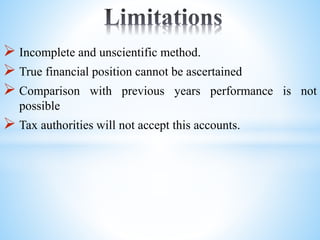

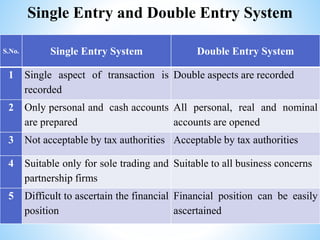

The document discusses the differences between single entry and double entry accounting systems. Single entry systems record only a single aspect of transactions, are incomplete and inaccurate, and do not properly show the financial position of a business. Double entry systems record both aspects of transactions, are more scientific and systematic, and can be used to accurately determine the financial position of a business. The document also compares balance sheets prepared under double entry versus statements of affairs prepared under single entry systems.