Research project presentation.

•Download as PPTX, PDF•

1 like•204 views

This document summarizes a student's research project on the impact of electronic banking on customer satisfaction in Pakistan. It presents data collected through surveys of business people, ordinary customers, and banking sector employees. The surveys found high levels of agreement that electronic banking benefits customers by saving time and reducing risks. However, some concerns around fraud and short-term profits were also identified. Overall, the combined data analysis indicates that electronic banking positively impacts customer satisfaction in Pakistan.

Report

Share

Report

Share

Recommended

E money survey 2017

The survey found that electronic money usage is growing but still nascent in Indonesia. The most popular card-based electronic money is Mandiri e-Money, while Go-Pay is the largest mobile app-based service. Most respondents report using electronic money for less than a year, indicating that most users are new to the technology. While electronic money adoption is increasing, over a quarter of respondents have not used any form of electronic money.

Banking and Millennial Entrepreneurs

Millennial entrepreneurs are quickly replacing retiring Boomers. How can banks serve this huge, diverse and technology-adept audience? You’ll learn:

• The business challenges Millennials face – and the opportunity that creates for banks

• The bank transaction preferences of Millennial entrepreneurs

• Their loan application activity and experience – and the challenge for traditional banks

• Awareness and perceptions of alternative lenders

• Bank brand perceptions and switching likelihood

E banking services of bank of maharashtra

This document presents a study on consumer awareness and perception of e-banking services provided by Bank of Maharashtra. The study utilized both primary and secondary research methods including a questionnaire survey of 35 customers. Key findings were that customers found e-banking services to be more convenient and secure than branch banking. However, some customers still felt unsure about security of e-banking transactions. The document concludes by providing suggestions to improve customer awareness and trust in e-banking services.

Customer Power: Banking part 1 of 4 - Retail banking relationships

Customer Power is a programme of research exploring the relationships that customers want to have with UK companies.

We’ve previously looked at the financial services, mobile, pay tv & energy sectors and now we are putting retail banks under the spotlight. This presentation is the first in a series of 4.

Here we look at whether consumers have the relationship they want with their bank, how it makes them feel, who the best banks are and why, and how banking compares with other sectors.

We have lots more data from this self-funded research, so if you would like to hear more, please get in touch - our contact details are included at the end.

Fintech lending in indonesia – consumer awareness 2017

This document examines consumer awareness of fintech lending in Indonesia in 2017. It finds that while the term "fintech" was still relatively new, with only about a third of respondents having heard it, over 90% had heard of lending, credit, or loans. Of respondents, 37.8% had previously applied for a loan, most commonly to start a business or purchase a vehicle. For those who hadn't applied, the largest reason was consciously avoiding debt. The survey concludes the market needs increased awareness of online or internet-based financing options.

Pdfcoffee.com e banking-project-pdf-free

This document is a project report on e-banking in India submitted by Surbhi Anjeev Singhal to the University of Mumbai. It contains an introduction to e-banking that defines it as the automated delivery of banking products and services directly to customers through electronic channels. It discusses the evolution and need for e-banking in India as well as its importance, features, and global presence. The report also covers the risks, security measures, benefits, challenges and SWOT analysis of e-banking. It examines various e-banking products and the Indian and future scenarios of e-banking in the country. Finally, it includes a case study on e-banking at Bank of Baroda

Project Report on e banking

The document is a student project report on e-banking in India. It includes an introduction that defines e-banking and discusses its background and development. It also outlines the objectives, methodology and limitations of the study. The conceptual framework section discusses how online banking works and its benefits to customers. The data analysis section examines how the internet and world wide web have enabled online banking services.

Credit card fraud

This document discusses credit card fraud, including its definition, types, implications, and common locations where it occurs. Credit card fraud involves stealing and misusing someone's credit card information to make unauthorized purchases. It can seriously harm victims by saddling them with debt and damaging their credit scores. Fraud occurs through various means such as online theft, physical card theft, counterfeiting, and phone/mail scams. Common locations with high fraud rates include supermarkets, hospitals, shopping centers, clothing stores, restaurants, and hotels.

Recommended

E money survey 2017

The survey found that electronic money usage is growing but still nascent in Indonesia. The most popular card-based electronic money is Mandiri e-Money, while Go-Pay is the largest mobile app-based service. Most respondents report using electronic money for less than a year, indicating that most users are new to the technology. While electronic money adoption is increasing, over a quarter of respondents have not used any form of electronic money.

Banking and Millennial Entrepreneurs

Millennial entrepreneurs are quickly replacing retiring Boomers. How can banks serve this huge, diverse and technology-adept audience? You’ll learn:

• The business challenges Millennials face – and the opportunity that creates for banks

• The bank transaction preferences of Millennial entrepreneurs

• Their loan application activity and experience – and the challenge for traditional banks

• Awareness and perceptions of alternative lenders

• Bank brand perceptions and switching likelihood

E banking services of bank of maharashtra

This document presents a study on consumer awareness and perception of e-banking services provided by Bank of Maharashtra. The study utilized both primary and secondary research methods including a questionnaire survey of 35 customers. Key findings were that customers found e-banking services to be more convenient and secure than branch banking. However, some customers still felt unsure about security of e-banking transactions. The document concludes by providing suggestions to improve customer awareness and trust in e-banking services.

Customer Power: Banking part 1 of 4 - Retail banking relationships

Customer Power is a programme of research exploring the relationships that customers want to have with UK companies.

We’ve previously looked at the financial services, mobile, pay tv & energy sectors and now we are putting retail banks under the spotlight. This presentation is the first in a series of 4.

Here we look at whether consumers have the relationship they want with their bank, how it makes them feel, who the best banks are and why, and how banking compares with other sectors.

We have lots more data from this self-funded research, so if you would like to hear more, please get in touch - our contact details are included at the end.

Fintech lending in indonesia – consumer awareness 2017

This document examines consumer awareness of fintech lending in Indonesia in 2017. It finds that while the term "fintech" was still relatively new, with only about a third of respondents having heard it, over 90% had heard of lending, credit, or loans. Of respondents, 37.8% had previously applied for a loan, most commonly to start a business or purchase a vehicle. For those who hadn't applied, the largest reason was consciously avoiding debt. The survey concludes the market needs increased awareness of online or internet-based financing options.

Pdfcoffee.com e banking-project-pdf-free

This document is a project report on e-banking in India submitted by Surbhi Anjeev Singhal to the University of Mumbai. It contains an introduction to e-banking that defines it as the automated delivery of banking products and services directly to customers through electronic channels. It discusses the evolution and need for e-banking in India as well as its importance, features, and global presence. The report also covers the risks, security measures, benefits, challenges and SWOT analysis of e-banking. It examines various e-banking products and the Indian and future scenarios of e-banking in the country. Finally, it includes a case study on e-banking at Bank of Baroda

Project Report on e banking

The document is a student project report on e-banking in India. It includes an introduction that defines e-banking and discusses its background and development. It also outlines the objectives, methodology and limitations of the study. The conceptual framework section discusses how online banking works and its benefits to customers. The data analysis section examines how the internet and world wide web have enabled online banking services.

