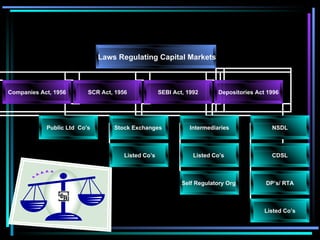

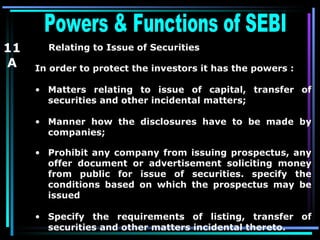

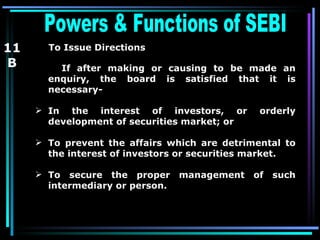

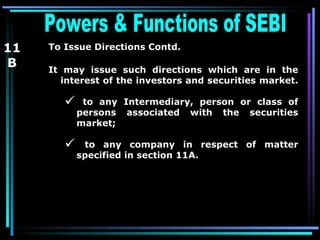

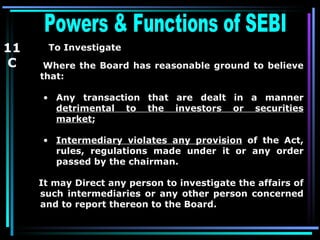

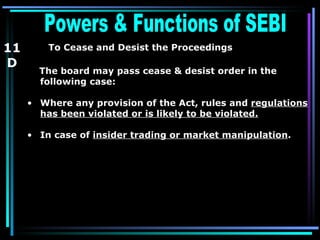

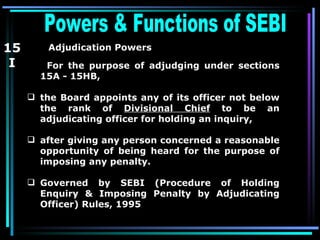

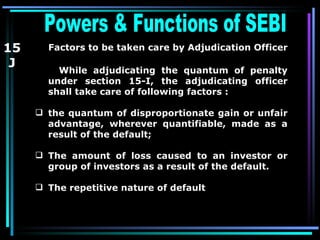

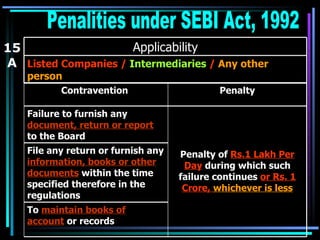

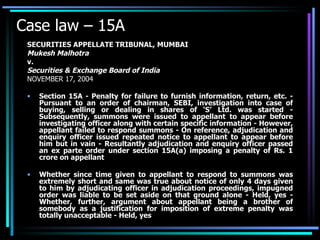

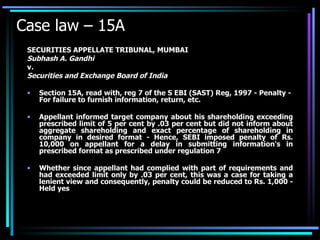

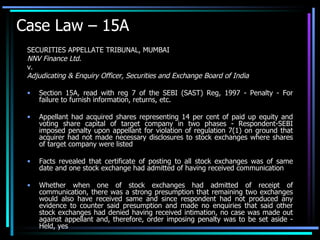

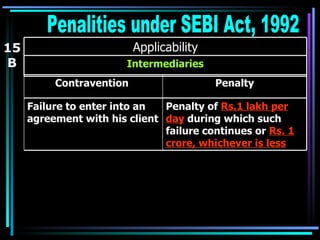

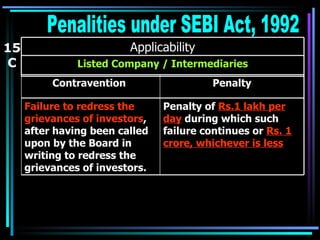

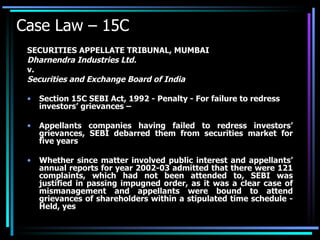

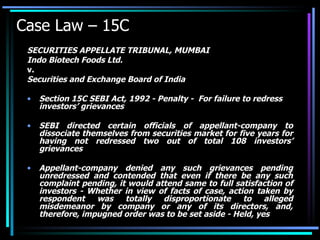

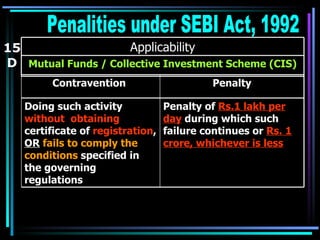

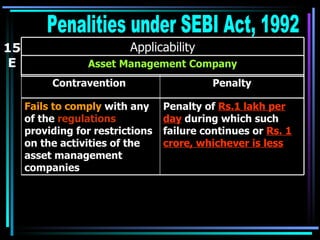

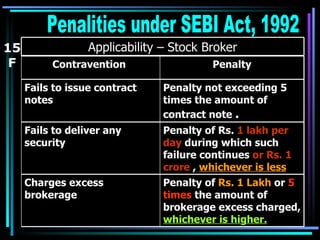

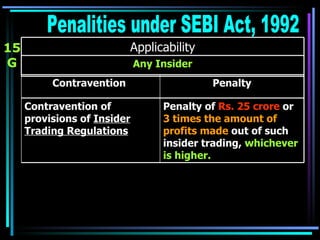

