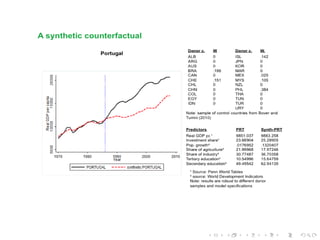

1) This document analyzes the economic benefits of EU membership using a synthetic counterfactual method to estimate growth effects.

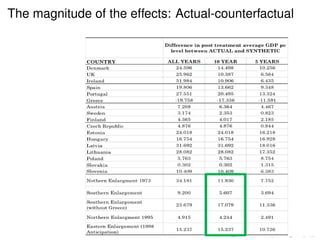

2) It finds generally positive effects of EU membership on growth and productivity, though there is heterogeneity across countries and enlargements. Countries joining in 1973 and 2004 saw larger effects than those joining in 1995 or 1980s (except Greece saw negative effects).

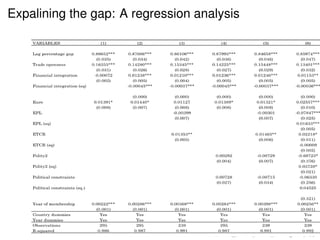

3) Institutional development and structural reforms were found to be crucial for countries to fully realize the growth benefits of EU membership. Economic integration and trade liberalization alone were not sufficient.