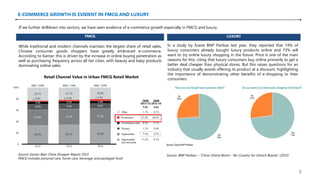

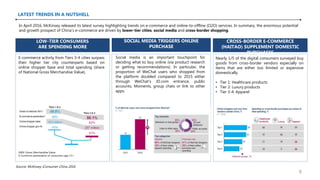

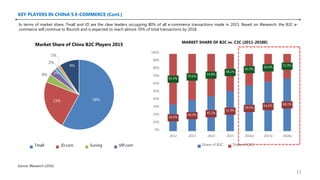

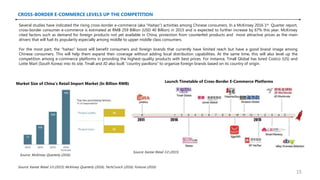

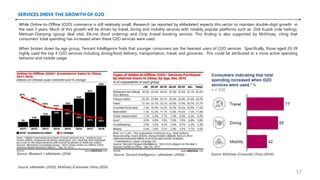

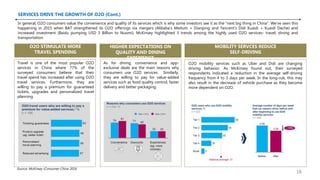

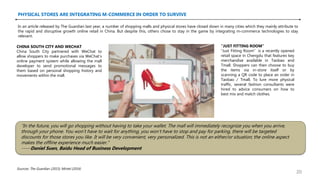

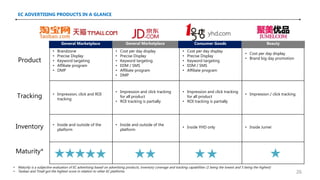

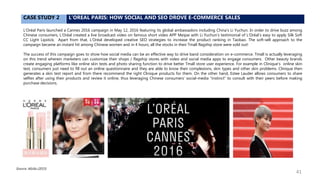

This document discusses the rapid growth of China's e-commerce market, which is projected to reach 9.6 trillion RMB by 2020, with notable trends such as increased online luxury purchases and the rise of cross-border shopping. It analyzes key players, emerging challenges, and advertising strategies within the industry, as well as case studies of successful brands. The publication aims to provide insights and guidance for marketers targeting the Chinese e-commerce landscape, especially in preparation for major sales events like Singles' Day.