Credit card fraud

This document discusses credit card fraud, including its definition, types, implications, and common locations where it occurs. Credit card fraud involves stealing and misusing someone's credit card information to make unauthorized purchases. It can seriously harm victims by saddling them with debt and damaging their credit scores. Fraud occurs through various means such as online theft, physical card theft, counterfeiting, and phone/mail scams. Common locations with high fraud rates include supermarkets, hospitals, shopping centers, clothing stores, restaurants, and hotels.

Banking service usage in Thailand

A half of Thai banking service users intend to use credit cards.

Find more at:

http://www.di-onlinesurvey.com/

Report on Online Banking for Women

Hi Friends,

This is the Report on Survey of Online Banking for Women which is basically based on Survey which is done by our group and I also includes Pie chart, Line chart and Bar chart for the same...

Thank You !

Regards,

Rahul Shah

(rahulshah4345@gmail.com / +91-9408134345)

Use of Automated Teller Machine (ATM) card in Dhaka City: A Survey to Reveal ...

IOSR Journal of Business and Management (IOSR-JBM) is a double blind peer reviewed International Journal that provides rapid publication (within a month) of articles in all areas of business and managemant and its applications. The journal welcomes publications of high quality papers on theoretical developments and practical applications inbusiness and management. Original research papers, state-of-the-art reviews, and high quality technical notes are invited for publications.

PPT

The document is a comprehensive project report on online banking in India. It includes an introduction to online banking, an overview of services provided, advantages and disadvantages. It also discusses the online banking scenario in India, top banks providing services, a SWOT analysis, objectives of the study, literature review, research methodology used, data analysis and findings. The key findings are that online banking is popular among young adults for convenience, most rate services as good, and nearly all see it as a better alternative to traditional banking.

Small Business Adoption of EMV Technology

Intuit surveyed small business owners to get their perspectives on EMV technology and the upcoming liability shift.

The survey data is based on an online multiple-choice questionnaire, administered to 504 U.S. small businesses, at the owner or manager level, with 1-100 employees. The survey was fielded by Ebiquity from April 22-27, 2015; all respondents accept credit cards through mobile swipers and/or physical point of sale terminals.

ONLINE BANKING

Online banking has grown in popularity in India, with over 60% of those surveyed using online banking services for their convenience and simplicity. While many banks have implemented online services, some users remain unfamiliar with the options or have concerns about security. Websites can also be improved to be more customizable according to user preferences and ensure marketing does not interfere with the banking experience. Overall, online banking provides benefits but also opportunities for further innovation to increase adoption and satisfaction.

CREDIT CARD USAGE IN VIETNAM

Online payment (79%), Shopping abroad (65%), Pay for utility (63%) are top 3 things appropriate for using credit card

Find more at: http://di-onlinesurvey.com/

20170616creditcardvnfinal-170621040148.pdf

The document summarizes the key findings of a survey about credit card usage in Vietnam conducted by Di-Marketing in June 2017. The survey had 410 respondents nationwide. Key findings include:

- On average, credit card users start owning a card at age 25. Online payment, shopping abroad, and paying utilities are the top three appropriate uses of credit cards.

- Respondents consider the current cash withdrawal interest rate acceptable but the overdue repayment interest high.

- Convenient carrying, online purchases, and urgent needs are seen as top advantages while interest if late, annual fees, and exceeding limits are top disadvantages.

Venkatesh TAPMI

This document analyzes digital and branch banking in India. It finds that while branch banking customers value privacy and face-to-face service, digital banking is most popular with younger users who prioritize security, responsiveness and convenience. Research also showed a need for better awareness and tailored products for women and rural customers. Recommendations include expanding access to banking in rural areas, improving specific product awareness, and personal financial management tools. The road ahead involves better serving currently underserved customer groups through marketing and useful new products.

Online Banking

This document provides an overview of online banking, including its history, features, and how to access it. It discusses the introduction and growth of online banking services in Bangladesh and highlights HSBC Bank Bangladesh. The advantages of online banking are convenience and around-the-clock access, while disadvantages include security concerns, technical issues, and the need for computer skills. Security measures like encryption and firewalls aim to protect users, but risks such as hacking still exist.

Indonesia Fintech Overview 2016

Fintech refers to technology-enabled innovation in financial services that could disrupt traditional models. Global fintech investment has grown substantially since 2010, led by North America. Consumer banking and payments are seen as the areas most likely to experience disruption. Fintechs focus on single services and extract value from data, while traditional banks offer multiple services and extract value from products. This evolution may help address Indonesia's large financing gap, as over half of its population lacks bank accounts and most small businesses rely on own funds rather than loans. Emerging fintech models like peer-to-peer lending, crowdlending, and online marketplaces could help connect borrowers and lenders in new ways.

ATM usage is increasing for cash transactions

The survey summarizes findings from an online survey of 1,086 Vietnamese bank customers in 5 major cities conducted in June 2015. Key findings include:

- Vietcombank, Agribank, and Vietinbank have the highest brand awareness and market share. ATM networks are the main source of brand awareness.

- ATM use, money transfers, and internet banking are the most commonly used services. Trust, nationwide ATM networks, and number of branches are top reasons for bank choice.

- 70% of customers are satisfied with their bank, though satisfaction levels vary, with HSBC the highest and Agribank the lowest.

Is consolidation the only future for challenger banking?

- The challenger banking space is highly crowded with both specialists offering basic accounts and cards and generalists offering a wider range of products, though most challengers offer limited products.

- Challenger banks are focusing on niche customer segments like millennials, immigrants, and small businesses with targeted offerings. However, customers still use traditional banks for most of their financial needs.

- While challenger banks have lower costs due to their digital focus, partnerships could help them further reduce costs and alleviate pressure to expand their product offerings to fully serve customer needs. Consolidation may be necessary for challengers to retain "not yet loyal" customers and improve rates of customer acquisition.

E-banking: Uses and perception.

This document summarizes a research study on the uses and perceptions of e-banking among customers of HDFC Bank in India. The study used a survey of 100 HDFC Bank customers and found that employees, males aged 21-40 earning Rs. 15,000-20,000 per month mostly use e-banking for convenience and personal banking transactions. While e-banking usage could be increased among other groups, customers perceive it as convenient and easy to use. The document recommends the bank increase awareness programs, attract new customers, and customize e-banking services.

