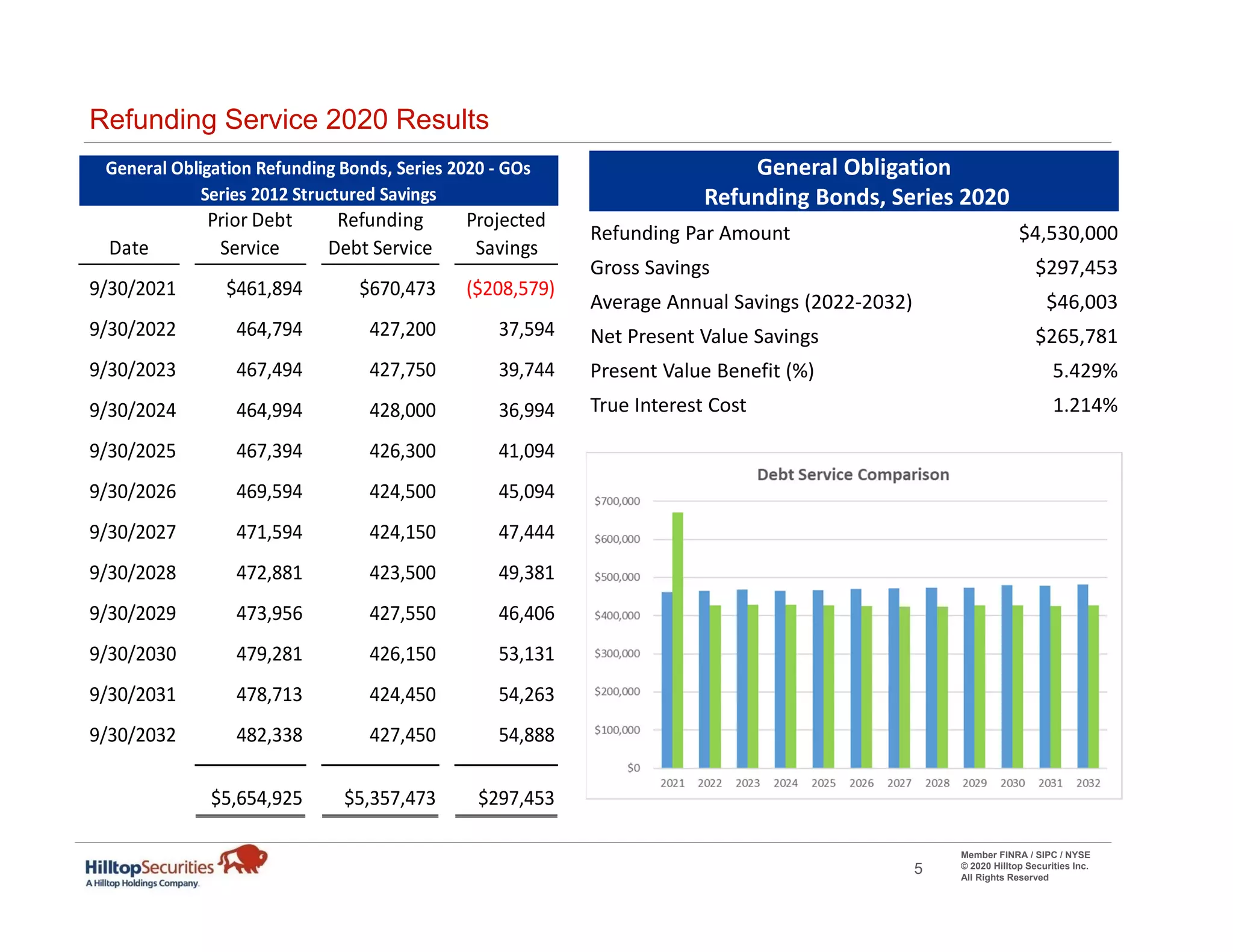

The document provides information on a municipal bond transaction for the City of Alamo Heights, Texas. It summarizes that the city achieved debt service savings through a refunding of callable bonds at historically low interest rates. Actual savings exceeded projections, with gross savings increasing 30% to $297,453. The refunding also allowed for an earlier call date of bonds by one year. Market data on municipal bonds and yields are also presented.