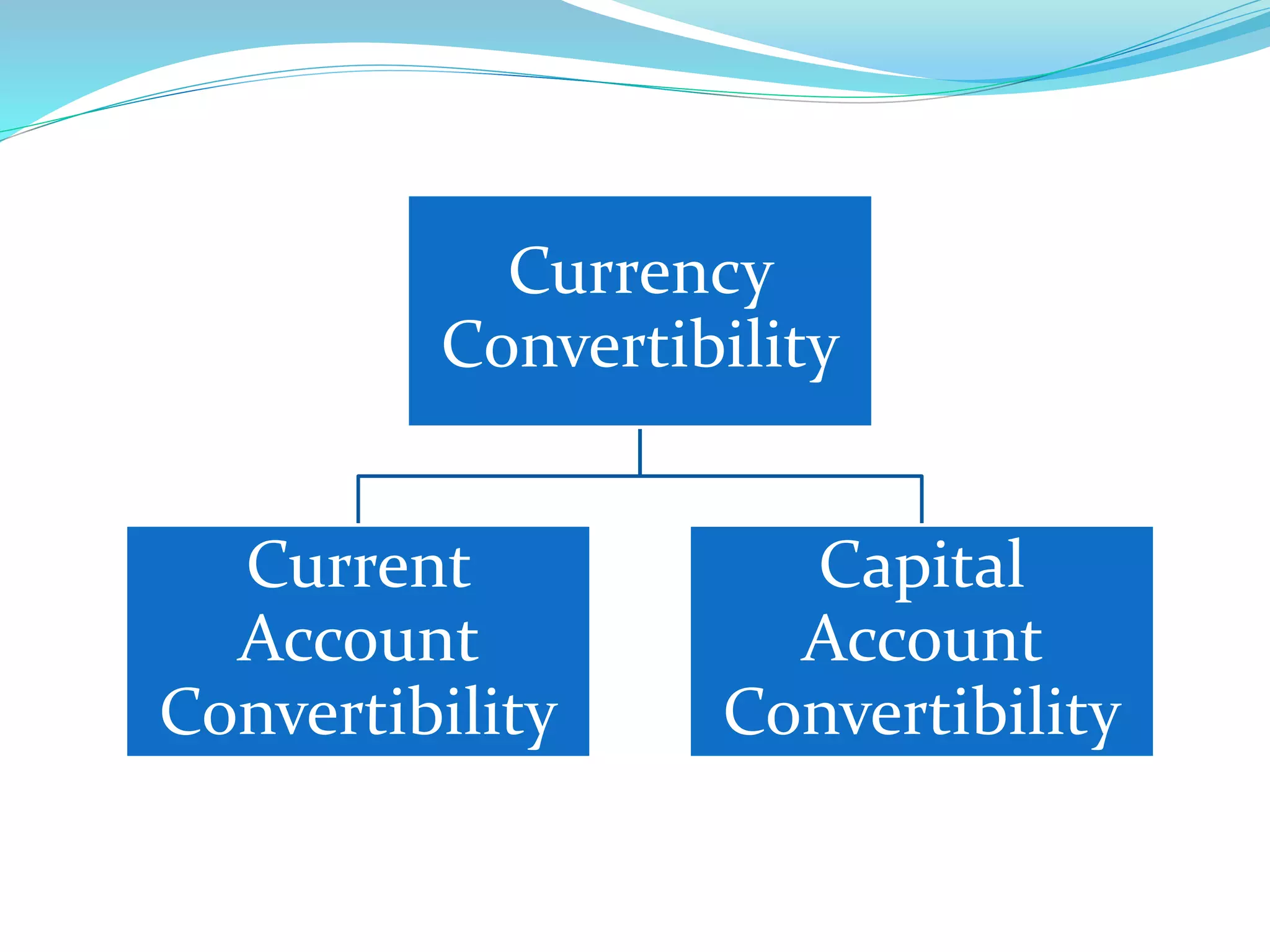

The document outlines the concept of 'deemed exports' in India, where goods supplied domestically are considered exported and can be sold to licensed importers within the country. It also discusses currency convertibility, detailing the transition from partial to full convertibility of the Indian rupee starting in 1992, along with the implications for international trade and finance. Two Tarapore Committees were established to guide the roadmap for capital account convertibility, suggesting a phased approach to achieve full convertibility by 2011.