Online banking serices

The document describes an online banking system with the following modules:

- Administrative module for administrators to access accounts, provide credentials, accept requests.

- Customer module for customers to transfer funds, access accounts, send requests.

- Transaction module containing transaction details.

- Security and authentication module for verifying users.

- Reports module for generating reports.

It discusses advantages like cost, speed but also issues like security, learning difficulties. Hardware requirements include a PC and software requirements include Windows, Java, databases.

challenge of Online Banking and Best Practice of Public and pvt sector banks

this ppt for challenges of online banking and how banks are mitigate this challenges and what are best practice of public and pvt sector Banks now a days.

PRESENTATION ON MOBIKWIK AND CONSUMER ADOPTION IN MOBILE WALLET

SECTOR INFORMATION (DIGITAL WALLET) WORLD WIDE AND INDIA

GDP CONTRIBUTION

FUTURE FORECAST OF DIGITAL WALLET WORLD WIDE AND INDIA

RESEARCH PART CONSUMER ADOPTION IN MOBILE WALLET

FINDINGS OF RESEARCH

Is technology aiding credit access

Technology is helping to improve credit access for small and medium enterprises (SMEs) in India. SMEs face difficulties obtaining credit due to inadequate financial records and high risks, but new fintech platforms are using alternative data and analytics to streamline lending. Capital Float, a case study example, uses digital data from e-commerce sellers to quickly provide working capital loans to SMEs. While credit gaps remain, partnerships between banks and fintechs as well as growing data availability are expanding credit availability and reducing costs for SMEs in India.

Payments Pulse Survey: Small Business Edition (October 2019)

This year’s survey, which focuses on the payment trends, interests, and views of Canadian small businesses, revealed the majority of small businesses do fewer than 25 per cent of their transactions in cash but still feel obligated to accept it.

The 2019 Payments Pulse: Small Business Edition was undertaken by Leger and Payments Canada between September 17, 2019 and September 24, 2019. An online survey of 300 Canadian small business owners of companies with less than 499 employees was completed using Leger’s online panel. The margin of error for this study was +/- 5.6%, 19 times out of 20.

A STUDY OF THE CONSUMER PERCEPTION ON PAYMENT METHODS

A "cashless economy" is one in which all transactions take place electronically through means such as direct debit, credit cards, debit cards, electronic clearing, and payment systems like India's Immediate Payment Service (IMPS), National Electronic Funds Transfer (NEFT), and Real Time Gross Settlement (RTGS). The study finds that most respondents use electronic payments as a highly convenient option. E-payments services aid clients by offering services that may be used anywhere and in safety. Epayment services are crucial in the choice of a certain bank card. This study is being presented in the hopes that it will alert borrowing authorities to the varied features of e-banking services.

Strategic Hero Honda

This document provides information about a student named Rehman Khan who is enrolled in the 2nd semester of the MBA program at Benazir Bhutto Shaheed University. Khan is working on a project about the strategic management of Hero Honda for his class instructed by Mr. Khuram Shakir. The document includes details about Hero Honda's vision, mission, products, growth strategy, competitors, and external environment. It analyzes Hero Honda using various frameworks including Porter's five forces, SWOT analysis, strategic group mapping, and more. Key rivals identified include Bajaj, TVS Motors, and a joint venture between Kinetic Motor Co. and Mahindra & Mahindra. The document

Assets price impact exchange rate and stock rate

1. The document analyzes the impact of exchange rates and interest rates on Pakistan's stock market (KSE-100 index) from 2006 to 2016 using time series data and econometric tools in EViews software.

2. Unit root tests and Johansen cointegration tests show there is no long-term relationship between the KSE-100 index and inflation rate, interest rate, and USD-PKR exchange rate.

3. Correlation analysis reveals the KSE-100 has a strong positive correlation with the exchange rate and negative correlations with interest rates and inflation.

More Related Content

Similar to Research project presentation.

Banking service usage in Thailand

A half of Thai banking service users intend to use credit cards.

Find more at:

http://www.di-onlinesurvey.com/

Report on Online Banking for Women

Hi Friends,

This is the Report on Survey of Online Banking for Women which is basically based on Survey which is done by our group and I also includes Pie chart, Line chart and Bar chart for the same...

Thank You !

Regards,

Rahul Shah

(rahulshah4345@gmail.com / +91-9408134345)

Use of Automated Teller Machine (ATM) card in Dhaka City: A Survey to Reveal ...

IOSR Journal of Business and Management (IOSR-JBM) is a double blind peer reviewed International Journal that provides rapid publication (within a month) of articles in all areas of business and managemant and its applications. The journal welcomes publications of high quality papers on theoretical developments and practical applications inbusiness and management. Original research papers, state-of-the-art reviews, and high quality technical notes are invited for publications.

PPT

The document is a comprehensive project report on online banking in India. It includes an introduction to online banking, an overview of services provided, advantages and disadvantages. It also discusses the online banking scenario in India, top banks providing services, a SWOT analysis, objectives of the study, literature review, research methodology used, data analysis and findings. The key findings are that online banking is popular among young adults for convenience, most rate services as good, and nearly all see it as a better alternative to traditional banking.

Small Business Adoption of EMV Technology

Intuit surveyed small business owners to get their perspectives on EMV technology and the upcoming liability shift.

The survey data is based on an online multiple-choice questionnaire, administered to 504 U.S. small businesses, at the owner or manager level, with 1-100 employees. The survey was fielded by Ebiquity from April 22-27, 2015; all respondents accept credit cards through mobile swipers and/or physical point of sale terminals.

ONLINE BANKING

Online banking has grown in popularity in India, with over 60% of those surveyed using online banking services for their convenience and simplicity. While many banks have implemented online services, some users remain unfamiliar with the options or have concerns about security. Websites can also be improved to be more customizable according to user preferences and ensure marketing does not interfere with the banking experience. Overall, online banking provides benefits but also opportunities for further innovation to increase adoption and satisfaction.

CREDIT CARD USAGE IN VIETNAM

Online payment (79%), Shopping abroad (65%), Pay for utility (63%) are top 3 things appropriate for using credit card

Find more at: http://di-onlinesurvey.com/

20170616creditcardvnfinal-170621040148.pdf

The document summarizes the key findings of a survey about credit card usage in Vietnam conducted by Di-Marketing in June 2017. The survey had 410 respondents nationwide. Key findings include:

- On average, credit card users start owning a card at age 25. Online payment, shopping abroad, and paying utilities are the top three appropriate uses of credit cards.

- Respondents consider the current cash withdrawal interest rate acceptable but the overdue repayment interest high.

- Convenient carrying, online purchases, and urgent needs are seen as top advantages while interest if late, annual fees, and exceeding limits are top disadvantages.

