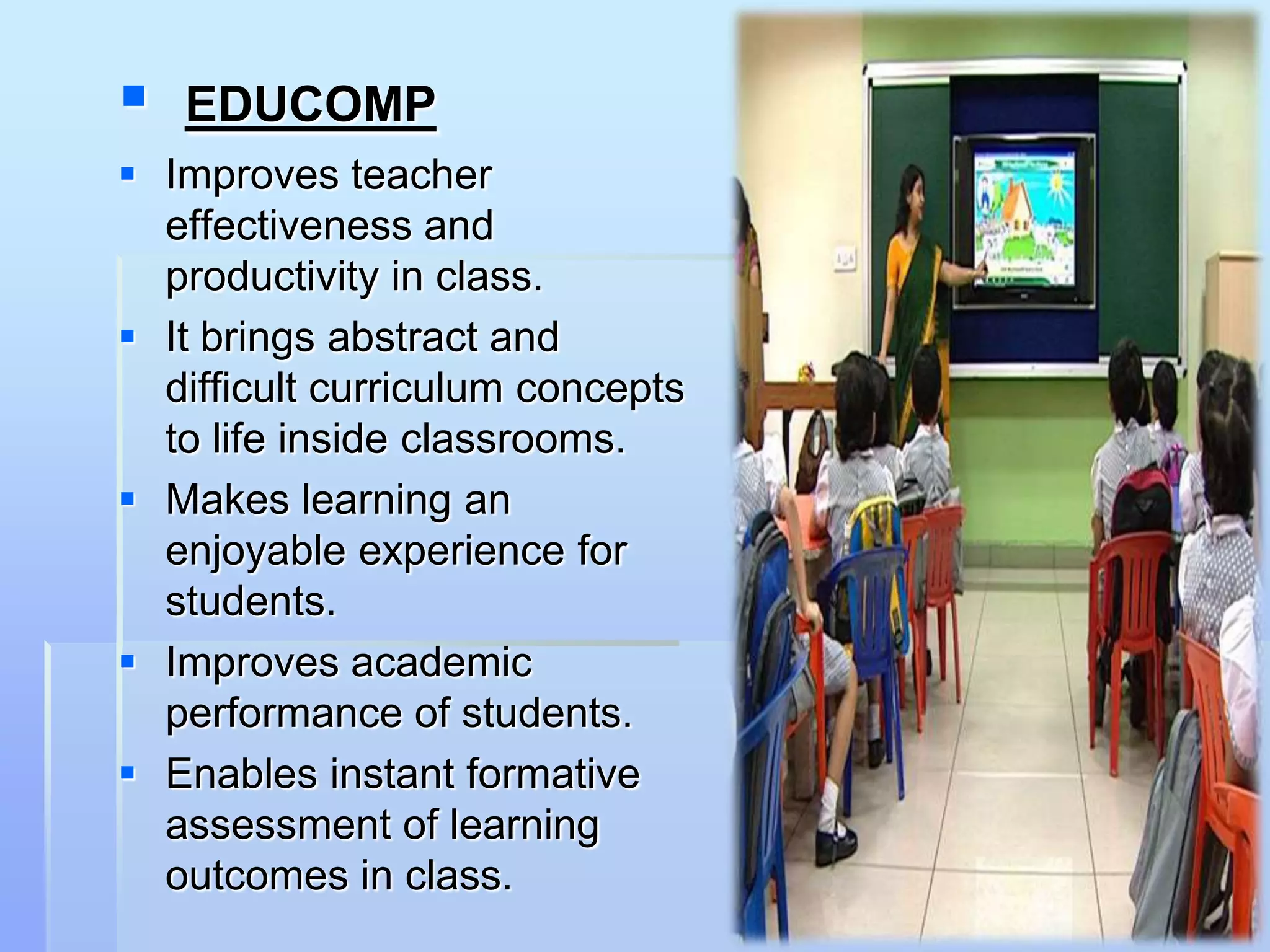

Technology plays an important role in various service sectors like banking, education, insurance, and healthcare. In banking, ATMs allow customers to perform many transactions and virtual banks provide services through interactive kiosks. Technology also aids education through tools like smart boards, projectors, and online learning systems that make lessons more engaging. Insurance companies use e-CRM and e-insurance platforms to better understand customers and provide personalized services digitally. Similarly, healthcare utilizes electronic medical records and other digital tools to improve care delivery and patient outcomes.