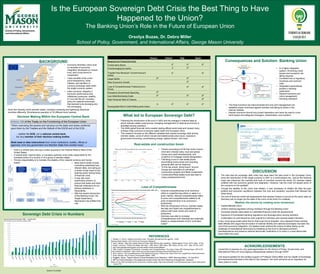

- The sovereign debt crisis in the EU highlighted weaknesses in the banking system and economic policies across members. It exposed inconsistent banking regulations and the risks of a "one size fits all" monetary policy for diverse economies.

- Factors that contributed to sovereign debt crises in various countries included real estate/construction booms and busts, loss of competitiveness after adopting the euro, excessive government borrowing and spending, and heavy foreign capital inflows.

- In response, the EU established a banking union and single supervisory mechanism to harmonize banking rules and oversight. This aims to minimize moral hazard and stabilize the financial system on a supranational level.