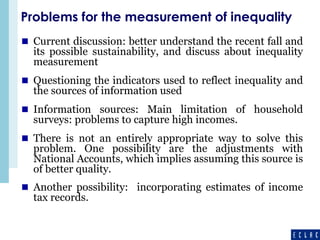

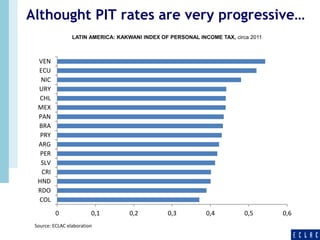

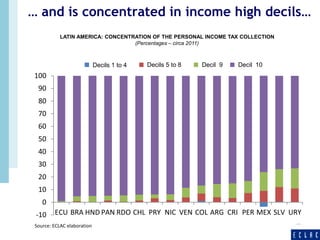

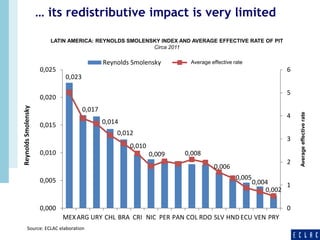

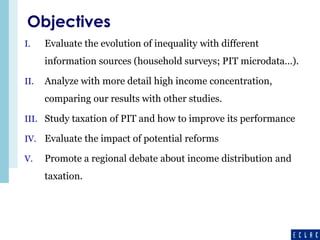

This document discusses inequality, redistribution, and fiscal policy in Latin America. It finds that while inequality has decreased in most Latin American countries since 2002, income remains highly concentrated among the top 1% and 10% of earners. It also finds that fiscal policy, particularly personal income tax policy, has had a limited impact on redistribution due to low tax burdens, an unbalanced tax structure reliant on consumption taxes, narrow tax bases, and low average tax rates on the highest incomes. The document analyzes potential reforms to personal income tax structures and rates that could increase tax progressivity and the redistributive impact of fiscal policy.

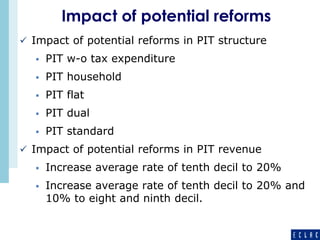

![Since 2002: tendency change, inequality fall in

most of the countries of the region

LATIN AMERICA (17 COUNTRIES): INEQUALITY,

GINI INDEX, 2002-2011

LATIN AMERICA AND OTHER REGIONS OF THE WORLD: GINI

CONCENTRATION COEFFICIENT, AROUND 2009 a

0.52

0.44

0.41

0.38 0.38

0.35

0.33

0.6

0.5

0.4

0.3

0.2

0.1

0

Latin America

and the

Caribbean

(18)

Sub-

Saharan

Africa

(37)

East Asia

and the

Pacific

(10)

North Africa

and Middle

East

(9)

South

Asia

(8)

Eastern

Europe and

Central Asia

(21)

OECD

(20)

Source: Economic Commission for Latin America and the Caribbean (ECLAC), on the basis of special tabulations of data from household surveys conducted in the respective countries;

World Bank, World Development Indicators [online].

a The regional data are expressed as simple averages, calculated using the latest observation available in each country for the 2000-2009 period.

b Organization for Economic Co-operation and Development.](https://image.slidesharecdn.com/session4jimenez3-141205064400-conversion-gate01/85/2014_05-21_OECD-ECLAC-PSE-EU-LAC-Forum_jimenez-4-320.jpg)