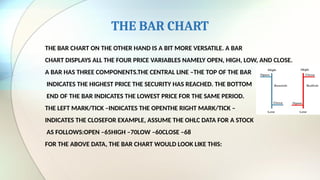

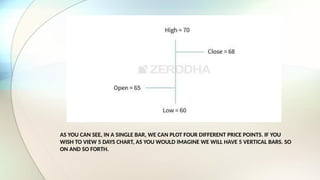

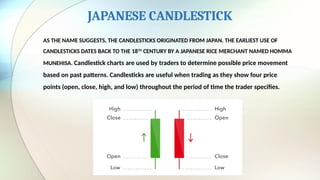

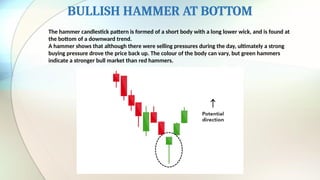

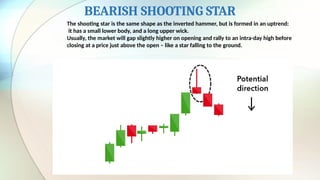

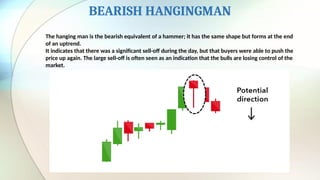

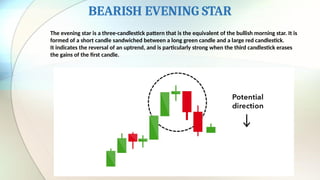

The document explains technical analysis, which forecasts stock prices using market-derived data and various chart types such as line, bar, and Japanese candlestick charts. It covers the importance of probability in stock selection, the significance of gaps in trading, and introduces various bullish and bearish candlestick patterns that indicate market trends. Additionally, it details timeframes for analysis and highlights specific candlestick patterns that traders use to make informed decisions.