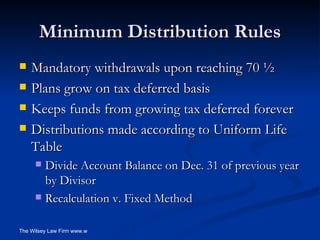

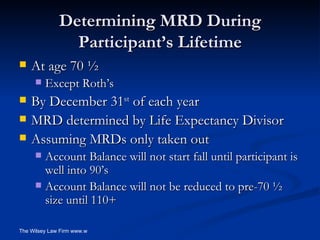

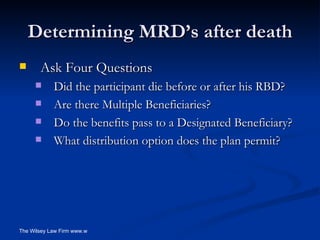

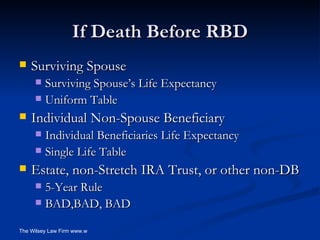

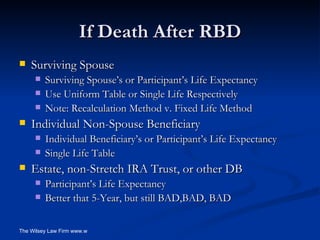

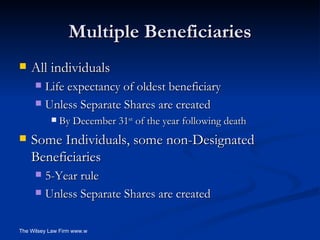

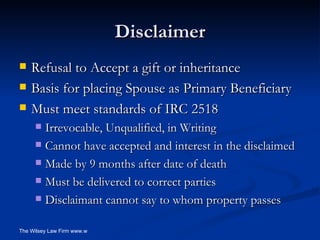

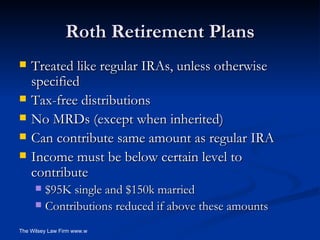

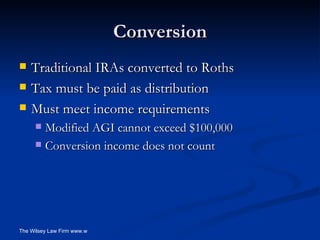

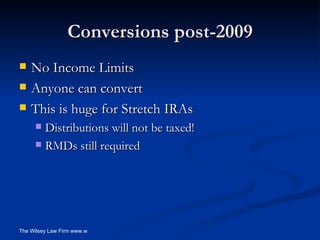

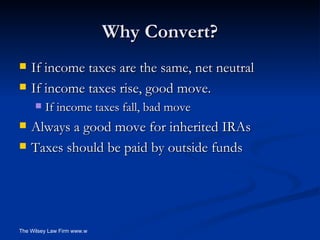

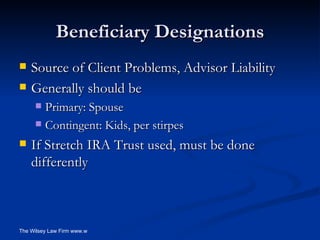

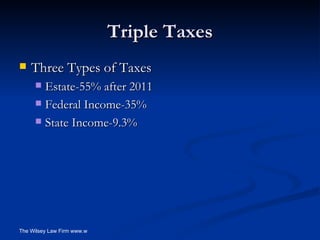

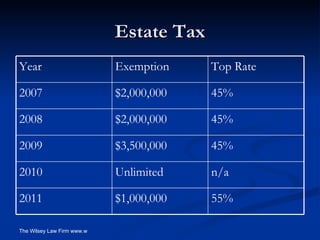

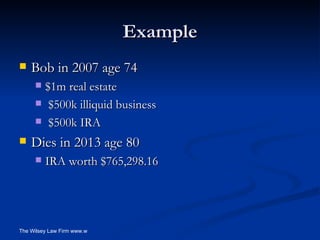

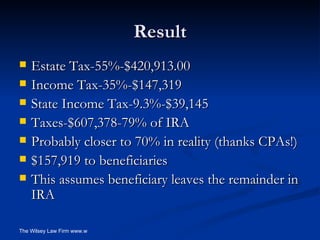

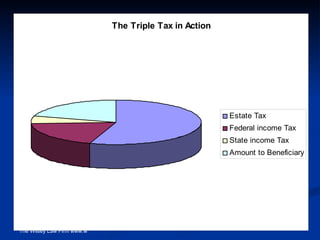

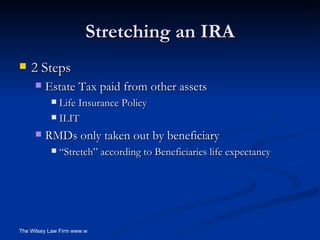

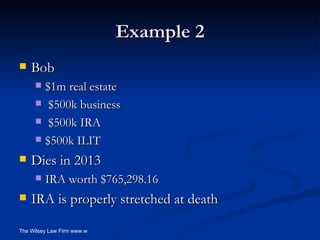

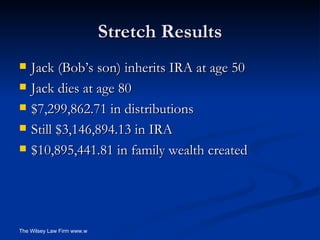

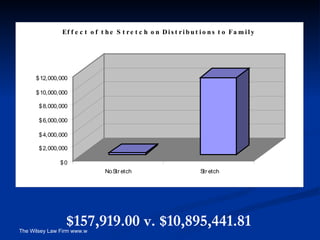

