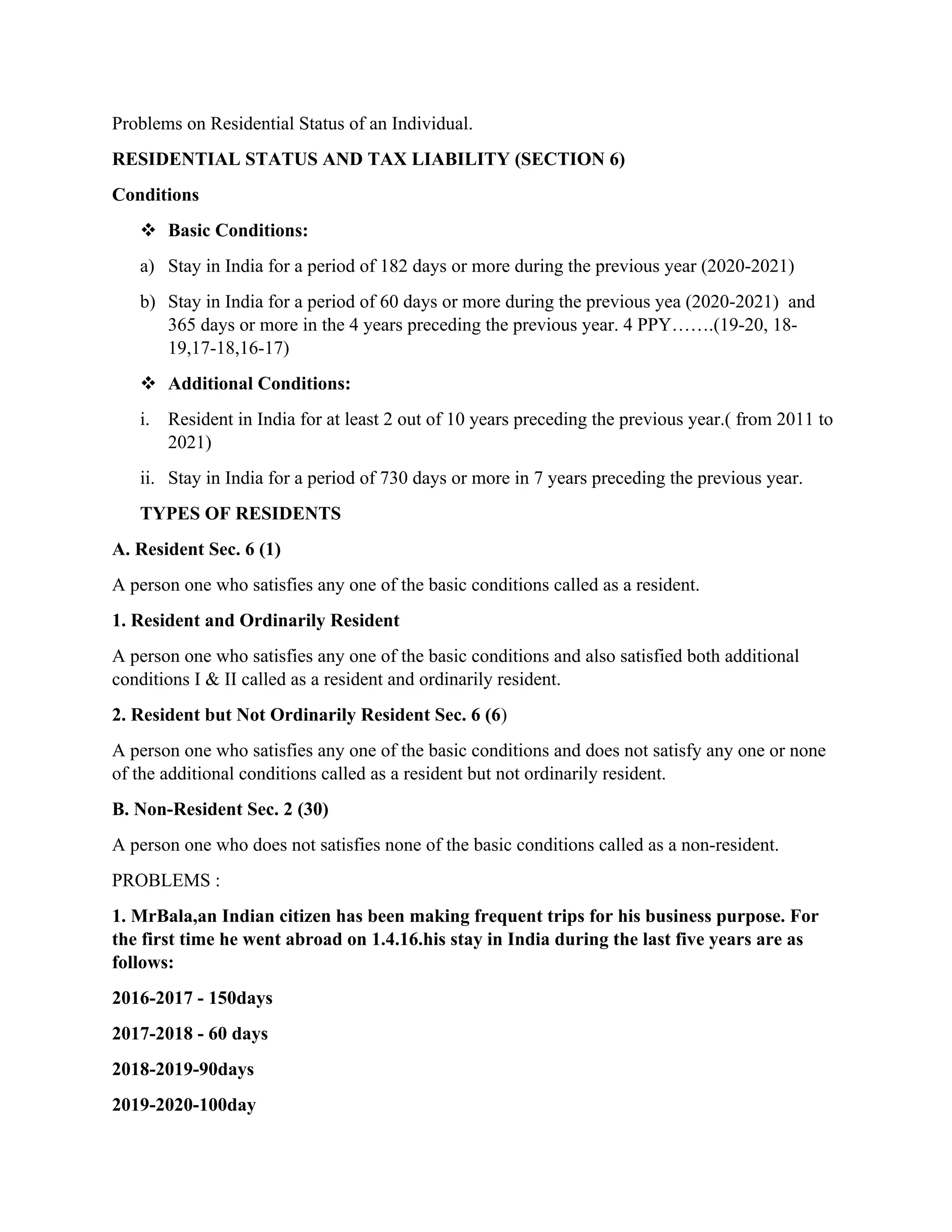

Mr. Bala is determined to be a resident and ordinarily resident based on the following:

- He satisfied the second basic condition of staying in India for 75 days in the previous year and 400 days in the 4 preceding years.

- He has been a permanent resident of India before first leaving in 2016, satisfying the additional conditions.

Mr. Tamilarasan is determined to be a resident and ordinarily resident based on the following:

- He satisfied the second basic condition of staying in India for 169 days in the previous year and over 365 days in the 4 preceding years

- He left India for the first time in 2020, satisfying the additional conditions.

Mr. Gowtham is