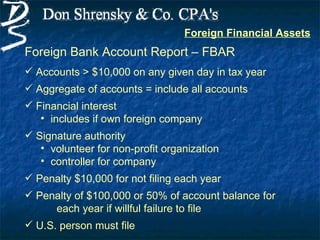

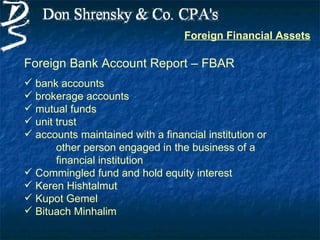

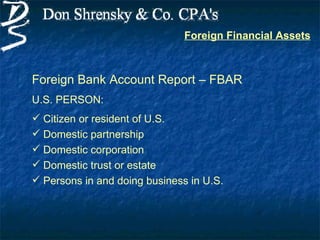

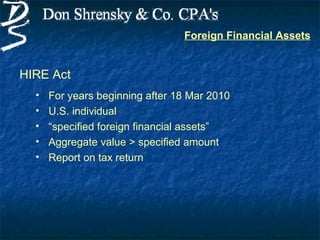

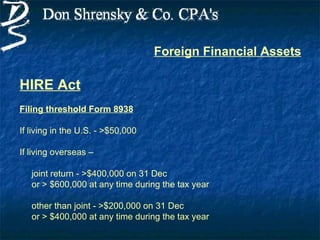

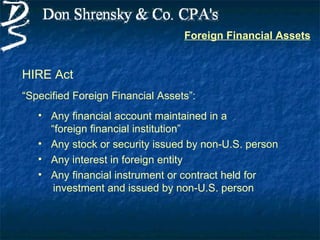

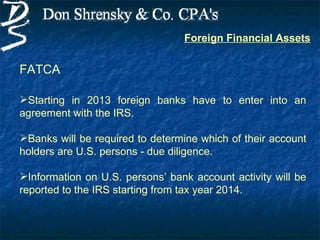

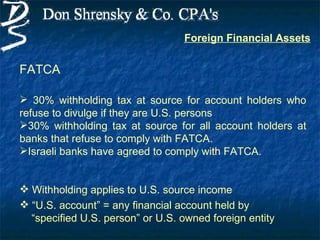

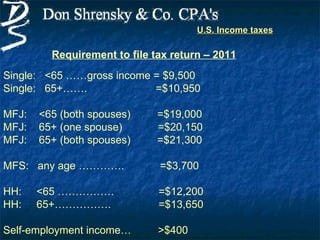

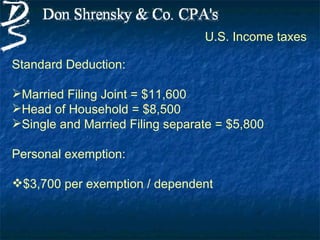

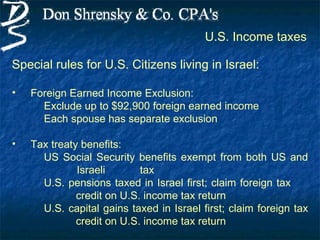

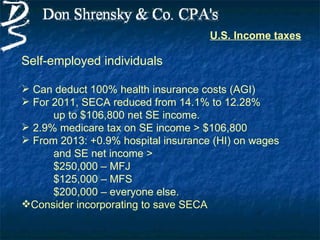

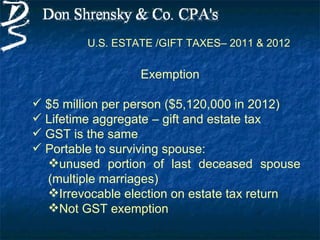

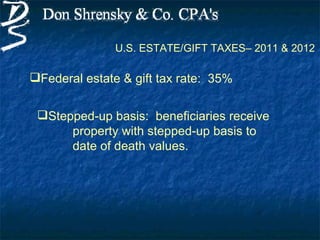

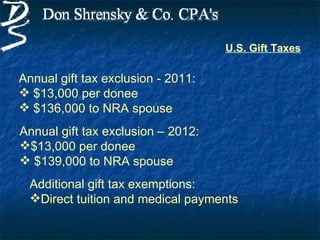

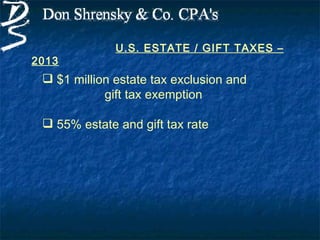

This document summarizes U.S. tax reporting requirements and rules for 2011 and beyond. It discusses income thresholds for filing requirements, standard deductions, personal exemptions, the foreign earned income exclusion, tax treaty benefits, self-employment taxes, income tax rates, capital gains taxes, the alternative minimum tax, donated IRAs, the surtax on unearned income, Keren Hishtalmut taxes, PFIC rules, child tax credits, additional child tax credits, estate and gift tax exemptions and rates, annual gift tax exclusions, and foreign financial asset reporting including the Foreign Bank Account Report (FBAR), Form 8938, the Foreign Account Tax Compliance Act (FATCA), and its proposed regulations.

![U.S. Income taxes

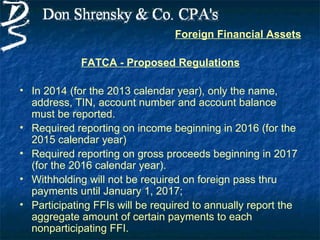

