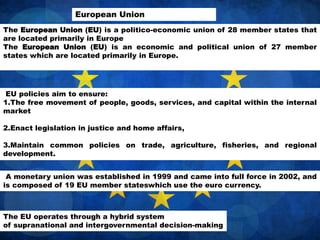

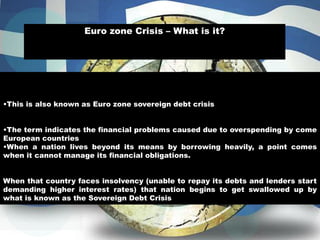

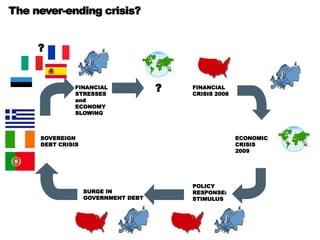

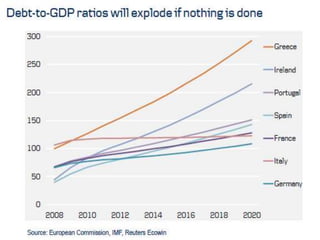

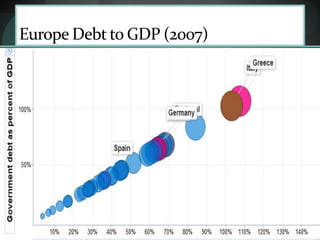

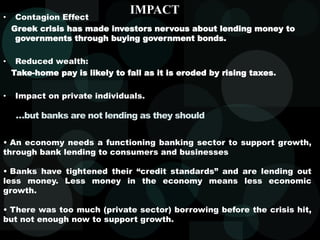

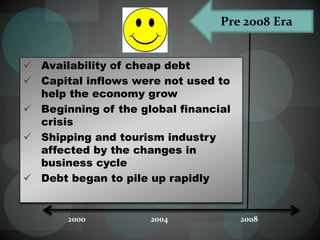

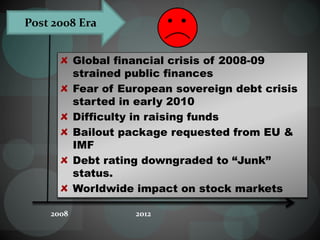

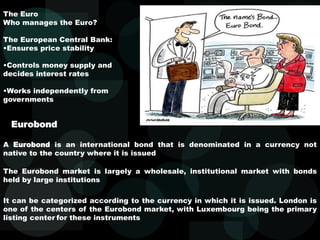

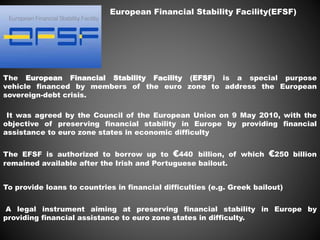

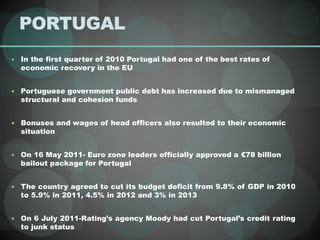

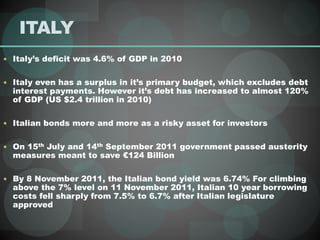

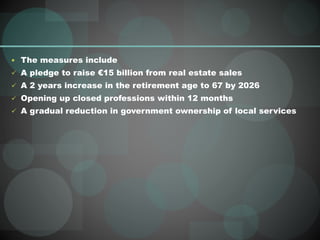

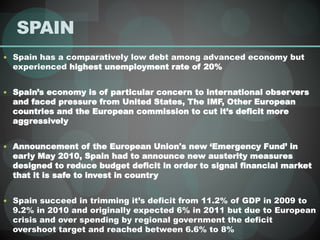

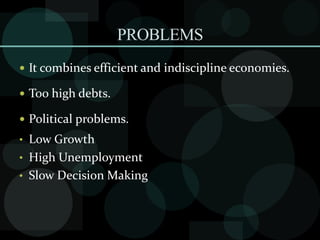

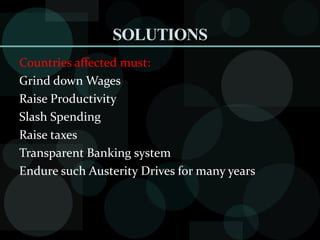

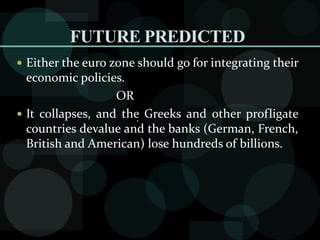

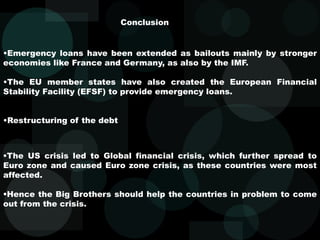

The document discusses the European Union, Eurozone, and the European sovereign debt crisis. It provides details on the countries that make up the Eurozone and EU. It then summarizes the sovereign debt crisis that began in Greece in 2009 and spread to other European countries like Portugal, Ireland, Italy, and Spain. It explains some of the key events and impacts of the crisis, as well as measures taken by the EU and European Central Bank to address the financial crisis.