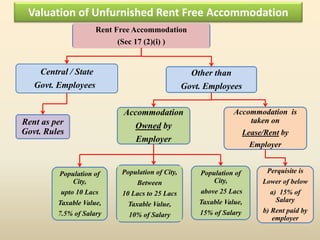

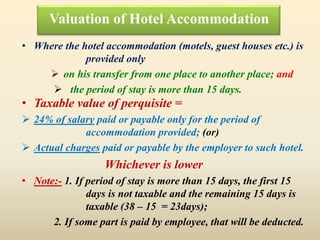

This document discusses rent free accommodation provided by employers and its taxation. It defines rent free accommodation and provides rules for valuation of unfurnished, furnished and accommodation provided at concessional rent. For unfurnished accommodation, taxable value is a percentage of salary based on city population size. Furnished accommodation value includes furniture costs. Concessional rent value is the difference between market rent and amount paid. Exceptions for certain government employees are also outlined.

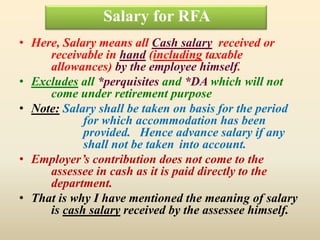

![Salary = Basic salary

+ DA, (if terms of employment so provide)

+ Bonus (Current year)

+ Commission

+ taxable portion of all allowances

+ Any monetary payments which is chargeable

[ but not to include perquisites u/s 17(2) ]](https://image.slidesharecdn.com/rfa-ppt-181004012207/85/Rent-Free-Accomodation-ppt-6-320.jpg)

![House provided at concessional rent

[ Sec.17(2)(ii) ]

Means employer has given a house to his employee for

which he is charging a part of rent .

Value of unfurnished house xxxxx

Add: 10% p.a. of cost of furniture (or)

Actual hire charges xxxx

xxxxx

Less: Amount paid by the employee xxxx

Value of house at concessional rent xxxxx](https://image.slidesharecdn.com/rfa-ppt-181004012207/85/Rent-Free-Accomodation-ppt-7-320.jpg)

![Rent Free Accommodation when NOT chargeable

[ Rule 3(1) ]

The value of perquisite shall be NIL in case of

* Judges of High Courts.

* Judges of Supreme Courts.

* Union Ministers.

* Opposition Leader.

* Officials in Parliament.

* Where the temporary accommodation is provided to an

employee working in mining site or project

execution site or a dam site or power generating

site or offshore site or remote area.](https://image.slidesharecdn.com/rfa-ppt-181004012207/85/Rent-Free-Accomodation-ppt-9-320.jpg)

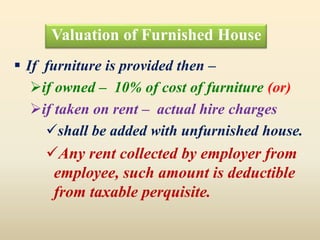

![Valuation of Furnished House

If the furniture is provided then –

if owned – 10% of cost of furniture (or)

if taken on rent – actual hire charges

shall be added with unfurnished house.

Here, Salary means

Salary = Basic salary

+ DA, (if terms of employment so provide)

+ Bonus (Current year)

+ Commission

+ taxable portion of all allowances

+ Any monetary payments which is chargeable

[ but not to include perquisites u/s 17(2) ]

Rent Actually paid by employee will be reduced from the

perquisite.](https://image.slidesharecdn.com/rfa-ppt-181004012207/85/Rent-Free-Accomodation-ppt-10-320.jpg)

![Perks taxable in specified cases

Specified employees mean,

a) Director employee, (or)

b) Employees having 20% or more voting rights in

employer company, (or)

c) Employees monetary salary is more than `50,000/- p.a.

[ Here, salary means all taxable benefit after

deduction u/s 16(ii) and 16(iii) ]

However, now-a-days, this classification does not have

much practical utility, because of Salary norms of `

50,000/- p.a.

Specified Employees-[ u/s 17(2)(iii) ]](https://image.slidesharecdn.com/rfa-ppt-181004012207/85/Rent-Free-Accomodation-ppt-16-320.jpg)

![-: Specified Employees :-

[u/s 17(2)(iii) ]

Specified employees mean,

a) Director employee, or

b) Employees having 20% or more voting rights in employer company, or

c) Employee having salary more than Rs.50,000/- p.a.

( Here, salary means all taxable benefit after deduction

u/s 16)

Notes :

1) Certain Perquisites are taxable in the hands of ALL employees

2) Certain Perquisites are taxable in the hands of Specified employees only.

3) Any employee, other than a specified employee, is a “non-specified

employee”.

4) However, now-a-days, this classification does not have much practical

utility, because of Salary norms of Rs.50000/- p.a.](https://image.slidesharecdn.com/rfa-ppt-181004012207/85/Rent-Free-Accomodation-ppt-17-320.jpg)