Venkatesh TAPMI

This document analyzes digital and branch banking in India. It finds that while branch banking customers value privacy and face-to-face service, digital banking is most popular with younger users who prioritize security, responsiveness and convenience. Research also showed a need for better awareness and tailored products for women and rural customers. Recommendations include expanding access to banking in rural areas, improving specific product awareness, and personal financial management tools. The road ahead involves better serving currently underserved customer groups through marketing and useful new products.

Online Banking

This document provides an overview of online banking, including its history, features, and how to access it. It discusses the introduction and growth of online banking services in Bangladesh and highlights HSBC Bank Bangladesh. The advantages of online banking are convenience and around-the-clock access, while disadvantages include security concerns, technical issues, and the need for computer skills. Security measures like encryption and firewalls aim to protect users, but risks such as hacking still exist.

Indonesia Fintech Overview 2016

Fintech refers to technology-enabled innovation in financial services that could disrupt traditional models. Global fintech investment has grown substantially since 2010, led by North America. Consumer banking and payments are seen as the areas most likely to experience disruption. Fintechs focus on single services and extract value from data, while traditional banks offer multiple services and extract value from products. This evolution may help address Indonesia's large financing gap, as over half of its population lacks bank accounts and most small businesses rely on own funds rather than loans. Emerging fintech models like peer-to-peer lending, crowdlending, and online marketplaces could help connect borrowers and lenders in new ways.

ATM usage is increasing for cash transactions

The survey summarizes findings from an online survey of 1,086 Vietnamese bank customers in 5 major cities conducted in June 2015. Key findings include:

- Vietcombank, Agribank, and Vietinbank have the highest brand awareness and market share. ATM networks are the main source of brand awareness.

- ATM use, money transfers, and internet banking are the most commonly used services. Trust, nationwide ATM networks, and number of branches are top reasons for bank choice.

- 70% of customers are satisfied with their bank, though satisfaction levels vary, with HSBC the highest and Agribank the lowest.

Is consolidation the only future for challenger banking?

- The challenger banking space is highly crowded with both specialists offering basic accounts and cards and generalists offering a wider range of products, though most challengers offer limited products.

- Challenger banks are focusing on niche customer segments like millennials, immigrants, and small businesses with targeted offerings. However, customers still use traditional banks for most of their financial needs.

- While challenger banks have lower costs due to their digital focus, partnerships could help them further reduce costs and alleviate pressure to expand their product offerings to fully serve customer needs. Consolidation may be necessary for challengers to retain "not yet loyal" customers and improve rates of customer acquisition.

E-banking: Uses and perception.

This document summarizes a research study on the uses and perceptions of e-banking among customers of HDFC Bank in India. The study used a survey of 100 HDFC Bank customers and found that employees, males aged 21-40 earning Rs. 15,000-20,000 per month mostly use e-banking for convenience and personal banking transactions. While e-banking usage could be increased among other groups, customers perceive it as convenient and easy to use. The document recommends the bank increase awareness programs, attract new customers, and customize e-banking services.

Online banking serices

The document describes an online banking system with the following modules:

- Administrative module for administrators to access accounts, provide credentials, accept requests.

- Customer module for customers to transfer funds, access accounts, send requests.

- Transaction module containing transaction details.

- Security and authentication module for verifying users.

- Reports module for generating reports.

It discusses advantages like cost, speed but also issues like security, learning difficulties. Hardware requirements include a PC and software requirements include Windows, Java, databases.

challenge of Online Banking and Best Practice of Public and pvt sector banks

this ppt for challenges of online banking and how banks are mitigate this challenges and what are best practice of public and pvt sector Banks now a days.

PRESENTATION ON MOBIKWIK AND CONSUMER ADOPTION IN MOBILE WALLET

SECTOR INFORMATION (DIGITAL WALLET) WORLD WIDE AND INDIA

GDP CONTRIBUTION

FUTURE FORECAST OF DIGITAL WALLET WORLD WIDE AND INDIA

RESEARCH PART CONSUMER ADOPTION IN MOBILE WALLET

FINDINGS OF RESEARCH

Is technology aiding credit access

Technology is helping to improve credit access for small and medium enterprises (SMEs) in India. SMEs face difficulties obtaining credit due to inadequate financial records and high risks, but new fintech platforms are using alternative data and analytics to streamline lending. Capital Float, a case study example, uses digital data from e-commerce sellers to quickly provide working capital loans to SMEs. While credit gaps remain, partnerships between banks and fintechs as well as growing data availability are expanding credit availability and reducing costs for SMEs in India.

Payments Pulse Survey: Small Business Edition (October 2019)

This year’s survey, which focuses on the payment trends, interests, and views of Canadian small businesses, revealed the majority of small businesses do fewer than 25 per cent of their transactions in cash but still feel obligated to accept it.

The 2019 Payments Pulse: Small Business Edition was undertaken by Leger and Payments Canada between September 17, 2019 and September 24, 2019. An online survey of 300 Canadian small business owners of companies with less than 499 employees was completed using Leger’s online panel. The margin of error for this study was +/- 5.6%, 19 times out of 20.

A STUDY OF THE CONSUMER PERCEPTION ON PAYMENT METHODS

A "cashless economy" is one in which all transactions take place electronically through means such as direct debit, credit cards, debit cards, electronic clearing, and payment systems like India's Immediate Payment Service (IMPS), National Electronic Funds Transfer (NEFT), and Real Time Gross Settlement (RTGS). The study finds that most respondents use electronic payments as a highly convenient option. E-payments services aid clients by offering services that may be used anywhere and in safety. Epayment services are crucial in the choice of a certain bank card. This study is being presented in the hopes that it will alert borrowing authorities to the varied features of e-banking services.

Similar to Research project presentation. (20)

Use of Automated Teller Machine (ATM) card in Dhaka City: A Survey to Reveal ...

Use of Automated Teller Machine (ATM) card in Dhaka City: A Survey to Reveal ...

Is consolidation the only future for challenger banking?

