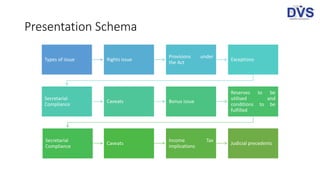

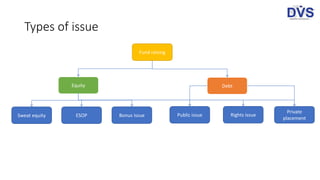

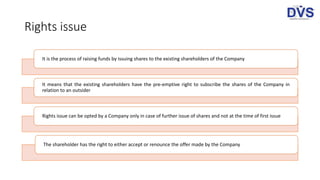

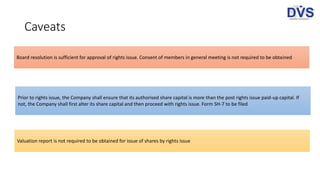

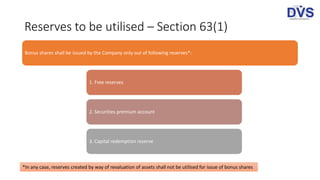

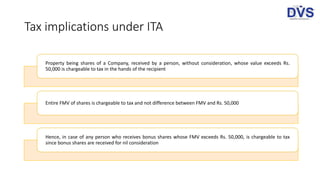

The document outlines the procedures and legal requirements for rights issues and bonus issues under the Companies Act, 2013, detailing the roles of existing shareholders, board resolutions, and compliance duties. It explains the distinctions between the two types of issues, including timelines for acceptance, documentation needed, and specific tax implications related to receiving shares without consideration. The document emphasizes the necessity for companies to ensure compliance with authorized share capital and various legal requirements prior to conducting these share issues.

![Judicial Precedents

Vestal Educational Services (P.) Ltd. vs. Lanka Venkata Naga Muralidhar - [2018] 100 taxmann.com 286 (NCL-AT)

Amount lent by shareholder to company to repay loan had been converted into equity without his knowledge, intimation or

authorization

Appellant claimed that allotment was done on basis of decision taken in board meeting where offer was made regarding issue

of equity shares at par on right issue basis to existing shareholders and respondent was shown as entitled/offered shares

However, company had not produced any evidence with regard to issue of notice offering shares to respondent or any other

shareholder and its acceptance by respondent

Thus, NCLAT held that impugned order passed by NCLT declaring said allotment to be null and void, was correct](https://image.slidesharecdn.com/rightsissueandbonusissue-191101042251/85/Rights-issue-and-bonus-issue-22-320.jpg)