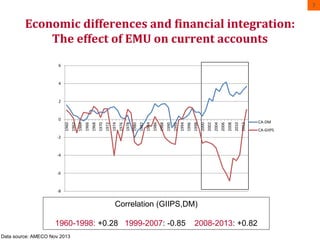

2) The crisis highlighted problems with economic diversity within the eurozone, as core countries were less affected than peripheral countries. It exposed flaws in the growth models of some southern eurozone countries.

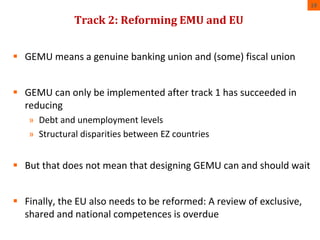

3) To address these issues, the document argues that Europe needs both "more Europe" in the form of fiscal and banking unions, as well as "better Europe" through structural reforms and strict rules to reduce economic differences between countries.