Is consolidation the only future for challenger banking?

challenge of Online Banking and Best Practice of Public and pvt sector banks

challenge of Online Banking and Best Practice of Public and pvt sector banks

PRESENTATION ON MOBIKWIK AND CONSUMER ADOPTION IN MOBILE WALLET

PRESENTATION ON MOBIKWIK AND CONSUMER ADOPTION IN MOBILE WALLET

Payments Pulse Survey: Small Business Edition (October 2019)

Payments Pulse Survey: Small Business Edition (October 2019)

A STUDY OF THE CONSUMER PERCEPTION ON PAYMENT METHODS

A STUDY OF THE CONSUMER PERCEPTION ON PAYMENT METHODS

More from Rehman khan shama

Strategic Hero Honda

This document provides information about a student named Rehman Khan who is enrolled in the 2nd semester of the MBA program at Benazir Bhutto Shaheed University. Khan is working on a project about the strategic management of Hero Honda for his class instructed by Mr. Khuram Shakir. The document includes details about Hero Honda's vision, mission, products, growth strategy, competitors, and external environment. It analyzes Hero Honda using various frameworks including Porter's five forces, SWOT analysis, strategic group mapping, and more. Key rivals identified include Bajaj, TVS Motors, and a joint venture between Kinetic Motor Co. and Mahindra & Mahindra. The document

Assets price impact exchange rate and stock rate

1. The document analyzes the impact of exchange rates and interest rates on Pakistan's stock market (KSE-100 index) from 2006 to 2016 using time series data and econometric tools in EViews software.

2. Unit root tests and Johansen cointegration tests show there is no long-term relationship between the KSE-100 index and inflation rate, interest rate, and USD-PKR exchange rate.

3. Correlation analysis reveals the KSE-100 has a strong positive correlation with the exchange rate and negative correlations with interest rates and inflation.

Corporate governance models

1 Anglo Saxon corporate governance model

2 German corporate governance model

3 Japan corporate governance model .

Marble Appraisal project of Pakistan

The document provides details about a proposed marble company project in Karachi, Pakistan. It includes:

1) An introduction to natural marble found in Balochistan and KPK provinces and the types available.

2) Details on the location, machinery used, and prices of different marble varieties from key mountain sources near Karachi.

3) A SWOT analysis identifying strengths like owned machinery, and weaknesses like lack of technology. Opportunities from CPEC and threats from risks in Balochistan mountains are also noted.

4) Recommendations around ensuring spare parts, quality control, developing sales networks, competitive pricing, training staff, and linking compensation to performance.

Attack cement Marketing strategy management project

The document provides information about Attock Cement Pakistan Limited (ACPL), including:

1) ACPL started commercial production in 1988 with a capacity of 2,400 MTPD and plans to increase capacity to 5,400 MTPD with a new plant.

2) The board of directors and management committees are listed.

3) The vision is to be the leading cement organization providing high quality cement and excelling in business. The mission is to be an industry leader through quality, service, customer satisfaction and shareholder value.

4) Strategic planning matrices are presented including SWOT analysis, competitive profile matrix, SPACE matrix, and BCG matrix to evaluate ACPL's strategies.

Online banking impact on customer satisfaction .

This document summarizes a student's research project on the impact of electronic banking on customer satisfaction in Pakistan. It presents data collected through surveys of business people, ordinary customers, and banking sector employees. The surveys found high levels of agreement that electronic banking benefits customers by saving time and reducing risks. However, some concerns around fraud and short-term profits were also identified. Overall, the combined data analysis indicates electronic banking positively impacts customer satisfaction in Pakistan.

Presentation of management .

This document discusses management topics for a class at Benazir Bhutto Shaheed University. It defines management as the achievement of objectives in a given environment with given resources. It describes three levels of management - top managers who do contingency planning, middle managers who receive decisions and achieve goals, and first-line managers who work on the ground and implement upper management policies. It also discusses three types of managerial skills - technical skills related to specific duties, human skills for working with people, and conceptual skills for abstract thinking and problem-solving. Finally, it outlines the five main management functions: planning, organizing, staffing, leading, and controlling.

Project of lucky cement .

Lucky cement project of market management included bcg matrix and ansoff matrix. All strategies of marketing applied for help university students .

Litrature reviews

The document discusses the role of electronic banking (e-banking) in Pakistan's banking sector. It defines e-banking as using technology like the internet, ATMs, phones, and mobile banking for financial transactions. Foreign banks introduced e-banking in Pakistan in the 1990s, and domestic banks soon followed with services like ATM cards and debit cards. The document examines how e-banking impacts customer satisfaction in Pakistan and discusses various e-banking services offered by banks. It analyzes the performance of banks that offer internet banking compared to those that do not.

Pak suzuki motore project HRM

- Pak Suzuki Motor is a joint venture between the Government of Pakistan and Suzuki Motor Japan established in 1982 that produces cars and motorcycles. It has over 60% market share in Pakistan.

- The document discusses the recruitment process for 150 new positions at Pak Suzuki Motor. It includes planning recruitment needs, advertising vacancies, selecting candidates through exams and interviews, and training and developing the selected candidates.

- Expenses are outlined for each stage of recruitment including advertising, selection exams, and training the new employees.

More from Rehman khan shama (10)

Attack cement Marketing strategy management project

Attack cement Marketing strategy management project

Recently uploaded

Pro-competitive Industrial Policy – OECD – June 2024 OECD discussion

Pro-competitive Industrial Policy – OECD – June 2024 OECD discussionOECD Directorate for Financial and Enterprise Affairs

This presentation by OECD, OECD Secretariat, was made during the discussion “Pro-competitive Industrial Policy” held at the 143rd meeting of the OECD Competition Committee on 12 June 2024. More papers and presentations on the topic can be found at oe.cd/pcip.

This presentation was uploaded with the author’s consent.

原版制作贝德福特大学毕业证(bedfordhire毕业证)硕士文凭原版一模一样

原版一模一样【微信:741003700 】【贝德福特大学毕业证(bedfordhire毕业证)硕士文凭】【微信:741003700 】学位证,留信认证(真实可查,永久存档)offer、雅思、外壳等材料/诚信可靠,可直接看成品样本,帮您解决无法毕业带来的各种难题!外壳,原版制作,诚信可靠,可直接看成品样本。行业标杆!精益求精,诚心合作,真诚制作!多年品质 ,按需精细制作,24小时接单,全套进口原装设备。十五年致力于帮助留学生解决难题,包您满意。

本公司拥有海外各大学样板无数,能完美还原海外各大学 Bachelor Diploma degree, Master Degree Diploma

1:1完美还原海外各大学毕业材料上的工艺:水印,阴影底纹,钢印LOGO烫金烫银,LOGO烫金烫银复合重叠。文字图案浮雕、激光镭射、紫外荧光、温感、复印防伪等防伪工艺。材料咨询办理、认证咨询办理请加学历顾问Q/微741003700

留信网认证的作用:

1:该专业认证可证明留学生真实身份

2:同时对留学生所学专业登记给予评定

3:国家专业人才认证中心颁发入库证书

4:这个认证书并且可以归档倒地方

5:凡事获得留信网入网的信息将会逐步更新到个人身份内,将在公安局网内查询个人身份证信息后,同步读取人才网入库信息

6:个人职称评审加20分

7:个人信誉贷款加10分

8:在国家人才网主办的国家网络招聘大会中纳入资料,供国家高端企业选择人才

Suzanne Lagerweij - Influence Without Power - Why Empathy is Your Best Friend...