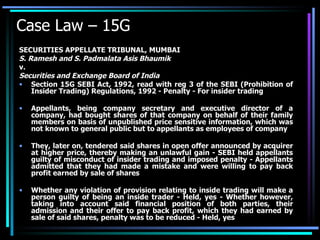

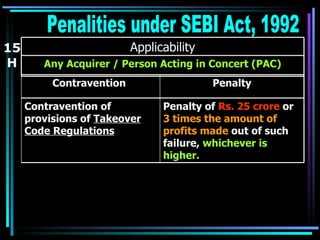

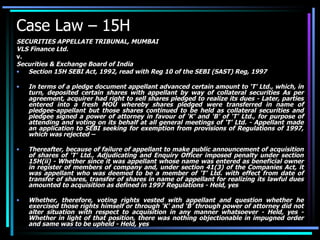

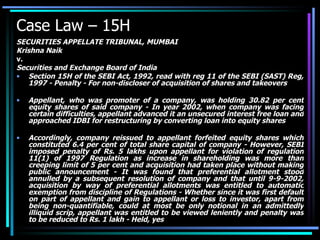

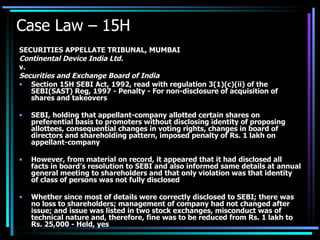

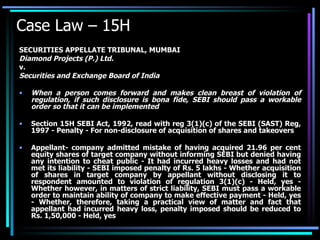

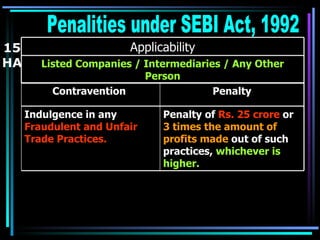

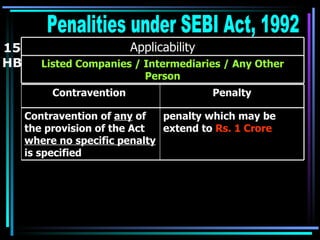

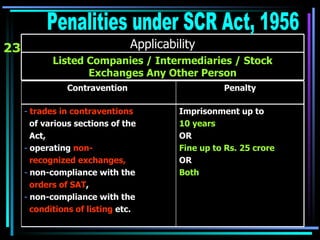

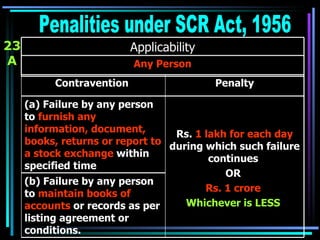

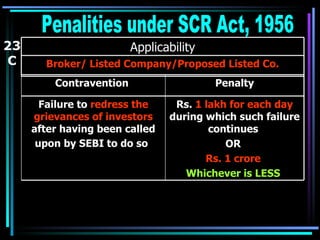

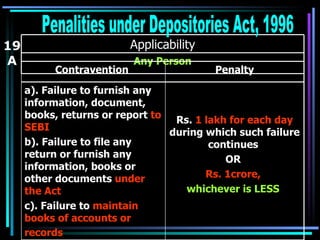

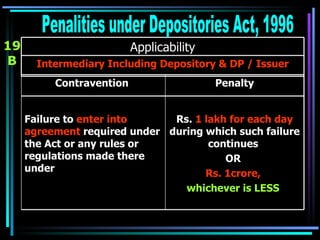

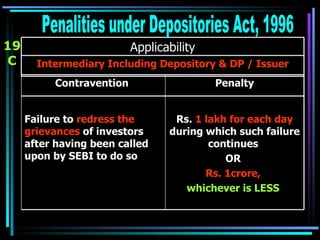

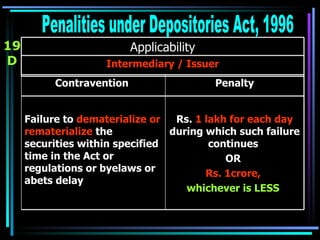

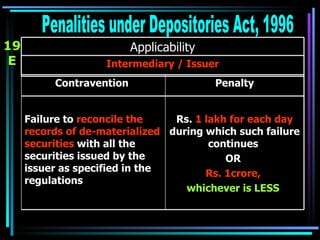

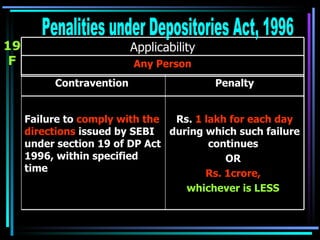

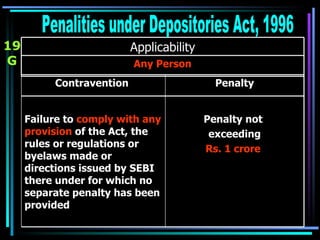

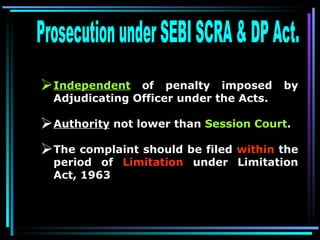

