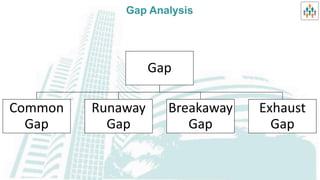

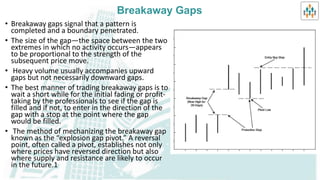

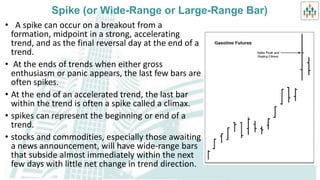

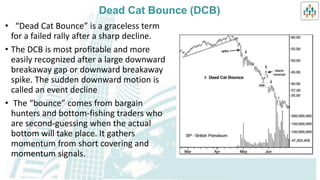

The document discusses various types of gaps that can occur in stock prices including common gaps, breakaway gaps, runaway gaps, exhaustion gaps, opening gaps, spikes, dead cat bounces, and island reversals. It provides details on how to identify each type of gap and what they may indicate about the strength and direction of a current price trend. Gaps occur when there is a price jump higher or lower without trading at all the prices in between.