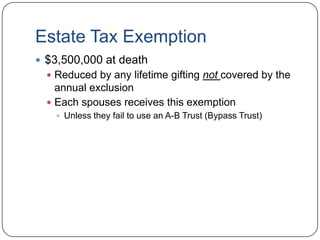

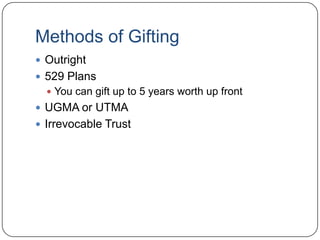

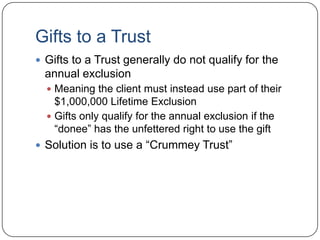

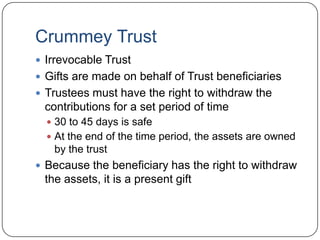

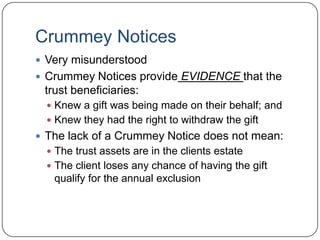

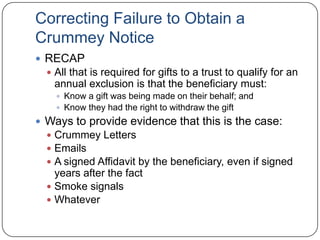

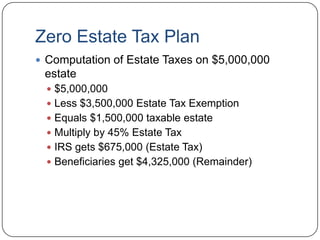

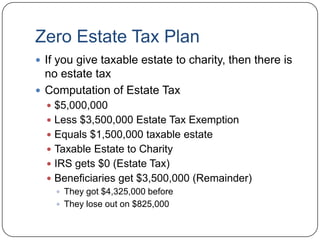

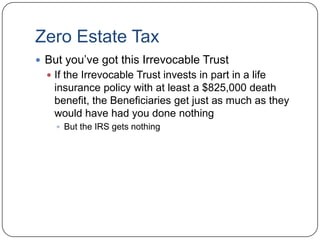

The document summarizes annual gifting and estate tax rules. It notes that individuals can gift up to $13,000 per year to an unlimited number of people gift-tax free under the annual exclusion. Any gifts over $13,000 to one person in a year will start reducing the $1 million lifetime gift tax exclusion. Upon death, individuals have a $3.5 million estate tax exemption that is reduced by lifetime gifts over annual exclusion amounts. The document reviews various gifting methods and strategies like Crummey trusts to leverage annual exclusions as well as zero estate tax planning using charitable gifts and irrevocable life insurance trusts.