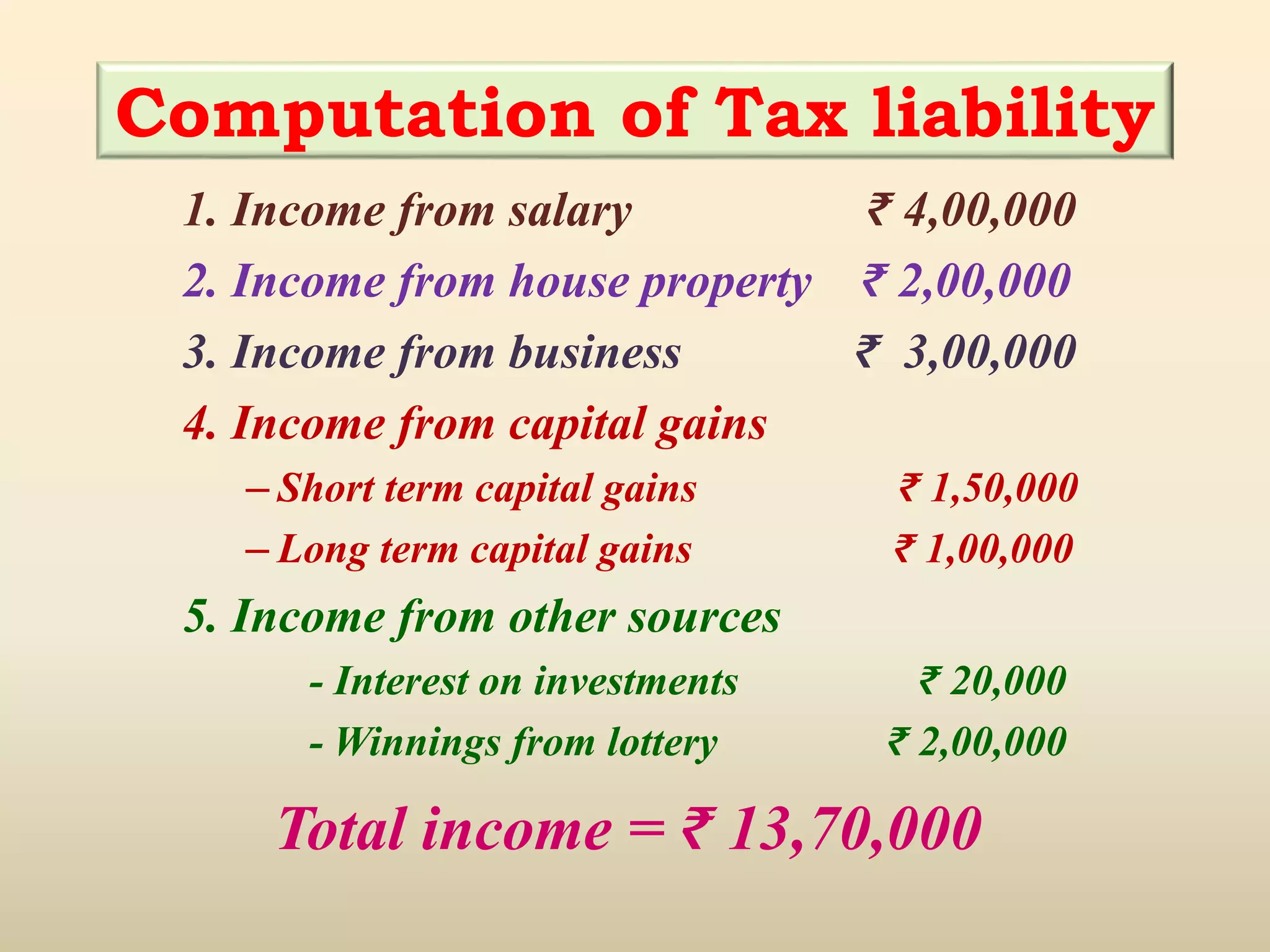

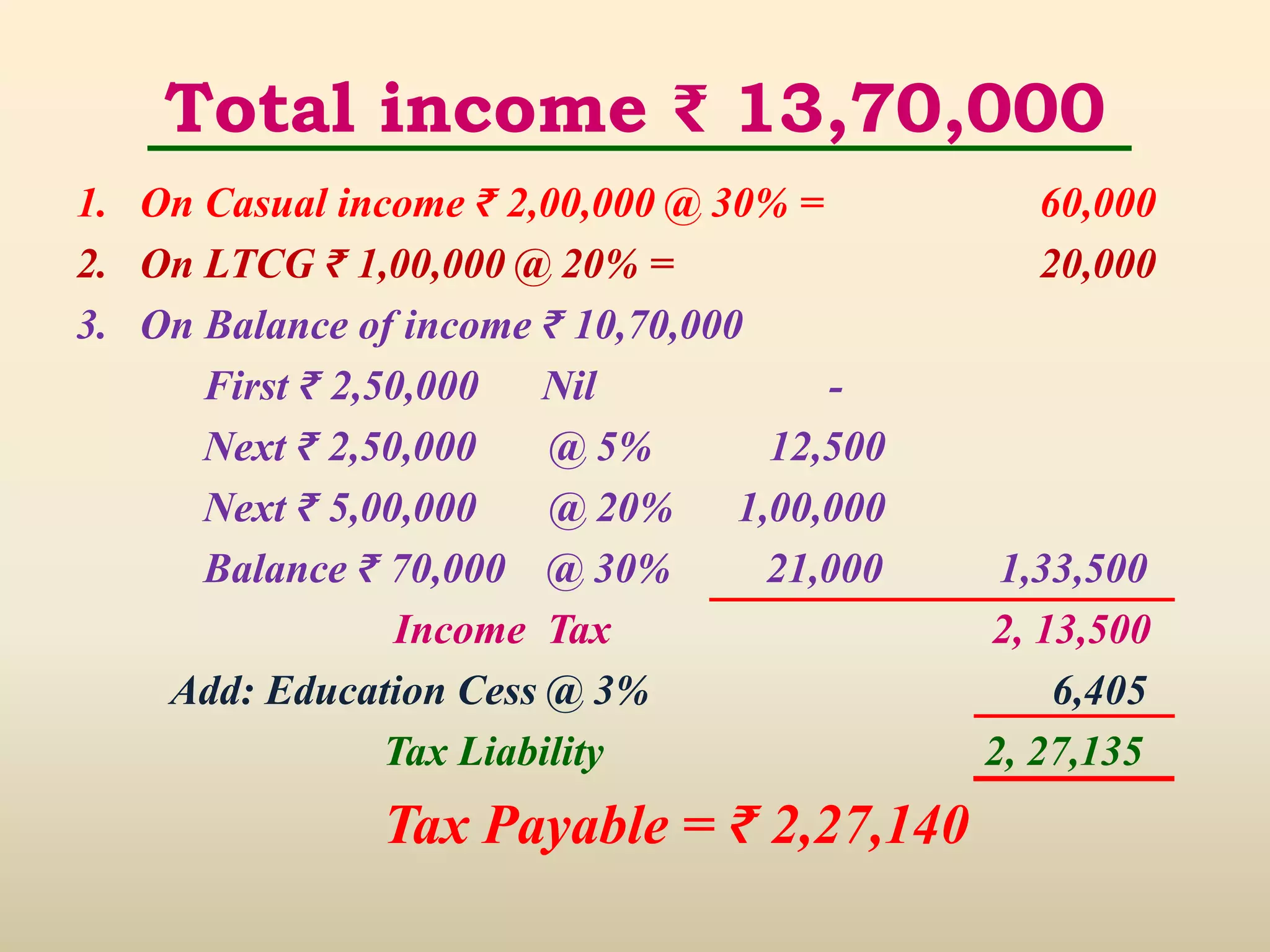

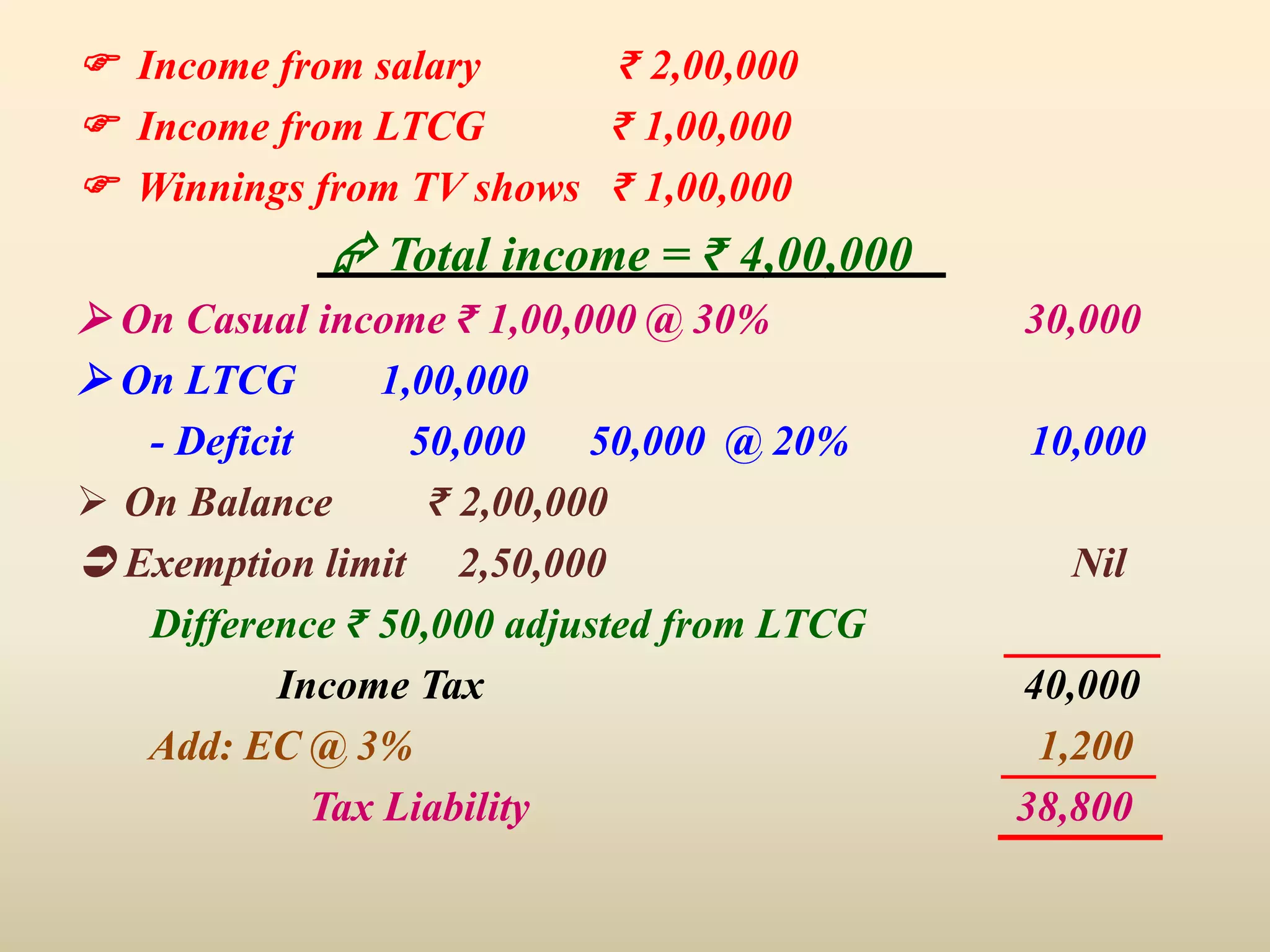

