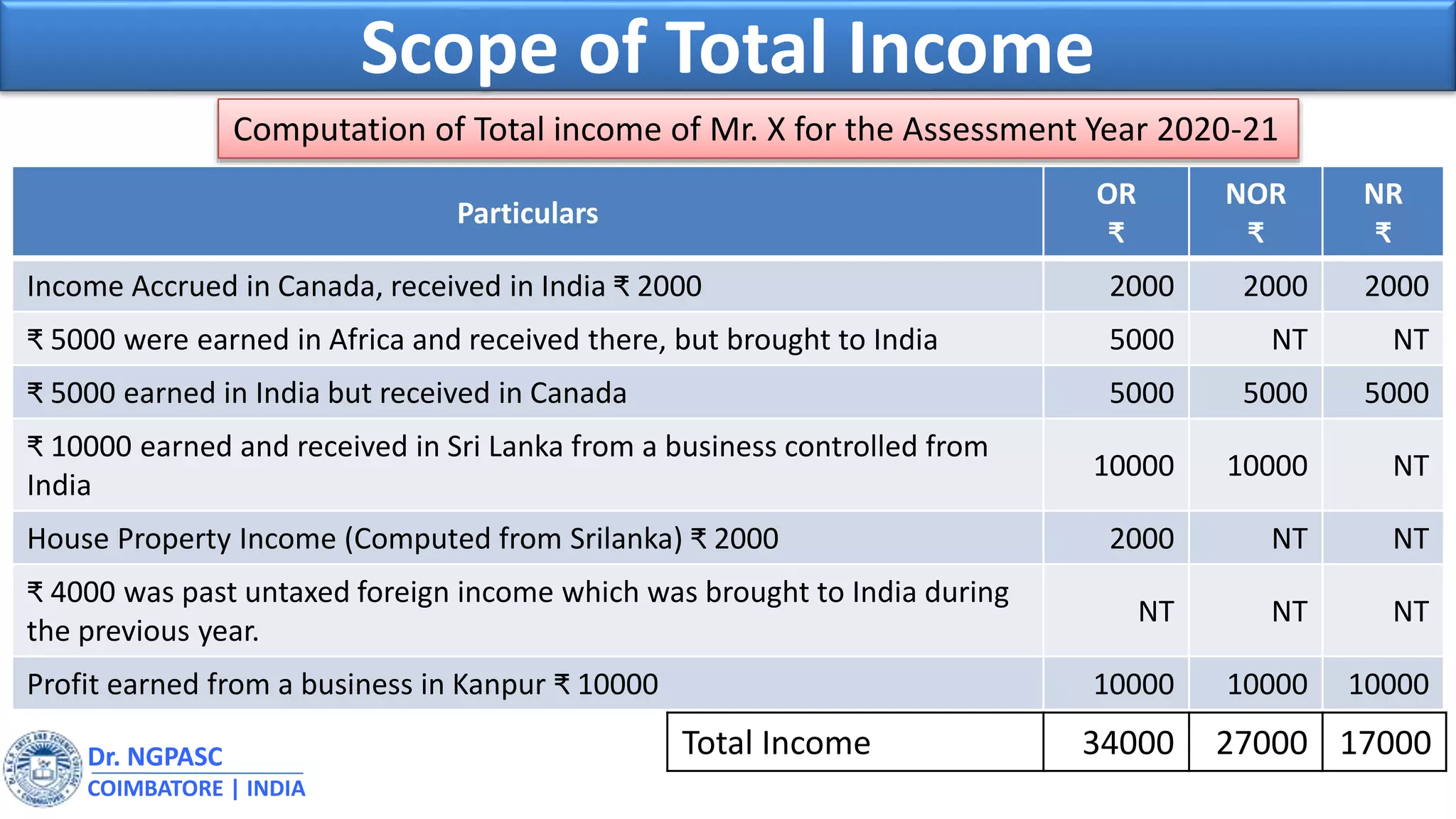

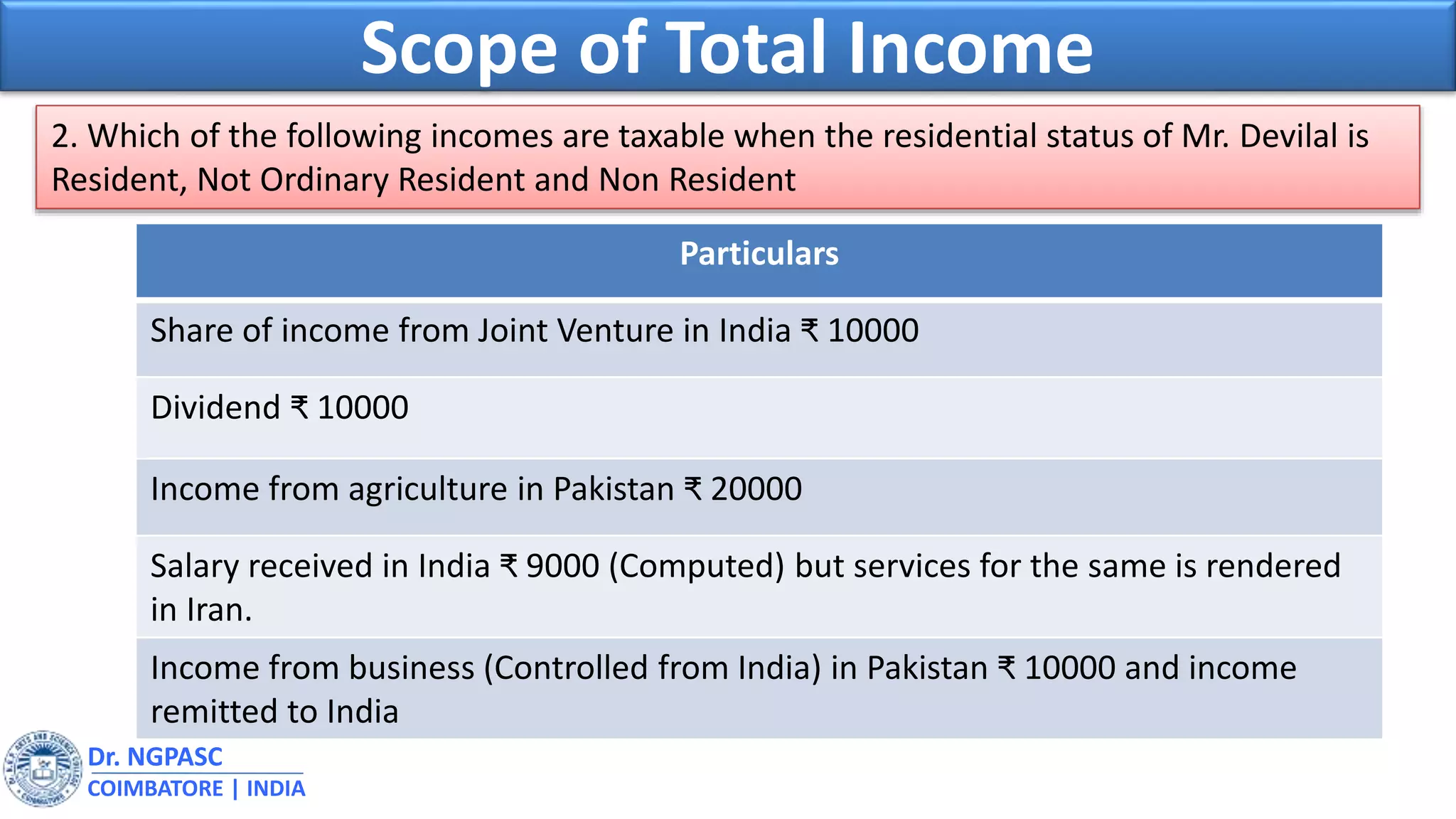

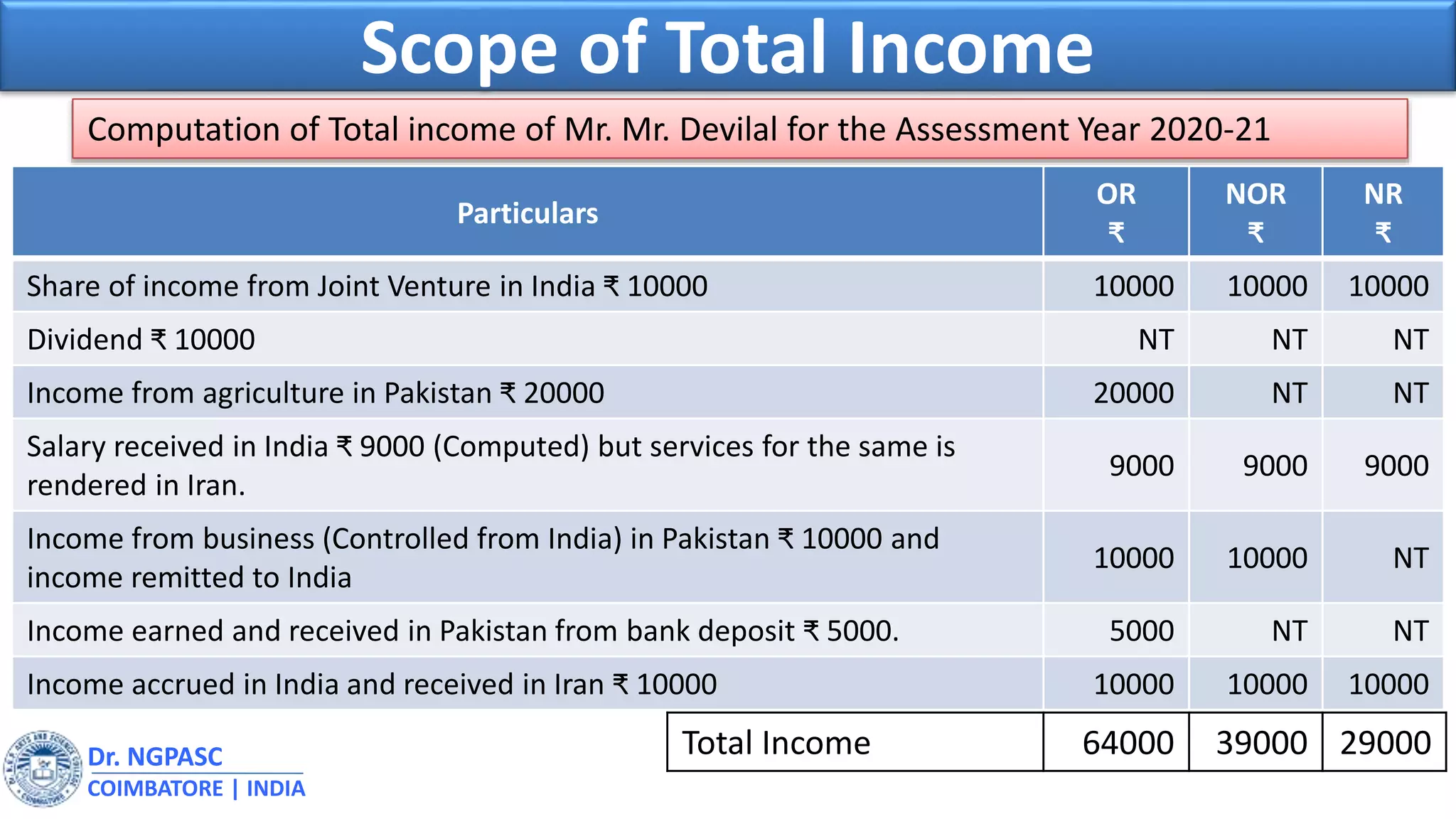

This document discusses the scope of total income that is taxable for two individuals, Mr. X and Mr. Devilal, based on their residential status of resident, not ordinary resident, or non-resident. For each individual, various types of income are listed along with whether they would be included in their total taxable income under each residential status. Computations of total income for each individual are also provided based on the residential statuses.