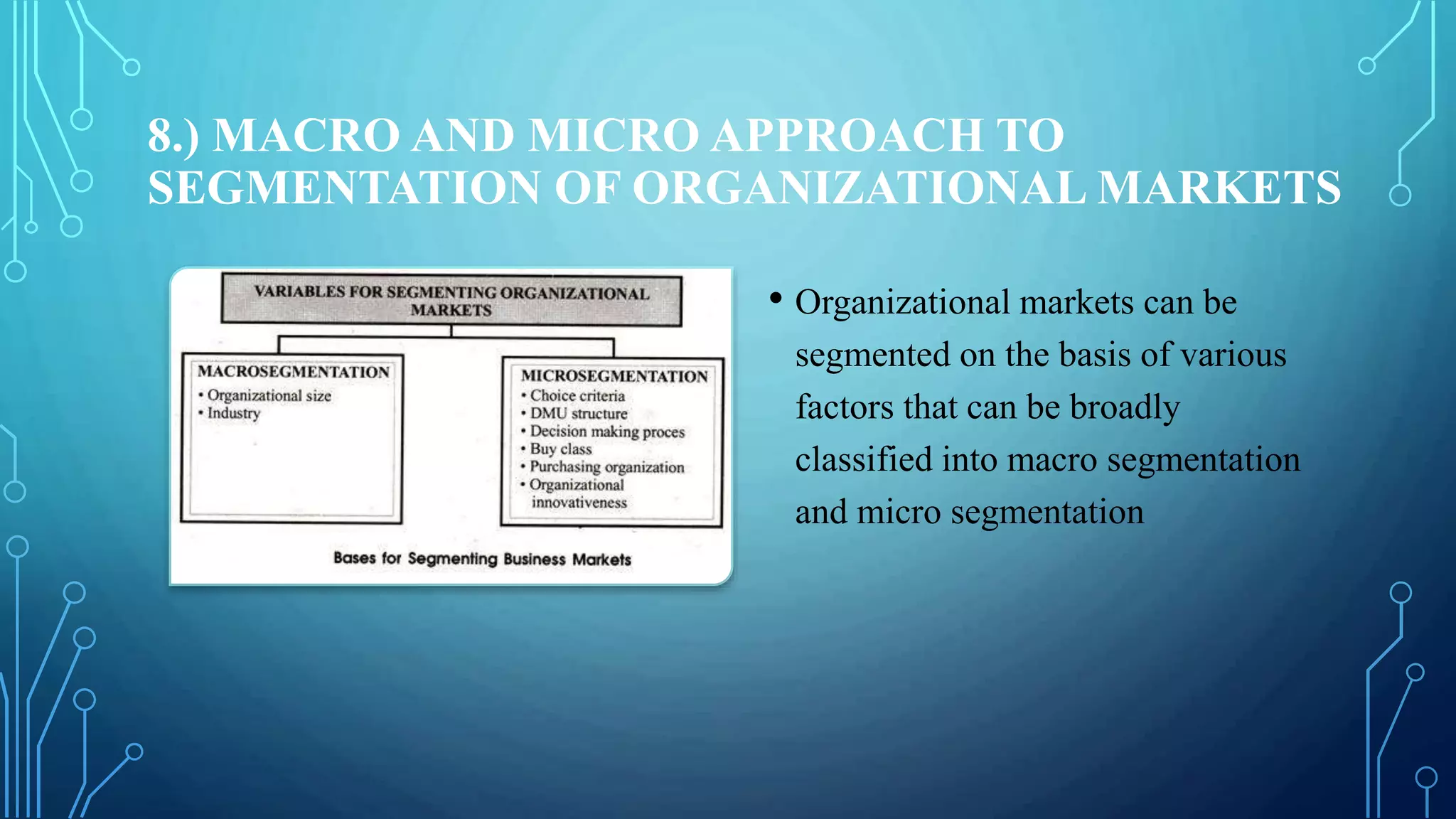

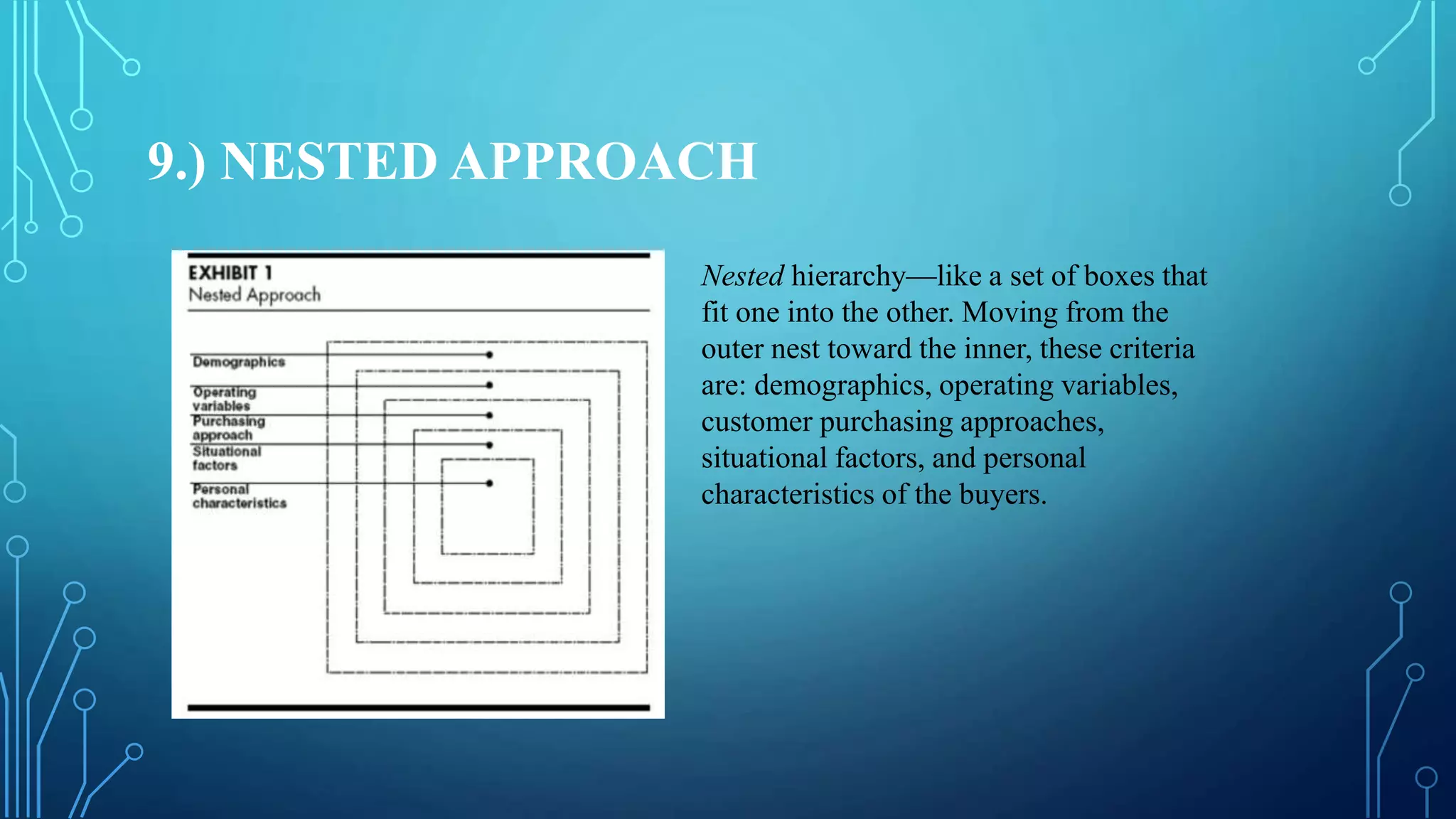

This document discusses segmentation strategies for organizational markets, emphasizing macro and micro approaches, as well as a nested segmentation framework. Macro segmentation considers factors such as organizational size, industry, and geographical location, while micro segmentation focuses on individual company purchasing behaviors and decision-making processes. Additionally, it contrasts the nested approach with Wind and Cardozo's two-stage segmentation model, which separates market segmentation into observable characteristics of buying organizations and less visible traits of decision-making units.