This is a workshop about communication and collaboration. We will experience how we can analyze the reasons for resistance to change (exercise 1) and practice how to improve our conversation style and be more in control and effective in the way we communicate (exercise 2).

This session will use Dave Gray’s Empathy Mapping, Argyris’ Ladder of Inference and The Four Rs from Agile Conversations (Squirrel and Fredrick).

Abstract:

Let’s talk about powerful conversations! We all know how to lead a constructive conversation, right? Then why is it so difficult to have those conversations with people at work, especially those in powerful positions that show resistance to change?

Learning to control and direct conversations takes understanding and practice.

We can combine our innate empathy with our analytical skills to gain a deeper understanding of complex situations at work. Join this session to learn how to prepare for difficult conversations and how to improve our agile conversations in order to be more influential without power. We will use Dave Gray’s Empathy Mapping, Argyris’ Ladder of Inference and The Four Rs from Agile Conversations (Squirrel and Fredrick).

In the session you will experience how preparing and reflecting on your conversation can help you be more influential at work. You will learn how to communicate more effectively with the people needed to achieve positive change. You will leave with a self-revised version of a difficult conversation and a practical model to use when you get back to work.

Come learn more on how to become a real influencer!

Carrer goals.pptx and their importance in real life

Career goals serve as a roadmap for individuals, guiding them toward achieving long-term professional aspirations and personal fulfillment. Establishing clear career goals enables professionals to focus their efforts on developing specific skills, gaining relevant experience, and making strategic decisions that align with their desired career trajectory. By setting both short-term and long-term objectives, individuals can systematically track their progress, make necessary adjustments, and stay motivated. Short-term goals often include acquiring new qualifications, mastering particular competencies, or securing a specific role, while long-term goals might encompass reaching executive positions, becoming industry experts, or launching entrepreneurial ventures.

Moreover, having well-defined career goals fosters a sense of purpose and direction, enhancing job satisfaction and overall productivity. It encourages continuous learning and adaptation, as professionals remain attuned to industry trends and evolving job market demands. Career goals also facilitate better time management and resource allocation, as individuals prioritize tasks and opportunities that advance their professional growth. In addition, articulating career goals can aid in networking and mentorship, as it allows individuals to communicate their aspirations clearly to potential mentors, colleagues, and employers, thereby opening doors to valuable guidance and support. Ultimately, career goals are integral to personal and professional development, driving individuals toward sustained success and fulfillment in their chosen fields.

Mẫu PPT kế hoạch làm việc sáng tạo cho nửa cuối năm PowerPoint

Mẫu PPT kế hoạch làm việc sáng tạo cho nửa cuối năm PowerPoint

Presentatie 8. Joost van der Linde & Daniel Anderton - Eliq 28 mei 2024

Dutch Power Event

“AI – Navigeren naar de toekomst?”

Op 28 mei 2024 bij Info Support.

Artificial Intelligence, Data and Competition – ČORBA – June 2024 OECD discus...

Artificial Intelligence, Data and Competition – ČORBA – June 2024 OECD discus...OECD Directorate for Financial and Enterprise Affairs

This presentation by Juraj Čorba, Chair of OECD Working Party on Artificial Intelligence Governance (AIGO), was made during the discussion “Artificial Intelligence, Data and Competition” held at the 143rd meeting of the OECD Competition Committee on 12 June 2024. More papers and presentations on the topic can be found at oe.cd/aicomp.

This presentation was uploaded with the author’s consent.

Competition and Regulation in Professions and Occupations – OECD – June 2024 ...

Competition and Regulation in Professions and Occupations – OECD – June 2024 ...OECD Directorate for Financial and Enterprise Affairs

This presentation by OECD, OECD Secretariat, was made during the discussion “Competition and Regulation in Professions and Occupations” held at the 77th meeting of the OECD Working Party No. 2 on Competition and Regulation on 10 June 2024. More papers and presentations on the topic can be found at oe.cd/crps.

This presentation was uploaded with the author’s consent.

Tom tresser burning issue.pptx My Burning issue

Addressing the status of black home ownership in America. and what actions are taken to impact these trends.

XP 2024 presentation: A New Look to Leadership

Presentation slides from XP2024 conference, Bolzano IT. The slides describe a new view to leadership and combines it with anthro-complexity (aka cynefin).

2024-05-30_meetup_devops_aix-marseille.pdf

Slides de notre meetup DevOps AixMarseille du 30 mai 2024 chez SmarTribune

Sujets: platform engineering / terragrunt / test containers

Artificial Intelligence, Data and Competition – OECD – June 2024 OECD discussion

Artificial Intelligence, Data and Competition – OECD – June 2024 OECD discussionOECD Directorate for Financial and Enterprise Affairs

This presentation by OECD, OECD Secretariat, was made during the discussion “Artificial Intelligence, Data and Competition” held at the 143rd meeting of the OECD Competition Committee on 12 June 2024. More papers and presentations on the topic can be found at oe.cd/aicomp.

This presentation was uploaded with the author’s consent.

Pro-competitive Industrial Policy – LANE – June 2024 OECD discussion

Pro-competitive Industrial Policy – LANE – June 2024 OECD discussionOECD Directorate for Financial and Enterprise Affairs

This presentation by Nathaniel Lane, Associate Professor in Economics at Oxford University, was made during the discussion “Pro-competitive Industrial Policy” held at the 143rd meeting of the OECD Competition Committee on 12 June 2024. More papers and presentations on the topic can be found at oe.cd/pcip.

This presentation was uploaded with the author’s consent.

Updated diagnosis. Cause and treatment of hypothyroidism

Types, classification, causes, diagnosis and treatment of hypothyroidism

Artificial Intelligence, Data and Competition – SCHREPEL – June 2024 OECD dis...

Artificial Intelligence, Data and Competition – SCHREPEL – June 2024 OECD dis...OECD Directorate for Financial and Enterprise Affairs

This presentation by Thibault Schrepel, Associate Professor of Law at Vrije Universiteit Amsterdam University, was made during the discussion “Artificial Intelligence, Data and Competition” held at the 143rd meeting of the OECD Competition Committee on 12 June 2024. More papers and presentations on the topic can be found at oe.cd/aicomp.

This presentation was uploaded with the author’s consent.

Collapsing Narratives: Exploring Non-Linearity • a micro report by Rosie Wells

Insight: In a landscape where traditional narrative structures are giving way to fragmented and non-linear forms of storytelling, there lies immense potential for creativity and exploration.

'Collapsing Narratives: Exploring Non-Linearity' is a micro report from Rosie Wells.

