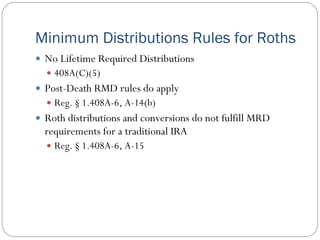

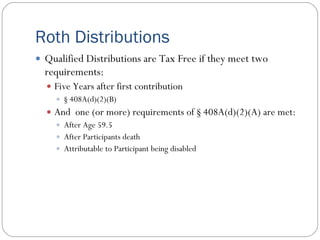

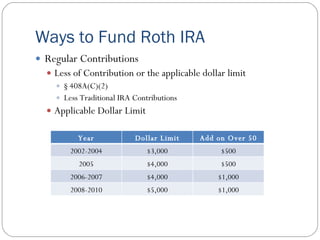

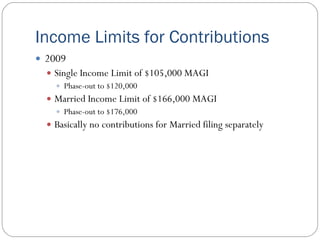

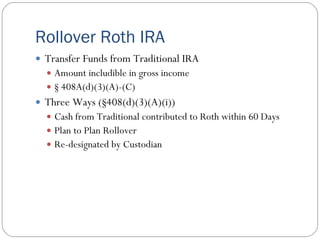

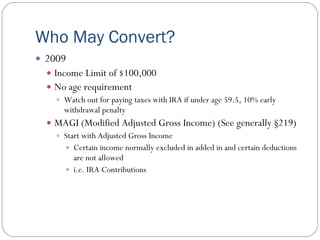

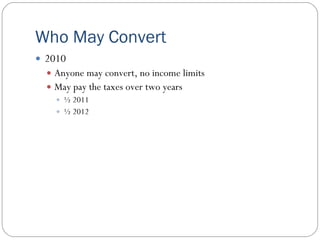

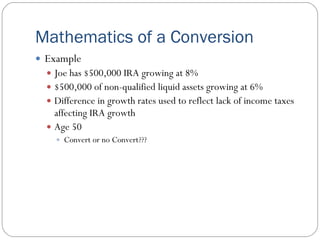

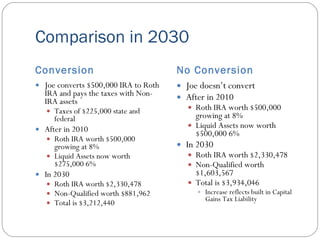

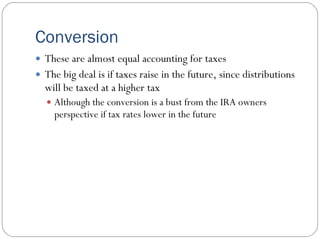

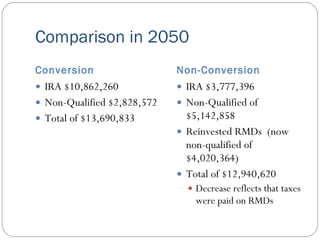

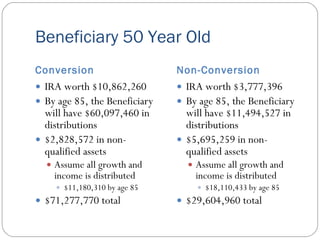

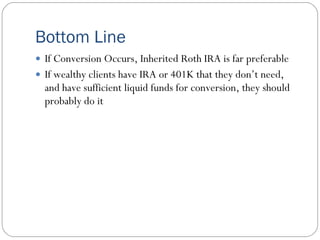

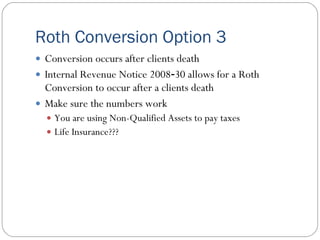

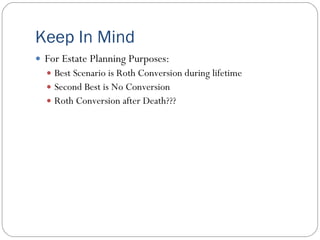

This document provides an overview of Roth IRA conversions. It discusses the advantages of Roth IRAs like tax-free qualified distributions and no required minimum distributions. It also covers eligibility requirements for conversions, the tax implications of conversions, and examples showing the potential benefits of conversions for both original account holders and beneficiaries.