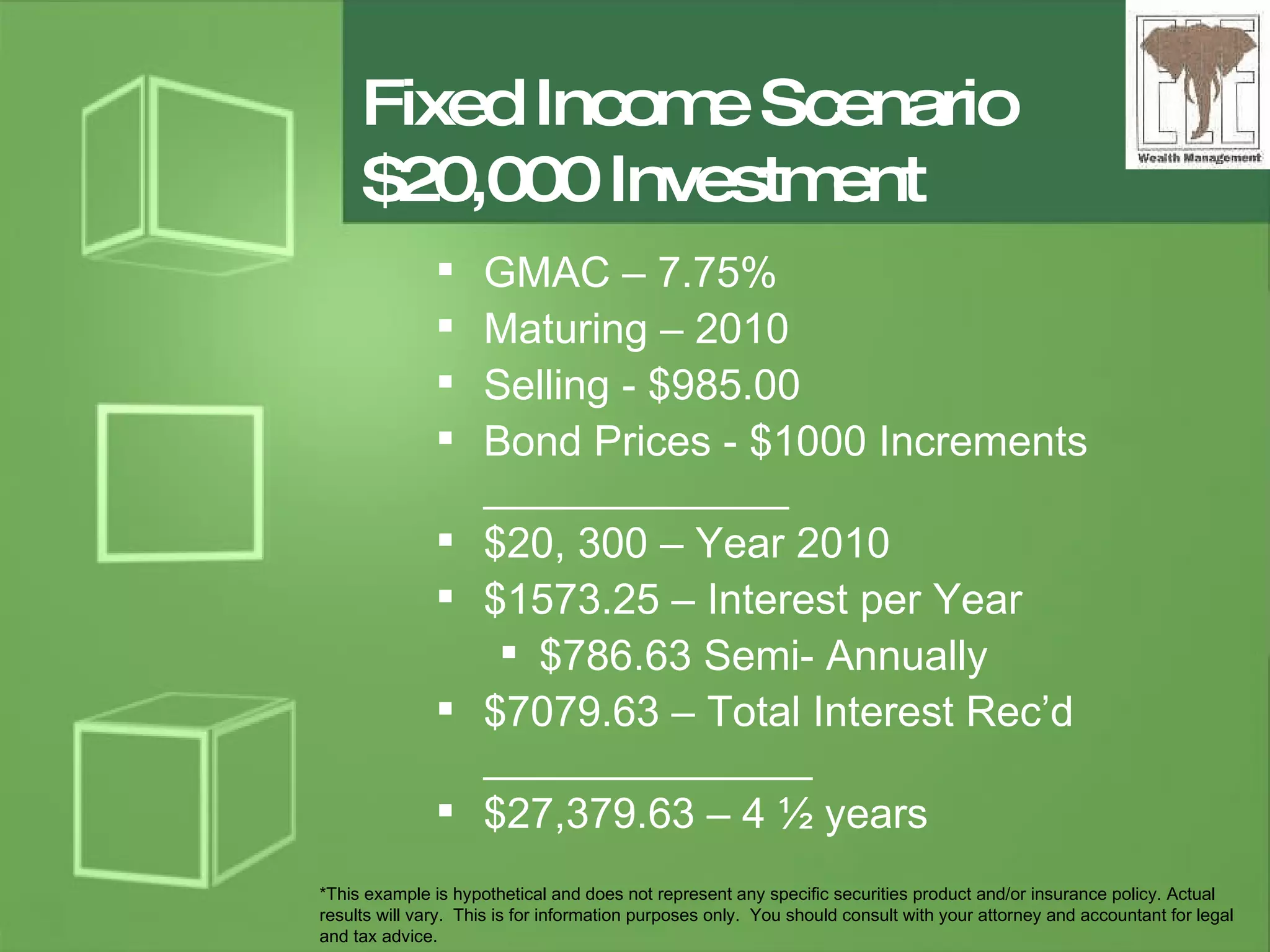

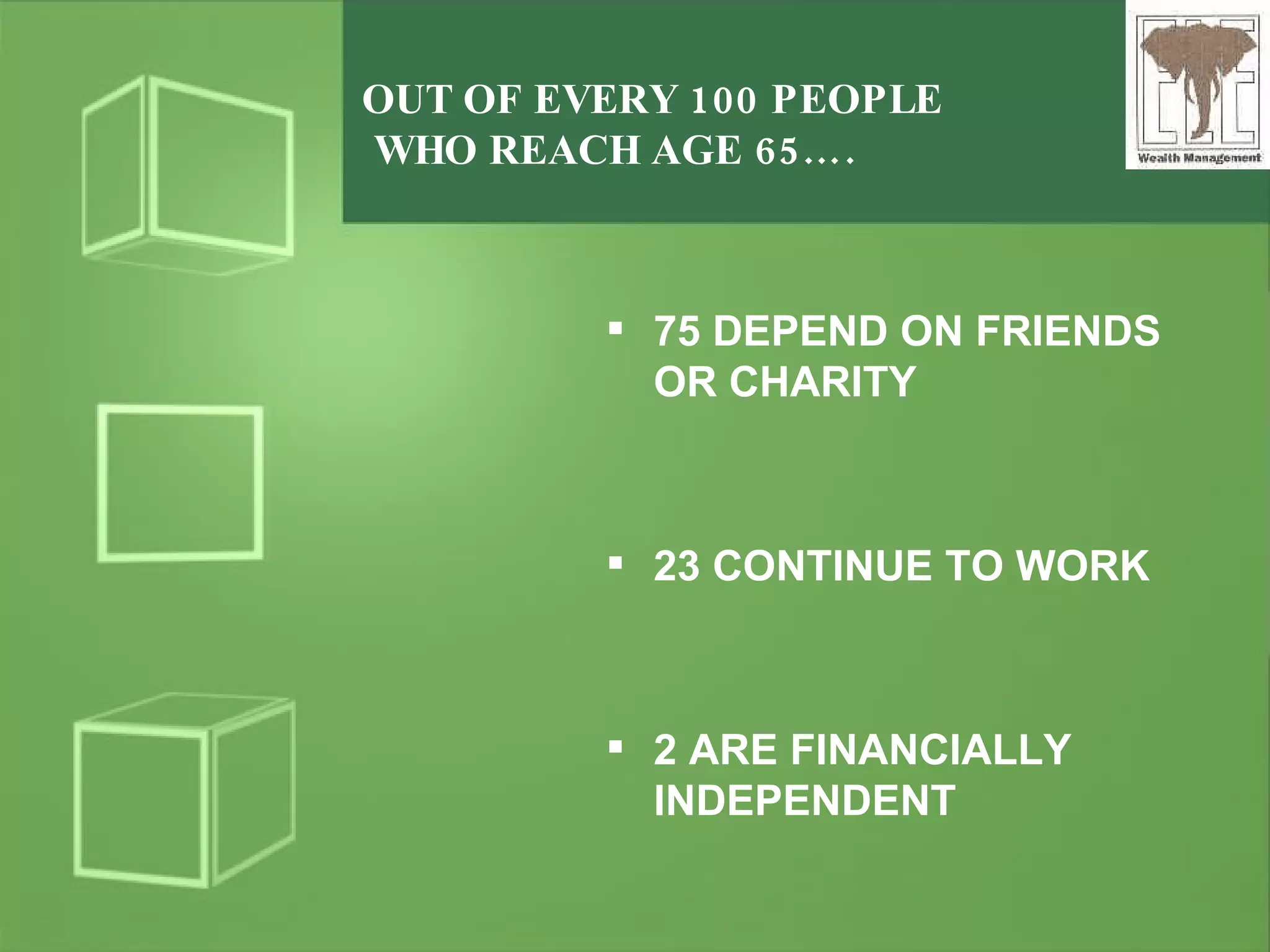

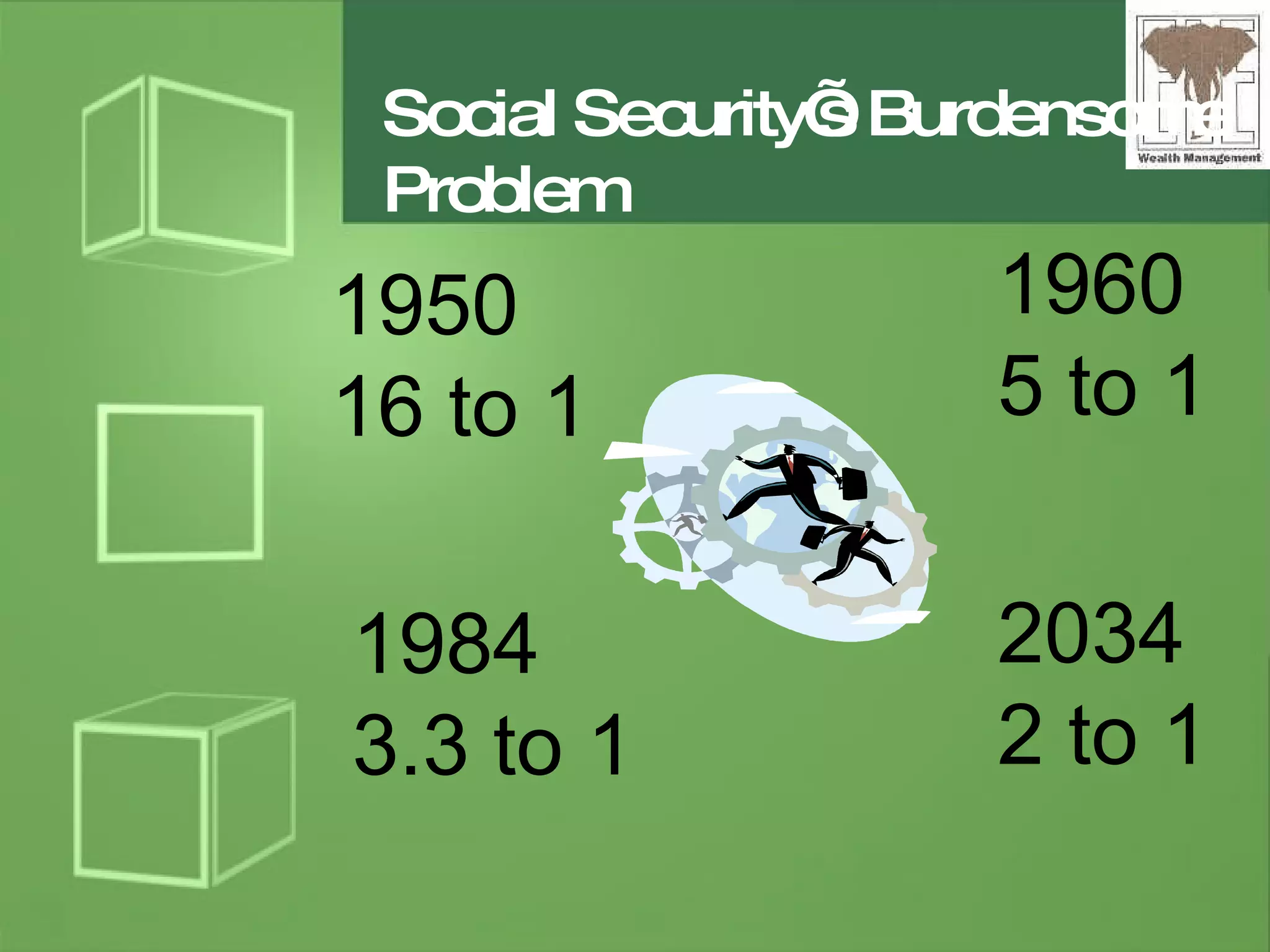

The document is a presentation by Ellis Liddell, president of ELE Wealth Management, that discusses the company's approach to financial planning and wealth management. It covers the five key areas of financial planning - personal planning, investment planning, protection planning, mortgage planning, and retirement planning. Specific topics discussed include types of investments like bonds and mutual funds, life insurance, mortgages, sources of retirement income, and types of retirement plans.