Rosie Wells is an Arts & Cultural Strategist uniquely positioned at the intersection of grassroots and mainstream storytelling.

Their work is focused on developing meaningful and lasting connections that can drive social change.

Please download this presentation to enjoy the hyperlinks!

Presentatie 4. Jochen Cremer - TU Delft 28 mei 2024

Dutch Power Event

“AI – Navigeren naar de toekomst?”

Op 28 mei 2024 bij Info Support.

Recently uploaded (20)

Pro-competitive Industrial Policy – OECD – June 2024 OECD discussion

Pro-competitive Industrial Policy – OECD – June 2024 OECD discussion

Suzanne Lagerweij - Influence Without Power - Why Empathy is Your Best Friend...

Suzanne Lagerweij - Influence Without Power - Why Empathy is Your Best Friend...

Carrer goals.pptx and their importance in real life

Carrer goals.pptx and their importance in real life

Mẫu PPT kế hoạch làm việc sáng tạo cho nửa cuối năm PowerPoint

Mẫu PPT kế hoạch làm việc sáng tạo cho nửa cuối năm PowerPoint

Presentatie 8. Joost van der Linde & Daniel Anderton - Eliq 28 mei 2024

Presentatie 8. Joost van der Linde & Daniel Anderton - Eliq 28 mei 2024

Artificial Intelligence, Data and Competition – ČORBA – June 2024 OECD discus...

Artificial Intelligence, Data and Competition – ČORBA – June 2024 OECD discus...

Competition and Regulation in Professions and Occupations – OECD – June 2024 ...

Competition and Regulation in Professions and Occupations – OECD – June 2024 ...

Artificial Intelligence, Data and Competition – OECD – June 2024 OECD discussion

Artificial Intelligence, Data and Competition – OECD – June 2024 OECD discussion

Pro-competitive Industrial Policy – LANE – June 2024 OECD discussion

Pro-competitive Industrial Policy – LANE – June 2024 OECD discussion

Updated diagnosis. Cause and treatment of hypothyroidism

Updated diagnosis. Cause and treatment of hypothyroidism

Artificial Intelligence, Data and Competition – SCHREPEL – June 2024 OECD dis...

Artificial Intelligence, Data and Competition – SCHREPEL – June 2024 OECD dis...

Collapsing Narratives: Exploring Non-Linearity • a micro report by Rosie Wells

Collapsing Narratives: Exploring Non-Linearity • a micro report by Rosie Wells

Presentatie 4. Jochen Cremer - TU Delft 28 mei 2024

Presentatie 4. Jochen Cremer - TU Delft 28 mei 2024

Research project presentation.

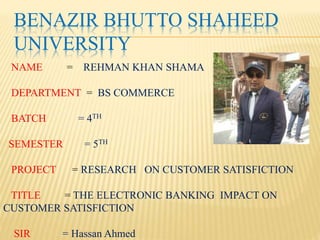

- 1. BENAZIR BHUTTO SHAHEED UNIVERSITY NAME = REHMAN KHAN SHAMA DEPARTMENT = BS COMMERCE BATCH = 4TH SEMESTER = 5TH PROJECT = RESEARCH ON CUSTOMER SATISFICTION TITLE = THE ELECTRONIC BANKING IMPACT ON CUSTOMER SATISFICTION SIR = Hassan Ahmed

- 2. ABSTRACT The electronic banking in Pakistan

- 3. DATA CONDUCT METHOLOGY I have survey to different place of people for conduct data and use to questions and get interview . The conducted data consist in three steps .1ST visit to market to conduct data from business people ,2nd time conduct data from ordinary people as college School and university and last time conduct data from banking sector .There is 20% percent data conduct from business person in market and 40% percent data conduct from ordinary people and 40% data conduct from bank sector. There is ask 20 question from individually person and consist questionnaire of this methodology as first part of questions Agree ,Strongly agree Neutral , Disagree ,Strongly disagree .2nd part of questions there is ask and select one correct answer the five option in .and 3rd methodological use yes & no .

- 4. S/n Questions Agree Strongly Agree Neutral Disagree Strongly disagree 1 The electronic banking facilities benefit every one 10 7 1 2 0 2 The e banking decrease risk in the way of customers. 9 2 7 2 0 3 Debit cards save amount from risk in different place. 11 4 4 0 1 4 Save the time when deposit amount in the bank’. 8 5 3 2 2 5 The bank employers can involve in the fraud from customers. 4 4 4 7 1 6 The(ATM) Machine facilities provide to customers every place. 12 6 1 1 0 7 Credit cards is very imported for customers. 6 1 8 4 1 8 The e banking increase own profit in short term. 4 3 10 1 2 9 The e banking decrease expenses in short term. 6 1 9 4 0 10 The e banking will be developing business in Pakistan. 10 4 3 12 1 Total 79% 36% 50% 35% 8% DATA CONDUCT FROM ORDINARY PEOPLE 40%

- 5. 79 36 50 35 8 0 10 20 30 40 50 60 70 80 90 Agree Strongly agree Nuetral Disagree strongly disagree DATA CONDUCT FROM ORDINARY PEOPLE 40%

- 6. Age 18-25 26-35 36-45 46-above Male 9 0 0 o Female 11 0 0 0 Total 20 0 0 0 Education Secondary graduate MBA M. Phil Total Male 3 6 o 0 9 Female 0 7 4 0 11 Total o 0 0 DATA CONDUCT FROM ORDINARY PEOPLE 40%

- 7. S/n Questions Agree Strongly Agree Neutra l Disagre e Strongly disagree 1 The electronic banking facilities benefit every one 8 1 1 0 0 2 The e banking decrease risk in the way of customers. 2 1 3 Debit cards save amount from risk in different place. 8 1 1 4 Save the time when deposit amount in the bank’. 8 1 0 0 5 The bank employers can involve in the fraud from customers. 1 2 1 3 6 The(ATM) Machine facilities provide to customers every place. 7 2 0 0 1 7 Credit cards is very imported for customers. 4 3 2 8 The e banking increase own profit in short term. 5 3 2 9 The e banking decrease expenses in short term. 4 4 10 The e banking will be developing business in Pakistan. 3 5 Tot al 48 23 6 6 1 DATA CONDUCT FROM BUSINESS PEOPLE 20%

- 8. 48 23 6 6 1 0 10 20 30 40 50 60 Agree Strongly agree Neutral Disagree Strongly disagree DATA CONDUCT FROM BUSINESS PEOLES 20%

- 9. Age 18- 25 26-35 36-45 46-above Total Male 1 5 3 1 10 Female 0 0 0 Total 0 0 0 Educatio n Secondar y graduate MBA M. Phil Total Male 2 3 3 1 10 Female 0 0 0 Total o 0 0 DATA CONDUCT FROM BUSINESS PEOPLE

