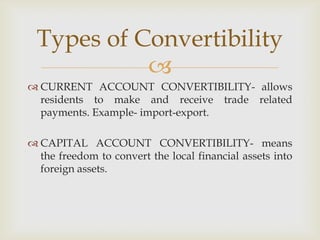

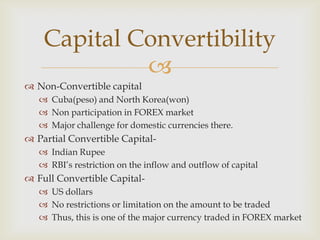

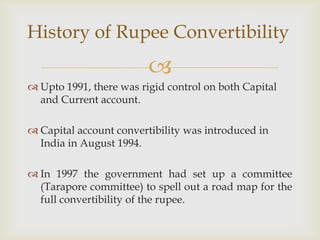

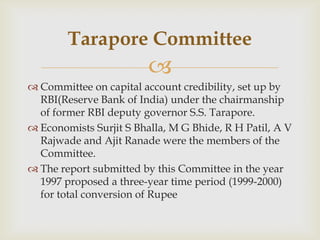

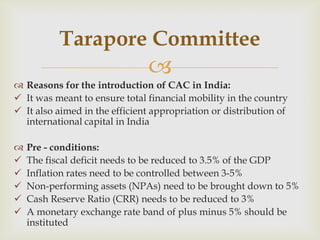

This document discusses the convertibility of the Indian rupee, including its history and recommendations from committees on adopting full capital account convertibility. It explains that the rupee is currently partially convertible on the capital account and fully convertible on the current account. Two committees, the Tarapore Committee in 1997 and 2006, made recommendations on introducing capital account convertibility in phases. However, the document notes that India still needs to strengthen its fundamentals like education, healthcare and infrastructure before fully opening up to potential financial volatility from capital account convertibility.