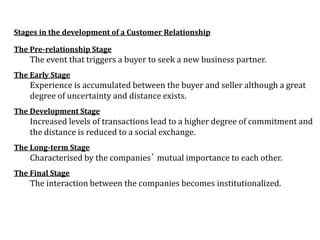

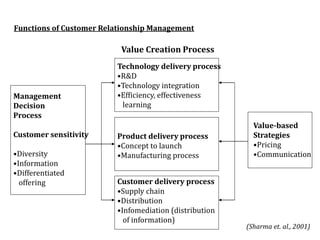

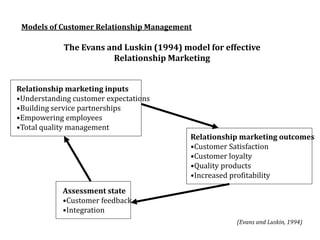

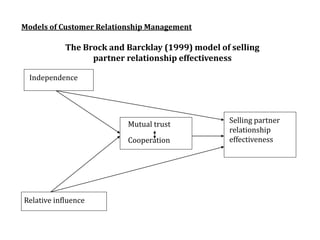

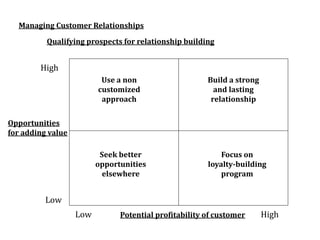

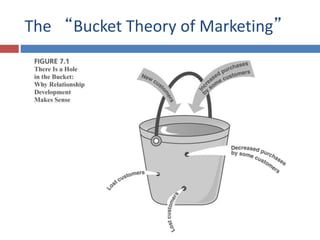

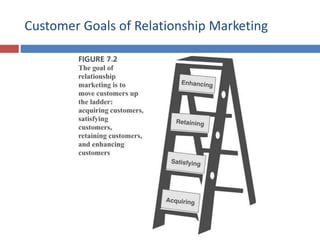

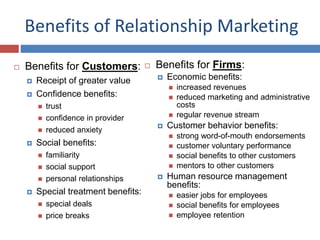

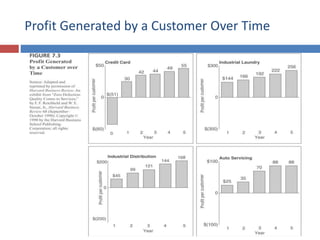

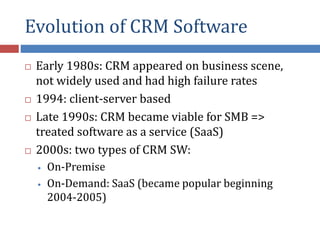

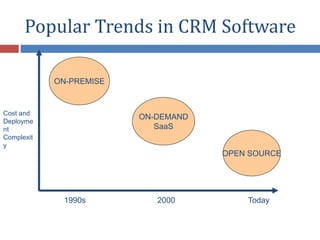

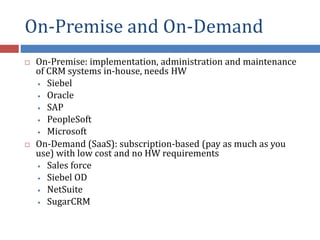

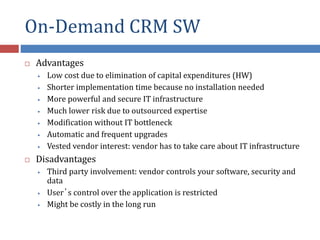

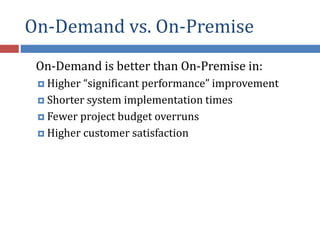

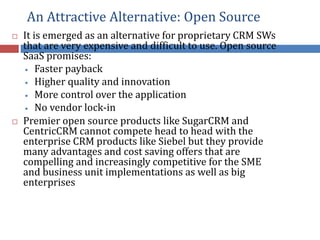

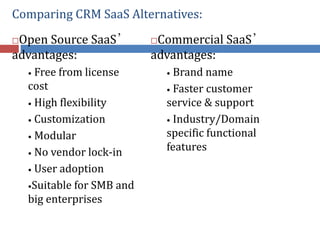

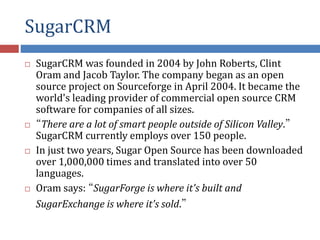

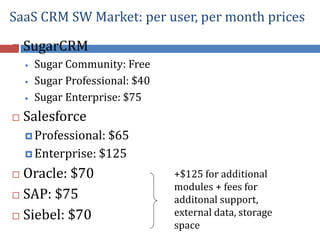

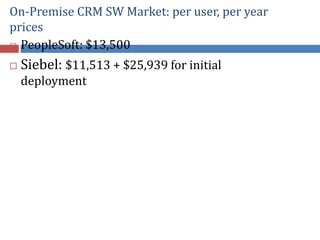

CRM is a business philosophy focused on developing long-term relationships with customers. It involves understanding customer needs, maintaining open communication, and delivering superior customer value profitably. The role of salespeople is to build and promote customer relationships by identifying needs, coordinating cooperation, and leading relationship development. Successful CRM leads to a unique asset of relationship networks. Relationship marketing similarly focuses on customer retention and relationship enhancement rather than new customer acquisition. On-demand CRM software like Salesforce has become popular due to its low costs and minimal IT requirements compared to on-premise software. Open source CRM is also emerging as a lower-cost alternative.