- 10. S/n Questions Agree Strongly Agree Neutral Disagree Strongly disagree 1 The electronic banking facilities benefit every one 4 1 0 0 0 2 The e banking decrease risk in the way of customers. 1 2 0 2 3 Debit cards save amount from risk in different place. 2 1 1 1 4 Save the time when deposit amount in the bank’. 2 3 0 0 5 The bank employers can involve in the fraud from customers. 3 1 1 6 The(ATM) Machine facilities provide to customers every place. 5 0 0 0 0 7 Credit cards is very imported for customers. 3 2 8 The e banking increase own profit in short term. 2 0 1 2 9 The e banking decrease expenses in short term. 3 1 1 10 The e banking will be developing business in Pakistan. 1 3 1 Total 26 7 9 8 0 Data conduct from Islamic bank 10%

- 11. 29 7 9 8 0 0 5 10 15 20 25 30 35 A gree Strongly agree neutral Disagree Strongly disagree DATA CONDUCT ISLAMIC BANK10%

- 12. Age 18-25 26-35 36-45 46-above Total Male 0 1 2 2 5 Female 0 0 0 0 0 ISLAMIC BANK Education Seconda ry graduat e MBA M. Phil Total Male 1 4 0 5 Female 0 0 0 0 0

- 13. S/n Questions Agree Strongly Agree Neutral Disagree Strongly disagree 1 The electronic banking facilities benefit every one 4 1 0 0 0 2 The e banking decrease risk in the way of customers. 1 1 0 1 2 3 Debit cards save amount from risk in different place. 3 2 0 0 4 Save the time when deposit amount in the bank’. 3 1 1 0 0 5 The bank employers can involve in the fraud from customers. 1 1 2 1 6 The(ATM) Machine facilities provide to customers every place. 3 2 0 0 0 7 Credit cards is very imported for customers. 1 3 1 8 The e banking increase own profit in short term. 2 1 1 1 9 The e banking decrease expenses in short term. 2 2 1 10 The e banking will be developing business in Pakistan. 2 2 1 Total 22 16 6 3 1 DATA CONDUCT FROM UNITED BANK 10%

- 14. 22 16 6 3 0 0 5 10 15 20 25 Agree Strongly agree Neutral Disagree Strongly disagree UNITED BANK 10%

- 15. Age 18-25 26-35 36-45 46-above Total Male 0 1 2 2 5 Female 0 0 0 0 0 Education Seconda ry graduat e MBA M. Phil Total Male 1 2 2 0 5 Female 0 0 0 0 0 UNITED BANK 10%

- 16. S/n Questions Agree Strongly Agree Neutral Disagree Strongly disagree 1 The electronic banking facilities benefit every one 4 1 0 0 0 2 The e banking decrease risk in the way of customers. 5 0 3 Debit cards save amount from risk in different place. 4 1 0 4 Save the time when deposit amount in the bank’. 5 0 0 5 The bank employers can involve in the fraud from customers. 4 1 6 The(ATM) Machine facilities provide to customers every place. 4 1 0 0 0 7 Credit cards is very imported for customers. 1 2 1 1 8 The e banking increase own profit in short term. 1 2 2 9 The e banking decrease expenses in short term. 2 1 2 10 The e banking will be developing business in Pakistan. 4 1 Total 34 5 4 3 2 SINDH BANK 10%

- 17. 34 5 4 3 0 0 5 10 15 20 25 30 35 40 Agree Strongly agree Neutral Disagree Strongly disagree SINDH BANK 10%

- 18. Age 18-25 26-35 36-45 46-above Total Male 1 2 1 5 Female 0 1 0 0 0 Education Seconda ry graduat e MBA M. Phil Total Male 2 1 1 0 4 Female 0 1 0 0 1 SINDH BANK MALE /FEMALE

- 19. S/n Questions Agree Strongly Agree Neutral Disagree Strongly disagree 1 The electronic banking facilities benefit every one 4 1 0 0 0 2 The e banking decrease risk in the way of customers. 2 1 2 3 Debit cards save amount from risk in different place. 3 2 0 4 Save the time when deposit amount in the bank’. 1 4 0 0 5 The bank employers can involve in the fraud from customers. 2 3 6 The(ATM) Machine facilities provide to customers every place. 1 4 0 0 0 7 Credit cards is very imported for customers. 1 4 8 The e banking increase own profit in short term. 4 1 9 The e banking decrease expenses in short term. 3 2 10 The e banking will be developing business in Pakistan. 5 Total 19 19 4 8 DATA CONDUCT FROM MEEZAN BANK 10%

- 20. 19 19 4 8 0 0 2 4 6 8 10 12 14 16 18 20 Agree Strongly agree Neutral Disagree Strongly disagree DATA CONDUCT FROM MEEZAN BANK 10%

- 21. Age 18-25 26-35 36-45 46-above Total Male 1 1 3 4 Female 0 1 0 0 0 Education Seconda ry graduat e MBA M. Phil Total Male 1 3 0 4 Female 0 1 0 0 1

- 22. 79 36 50 35 8 0 10 20 30 40 50 60 70 80 90 DATA CONDUCT FROM ORDINARY PEOPLE 40% 48 23 6 6 1 0 10 20 30 40 50 60 Agree Strongly agree Neutral Disagree Strongly disagree DATA CONDUCT FROM BUSINESS PEOLES 20%

- 23. 22 16 6 3 0 0 5 10 15 20 25 Agree Strongly agree Neutral Disagree Strongly disagree DATA CONDUCT FROM UNITED BANK 10% 29 7 9 8 0 0 5 10 15 20 25 30 35 A gree Strongly agree neutral Disagree Strongly disagree Data conduct from islamic bank 10% 34 5 4 3 0 0 5 10 15 20 25 30 35 40 Agree Strongly agree Neutral Disagree Strongly disagree DATA CONDUCT FROM SINDH BANK 10% 19 19 4 8 0 0 2 4 6 8 10 12 14 16 18 20 Agree Strongly agree Neutral Disagree Strongly disagree DATA CONDUCT FROM MEEZAN BANK 10%

- 24. 73 47 23 22 0 0 10 20 30 40 50 60 70 80 Agree Strongly agree Neutral Disagree Strongly disagree COMBINE DATA OF BANKING SECTOR 40%

- 25. 63 29.5 28 20.5 4.5 0 10 20 30 40 50 60 70 Agree Strongly agree Neutral Disagree Strongly disagree COMBINE DATA OF CUSTOMER 60%

- 26. 73, 53% 63.5, 47% BANKING SECTOR CUSTOMER RESULT OF COMBINATION DATA OF ELECTRONIC BANKING IMPACT ON CUSTOMER SATISFICTION