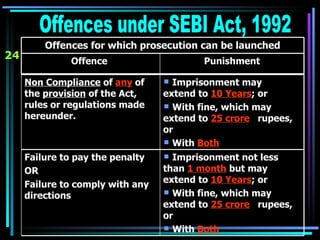

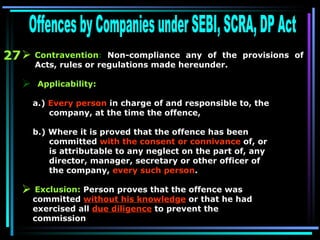

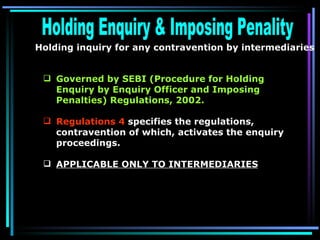

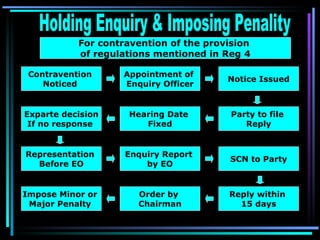

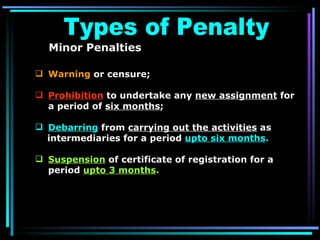

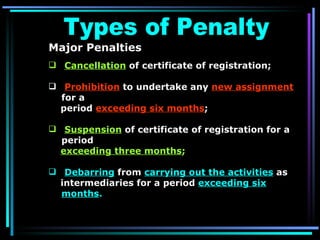

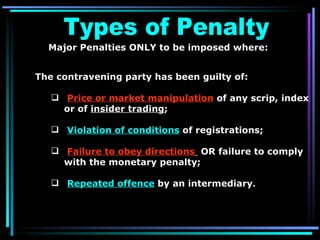

The document discusses various laws and regulations governing capital markets and companies in India, including the powers and functions of the Securities and Exchange Board of India (SEBI). It outlines SEBI's powers relating to registration and regulation of intermediaries, prohibition of unfair trade practices, and investigation and enforcement actions. It also describes various penalties that SEBI can impose under the SEBI Act for non-compliance, such as penalties for failure to furnish information or redress investor grievances.