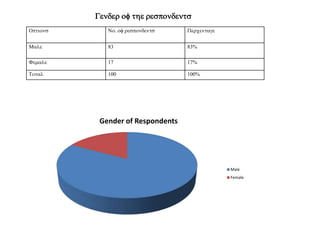

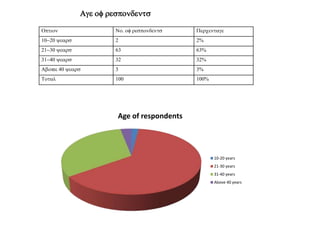

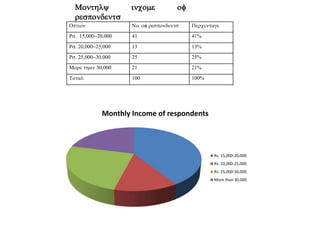

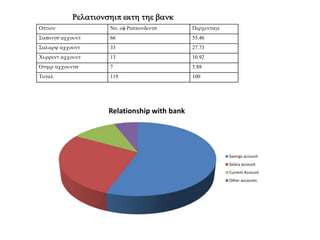

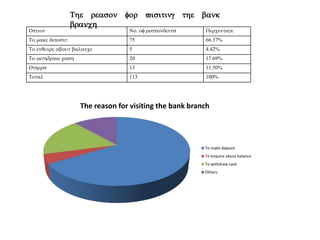

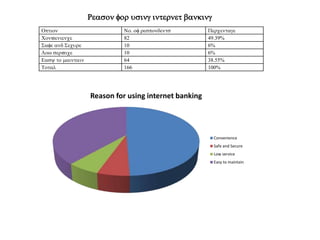

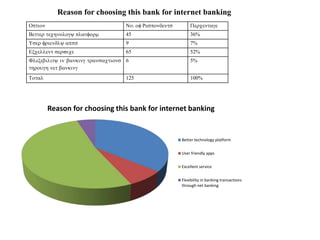

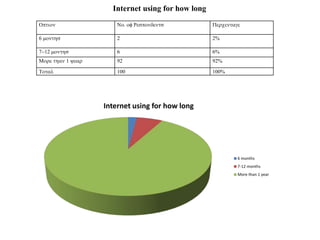

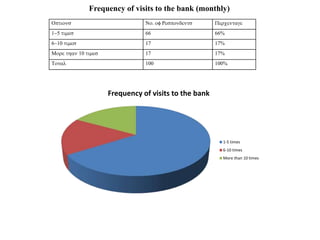

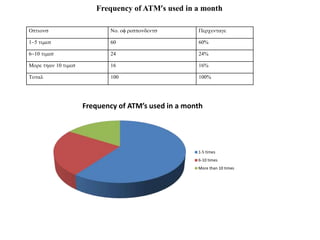

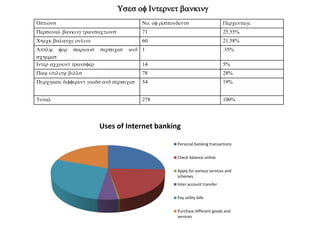

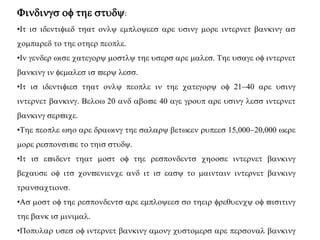

This document summarizes a research study on the uses and perceptions of e-banking among customers of HDFC Bank in India. The study used a survey of 100 HDFC Bank customers and found that employees, males aged 21-40 earning Rs. 15,000-20,000 per month mostly use e-banking for convenience and personal banking transactions. While e-banking usage could be increased among other groups, customers perceive it as convenient and easy to use. The document recommends the bank increase awareness programs, attract new customers, and customize e-banking services.