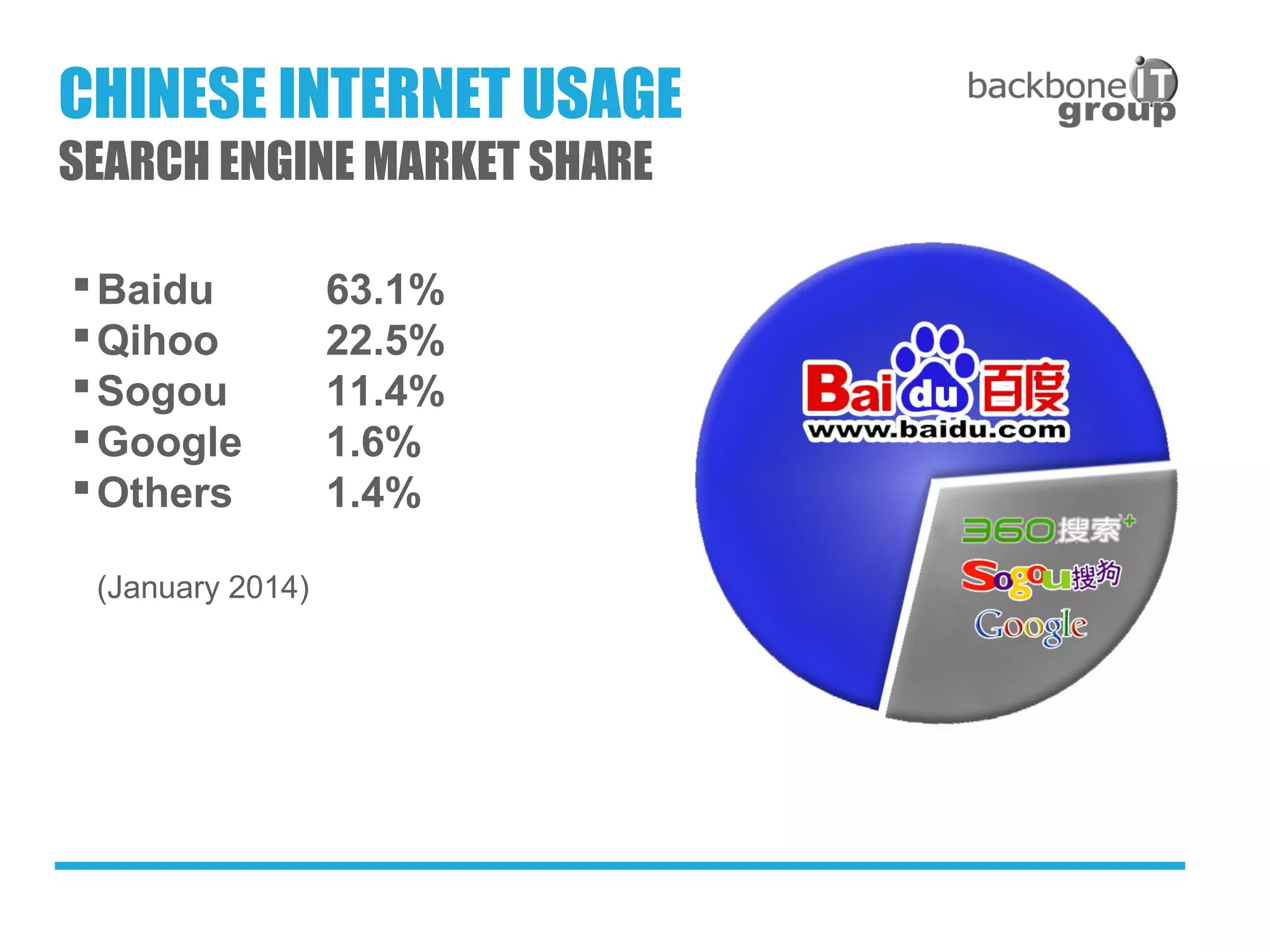

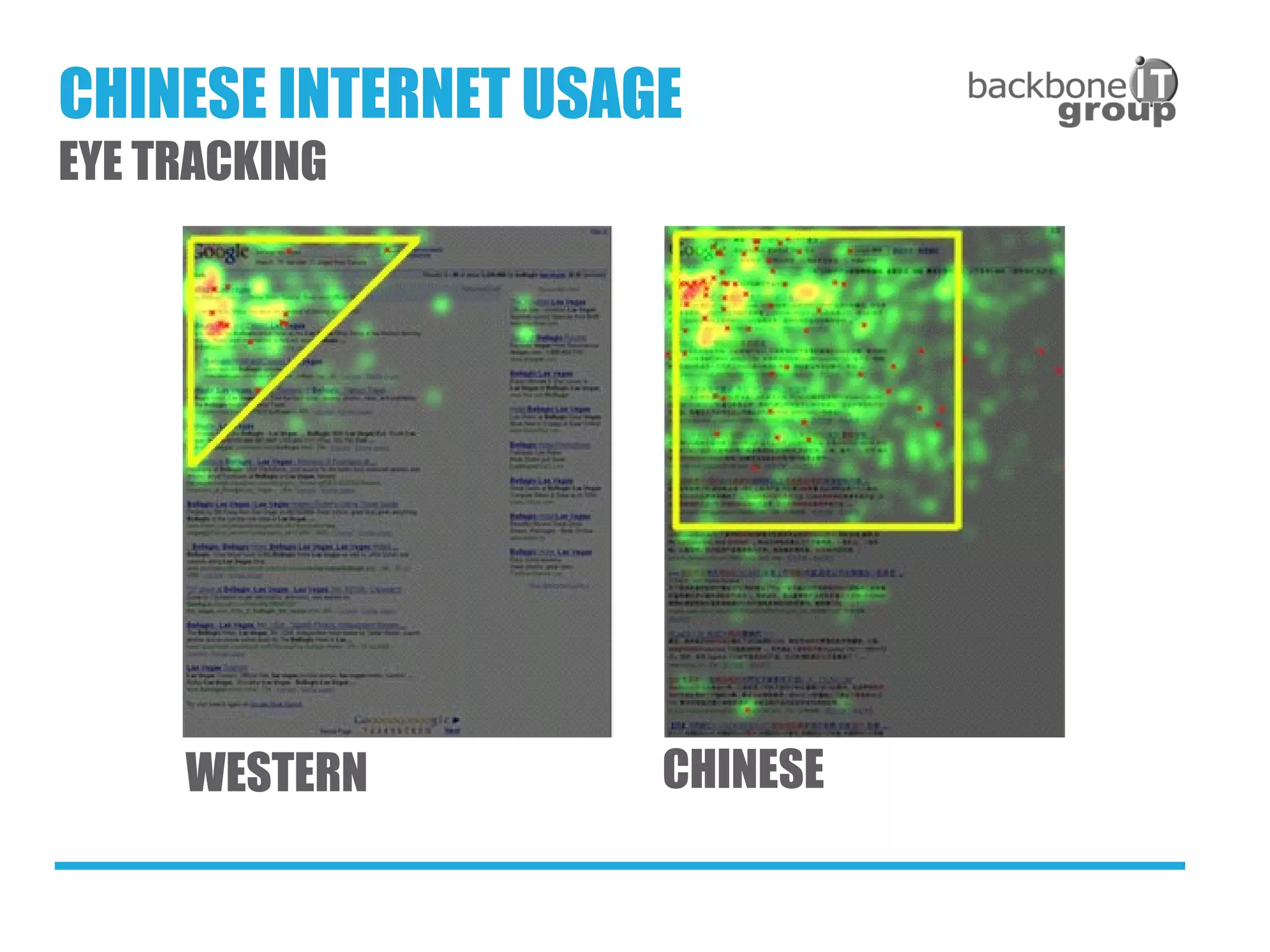

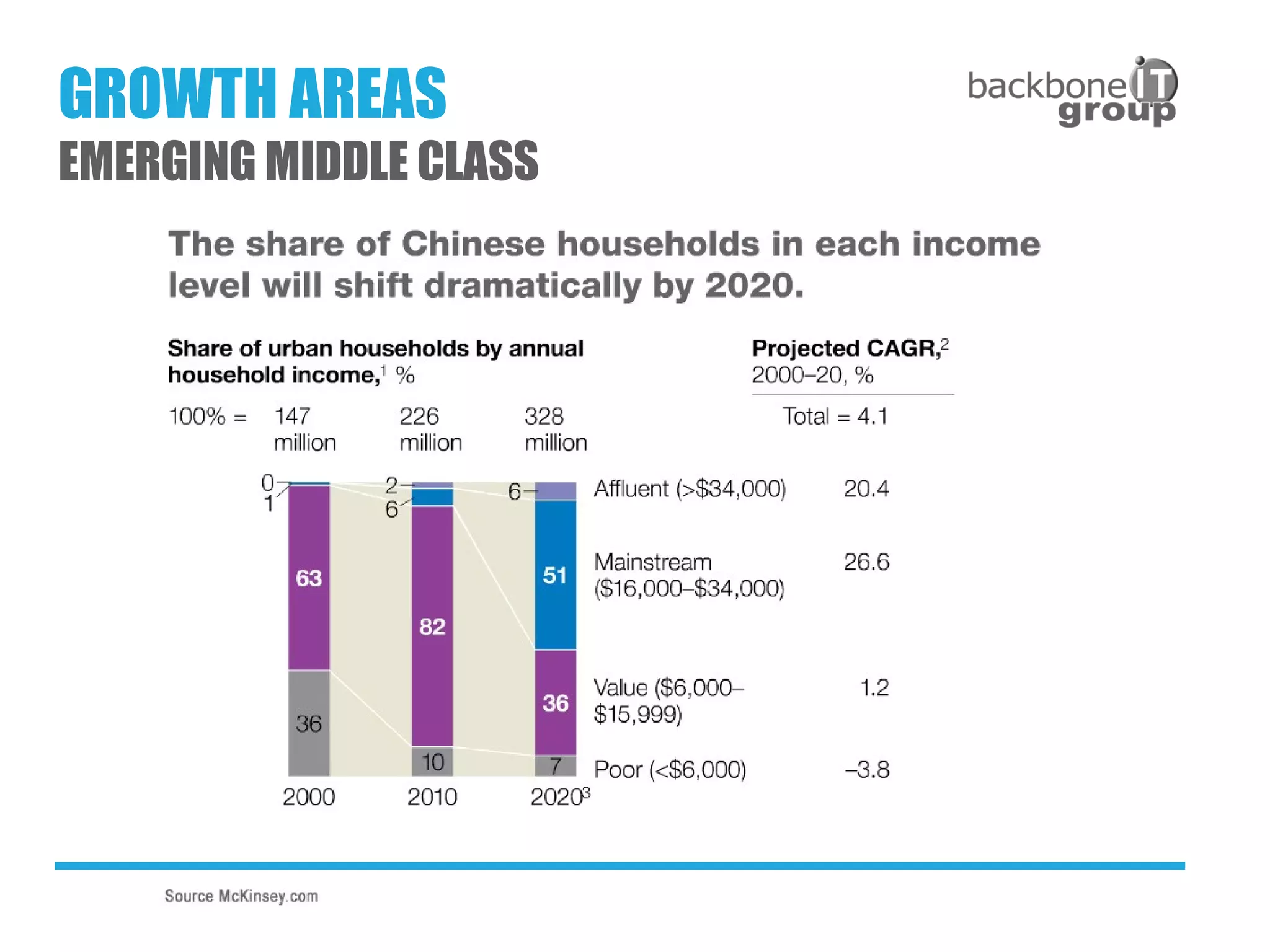

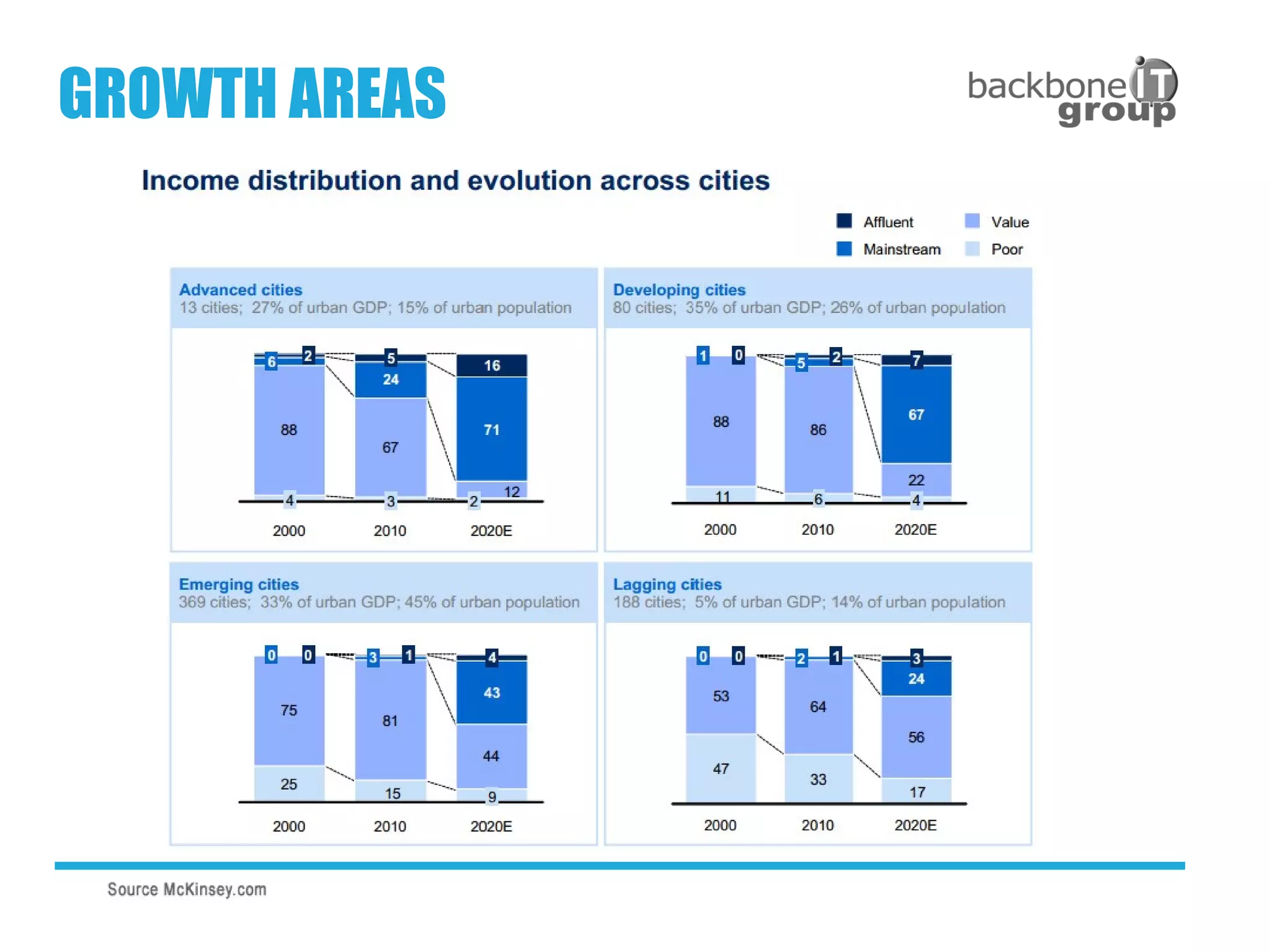

This document discusses opportunities for international e-commerce companies focusing on the Chinese market. It notes that China's economic growth and developing middle class have increased consumer demand and spending power. While Western assumptions about Internet usage do not always apply in China, opportunities exist in e-commerce marketplaces, social media, and working with local partners to understand preferences and build trust with Chinese consumers. Success requires a strategic approach and understanding key differences compared to other markets.

![[There are] certain misperceptions and false

assumptions in the Western world regarding Chinese

Internet usage.

For example, people in the United States and Europe

assume that going online involves using search engines,

checking email and purchasing items online. This is not

the case in China.

There is a general false assumption that the whole world

uses the Internet in the same way.

“

”

KAI-FU LEE

FOUNDING PRESIDENT OF GOOGLE CHINA](https://image.slidesharecdn.com/richardunwinbackboneit-140605104514-phpapp01/75/Richard-Unwin-Backbone-IT-8-2048.jpg)