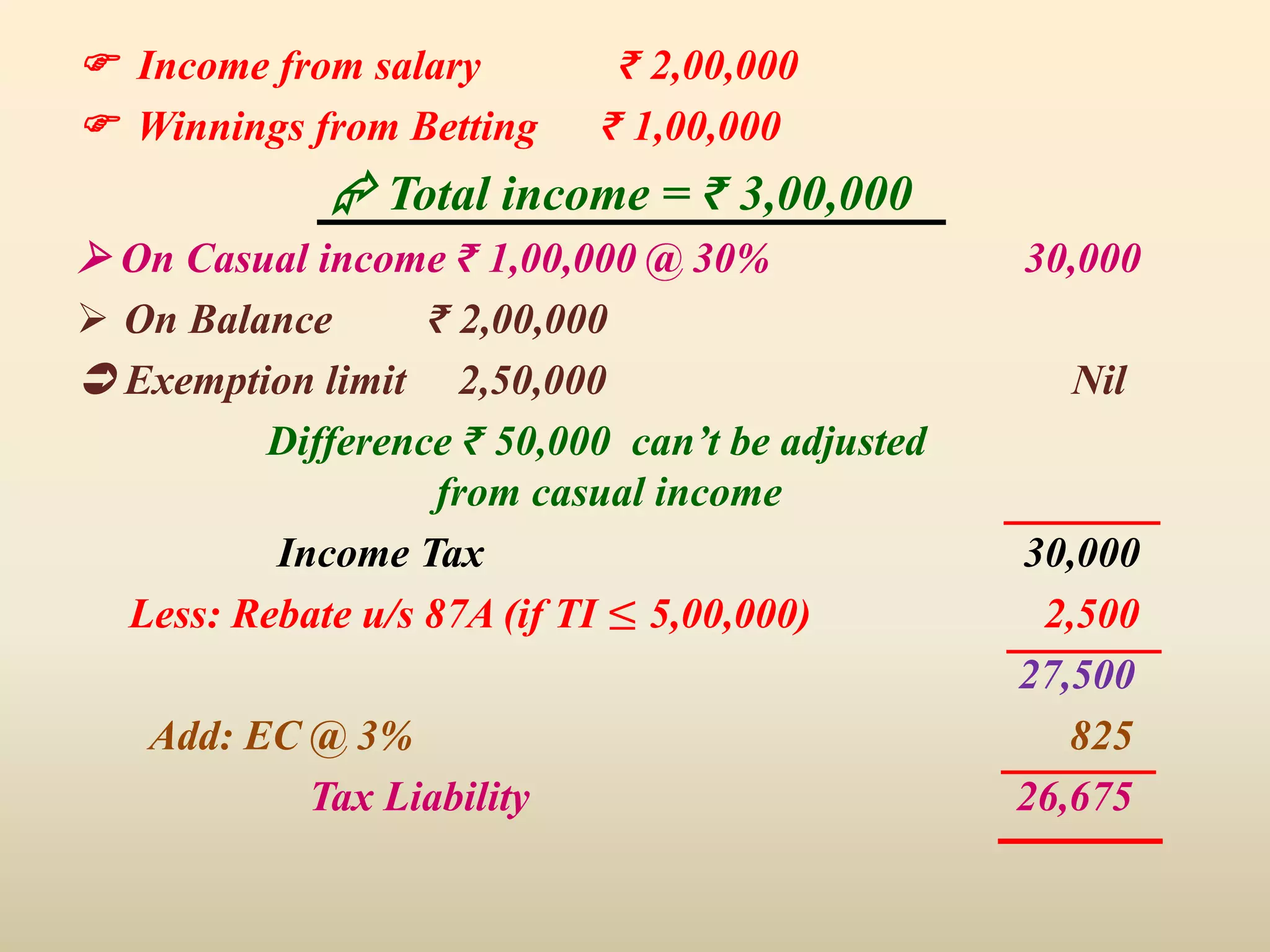

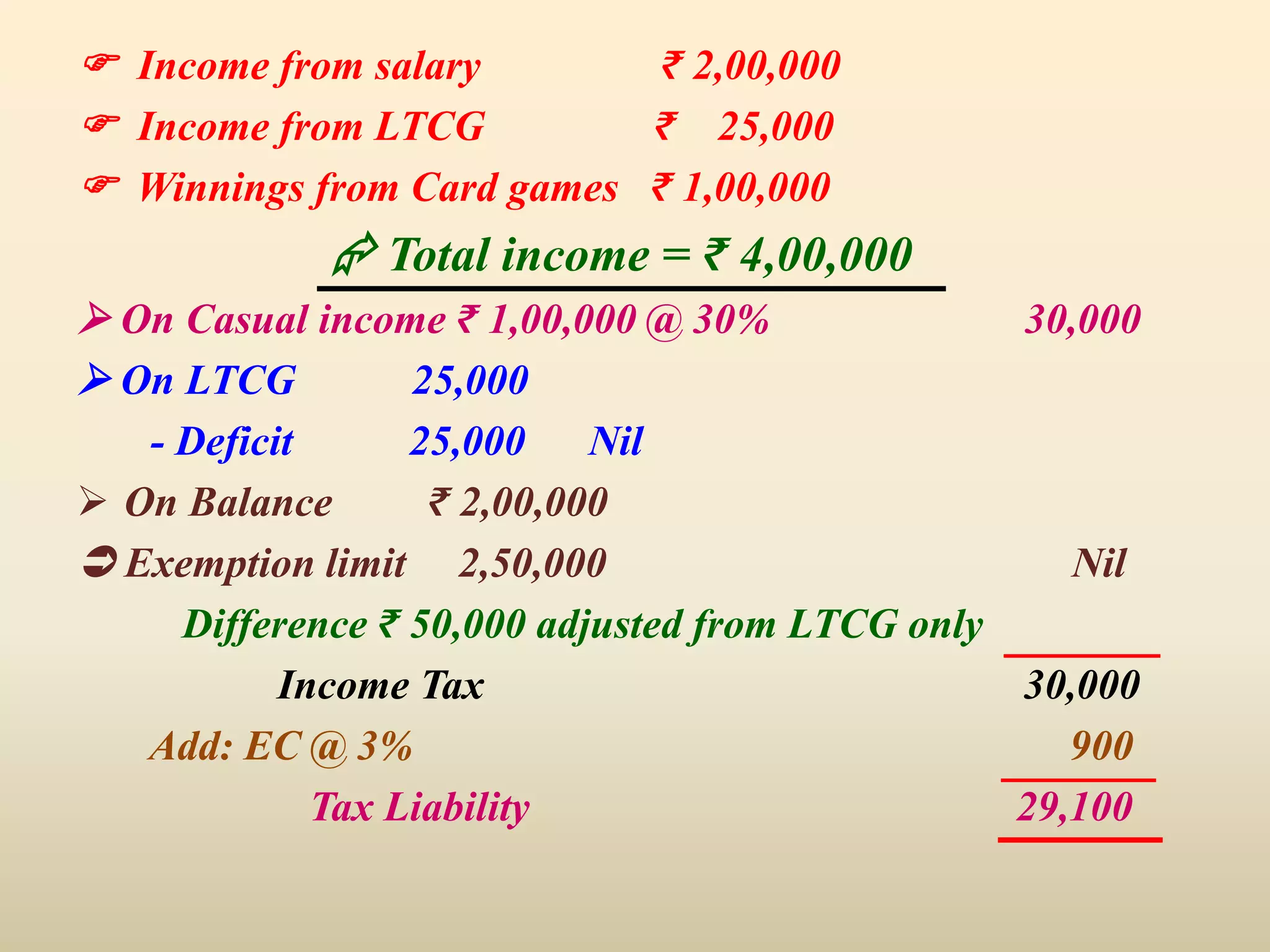

This document provides examples for computing tax liability in India based on different sources of income. It gives the total income, taxable income and tax payable calculations for 4 scenarios involving income from salary, house property, business, capital gains, other sources, and casual income like lottery or betting winnings. Tax is calculated by applying the appropriate tax rates to income slabs and adjusting any losses from capital gains against other sources as per income tax rules.