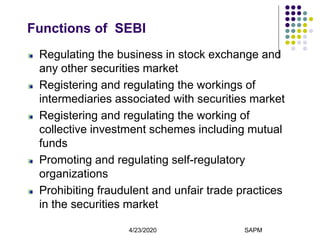

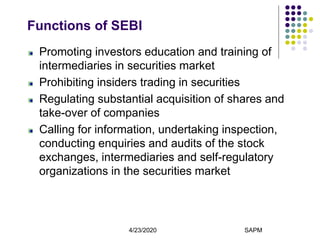

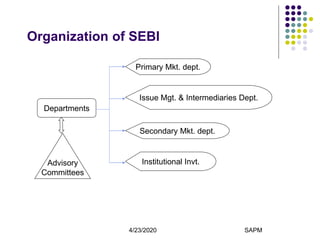

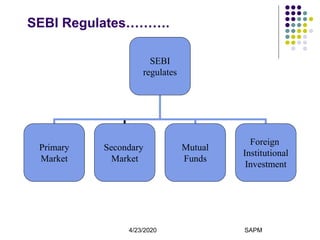

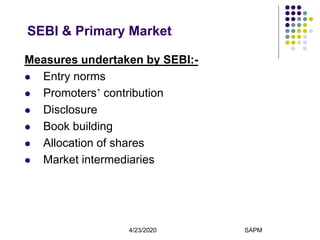

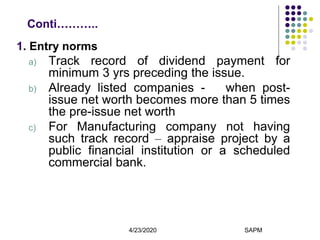

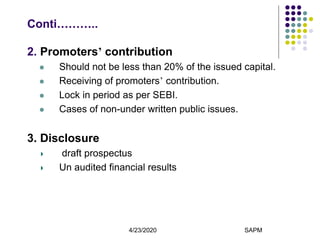

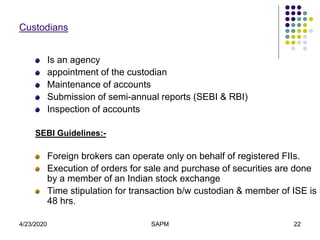

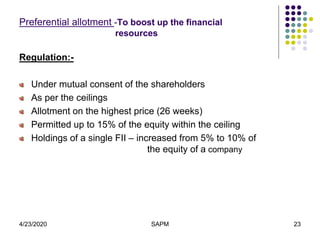

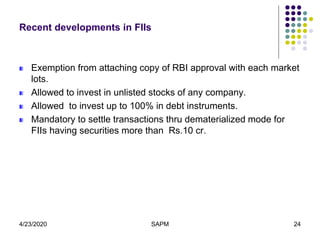

SEBI (Securities and Exchange Board of India) is a statutory body that regulates and develops the securities market in India. Its key objectives are to protect investors, promote the securities market, and regulate market activities. SEBI regulates both the primary market (initial public offerings) and secondary market (stock exchanges). It sets rules for public issues, disclosure requirements, book building, and intermediaries like merchant bankers. In the secondary market, SEBI has implemented reforms around market infrastructure, clearing and settlement, and monitoring price stabilization. SEBI also regulates foreign institutional investments in India through registration of FIIs and setting investment ceilings and guidelines.