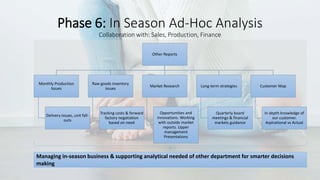

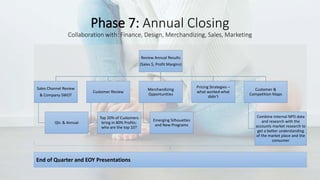

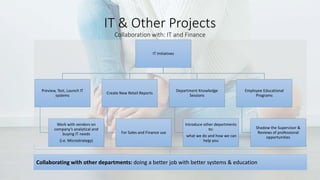

The document outlines the annual cycle and responsibilities of a retail planning and merchandizing analytics department. It involves 7 phases: 1) setting financial budgets and goals for the year, 2) developing a pre-market merchandizing plan, 3) in-market business reviews and negotiations, 4) post-market analysis of what was cut and sold, 5) managing ongoing in-season sales, 6) providing ad-hoc analysis to support decisions, and 7) annual closing including financial reporting. The department collaborates across finance, sales, marketing, production and design to develop plans, analyze performance, and support strategic decision making.