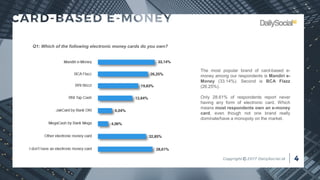

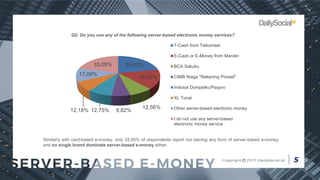

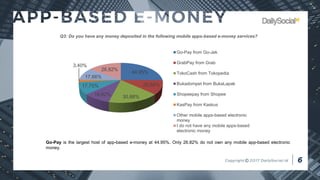

The survey found that electronic money usage is growing but still nascent in Indonesia. The most popular card-based electronic money is Mandiri e-Money, while Go-Pay is the largest mobile app-based service. Most respondents report using electronic money for less than a year, indicating that most users are new to the technology. While electronic money adoption is increasing, over a quarter of respondents have not used any form of electronic money.