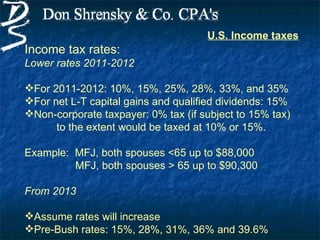

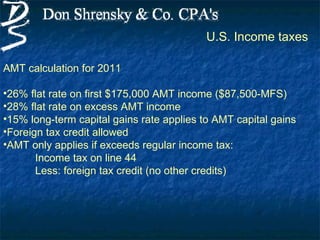

AMT (Alternative Minimum Tax) for 2011

The AMT exemption levels for 2011 are as follows:

Married Filing Joint = $74,450, [25% phaseout for AGI

exceeding $150,000]

Single = $48,450, [25% phaseout for AGI exceeding

$112,500]

Head of Household = $48,450, [25% phaseout for AGI

exceeding $112,500]

Married Filing Separate = $37,225, [25% phaseout for AGI

exceeding $75,000]](https://image.slidesharecdn.com/2012aaciseminarmarch2012-120321050430-phpapp02/85/US-Tax-Reporting-for-2011-and-Beyond-10-320.jpg)

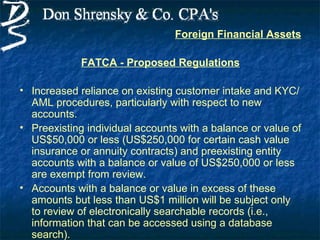

![Information Reports

TD F 90-22.1 Foreign Bank Account Report - FBARs

3520 Annual Return to Report Transactions with Foreign Trusts

and Receipt of Certain Foreign Gifts

3520-A Information Return of Foreign Trust with a US Owner

5471 Information Return of US Persons with Respect to Certain

Foreign Corporations

5472 Information Return of a 25% Foreign-Owned US Corporation

or a Foreign Corporation Engaged in a US Trade or Business

926 Return by a US Transferor of Property to a Foreign

Corporation

8865 Return of US Persons with Respect to Certain Foreign

Partnerships

8938 Statement of Specified Foreign Financial Assets [new 2011]](https://image.slidesharecdn.com/2012aaciseminarmarch2012-120321050430-phpapp02/85/US-Tax-Reporting-for-2011-and-Beyond-24-320.jpg)