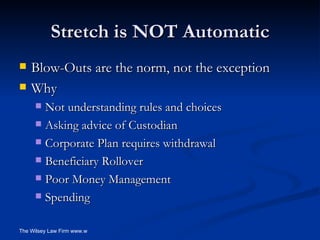

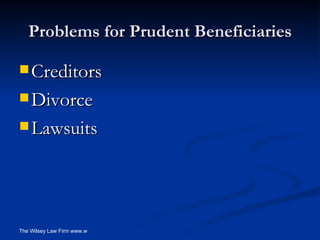

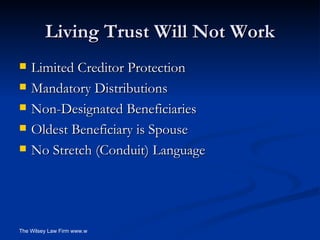

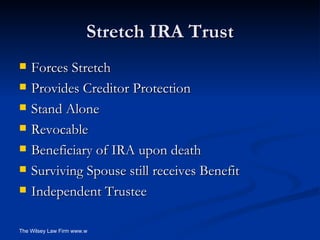

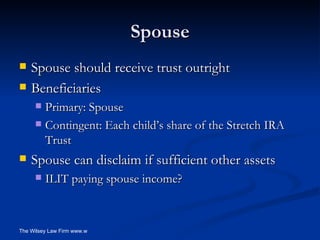

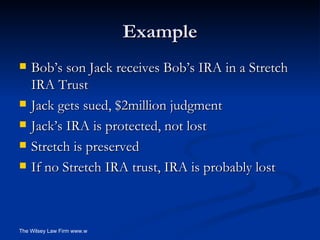

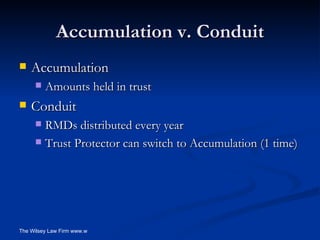

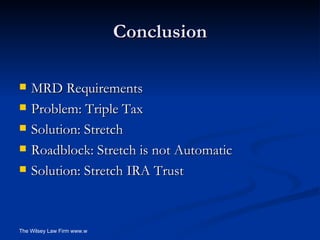

The document outlines essential information regarding IRAs and 401(k)s, including minimum distribution rules, beneficiary designations, and strategies for Roth IRA conversions. It highlights the significance of understanding tax implications, the importance of proper beneficiary designations, and the tactical use of stretch IRA trusts for estate planning. Additionally, it warns of the potential pitfalls and liabilities faced by financial advisors in managing clients' retirement accounts and wealth transfer strategies.