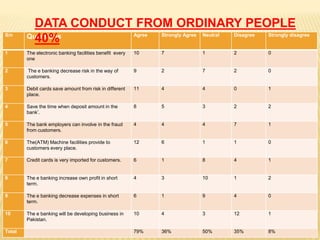

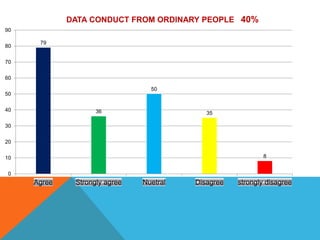

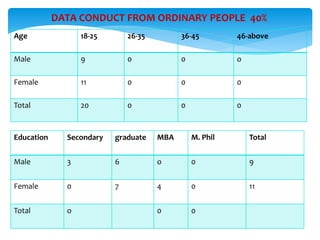

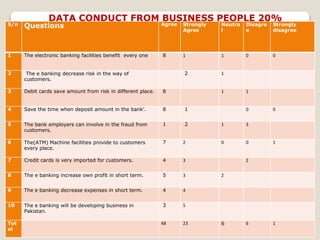

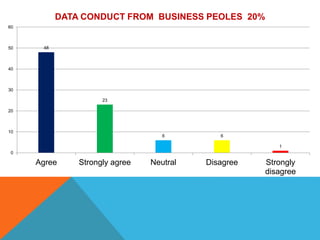

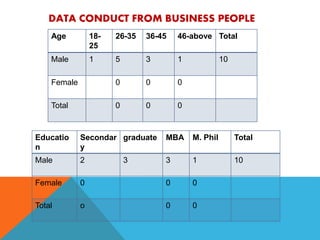

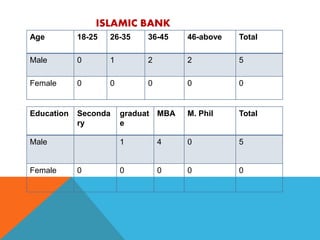

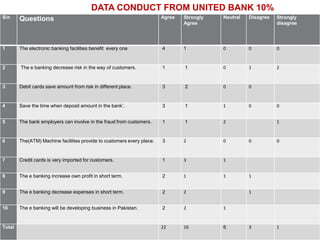

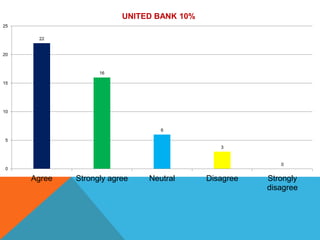

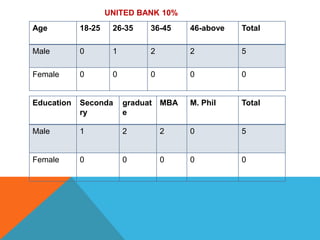

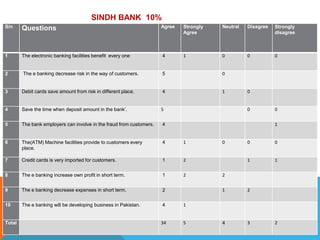

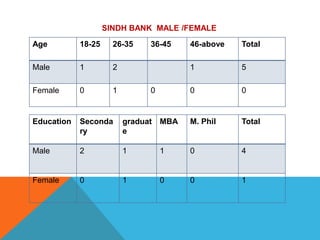

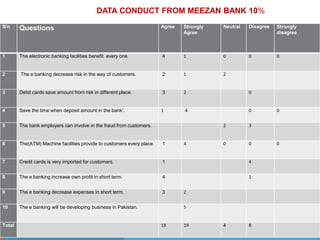

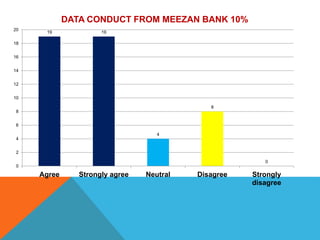

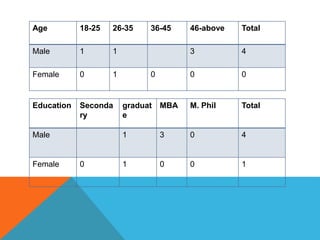

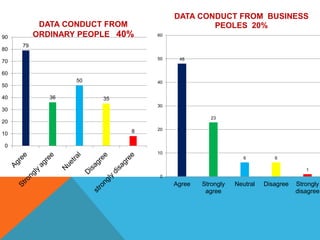

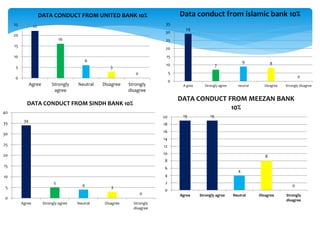

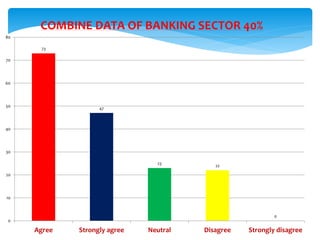

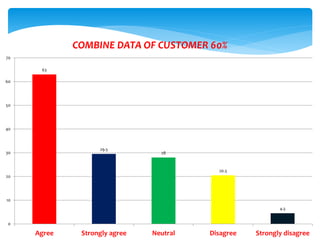

This document summarizes a student's research project on the impact of electronic banking on customer satisfaction in Pakistan. It presents data collected through surveys of business people, ordinary customers, and banking sector employees. The surveys found high levels of agreement that electronic banking benefits customers by saving time and reducing risks. However, some concerns around fraud and short-term profits were also identified. Overall, the combined data analysis indicates electronic banking positively impacts customer satisfaction in Pakistan.