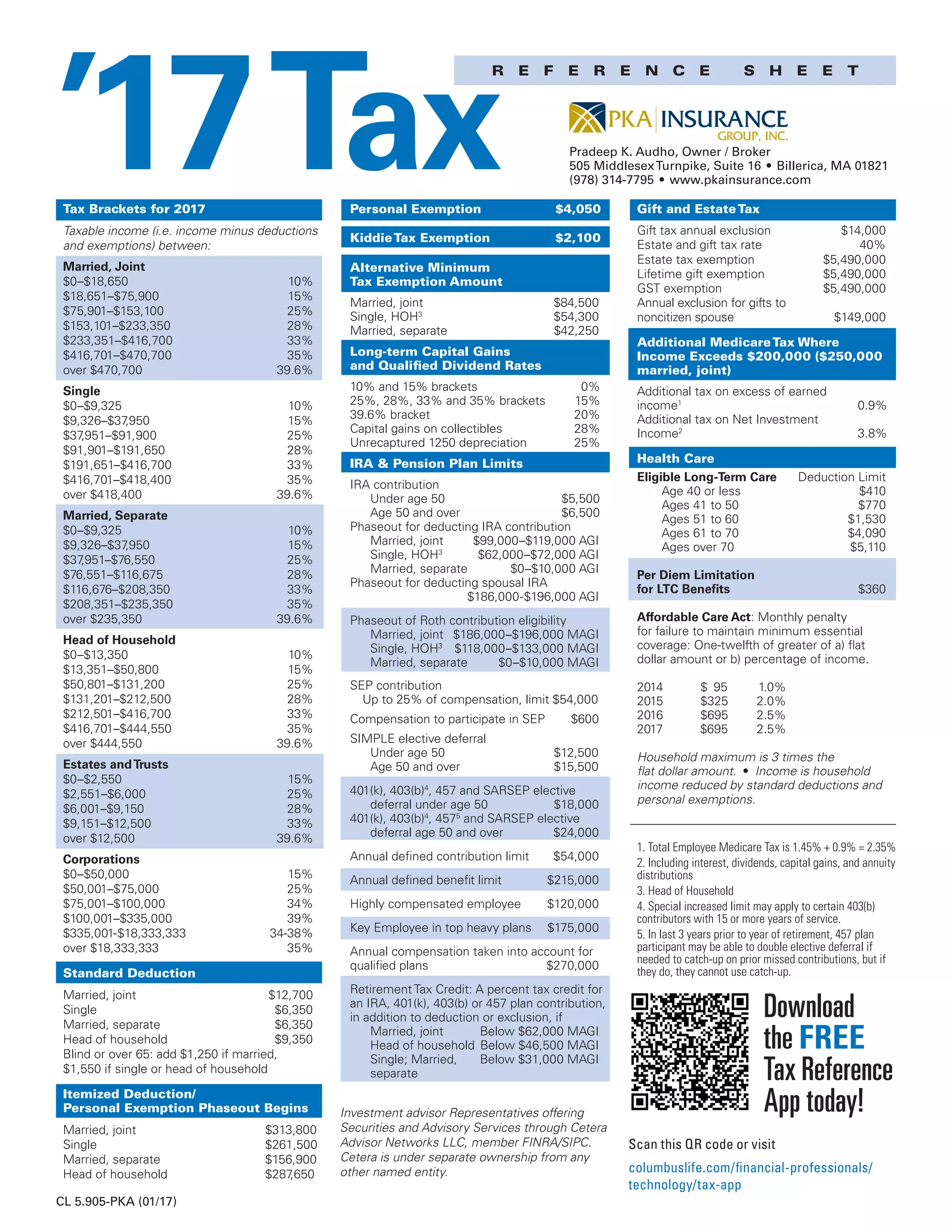

This document provides a summary of key 2017 tax reference information including:

- Personal exemption and standard deduction amounts.

- Capital gains tax rates and IRA/pension plan contribution limits.

- Estate and gift tax exemption amounts.

- Medicare surtax thresholds.

- Health care penalties for no coverage and long-term care deduction limits.

- Standard deduction amounts and tax brackets for single, married joint, married separate, head of household, estates and trusts, and corporations.