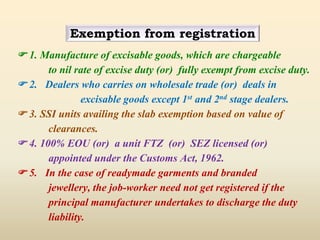

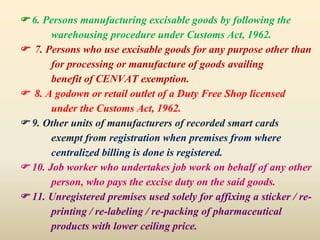

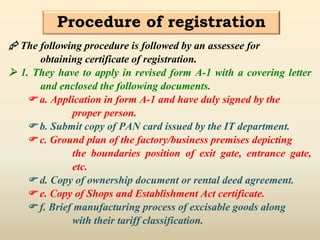

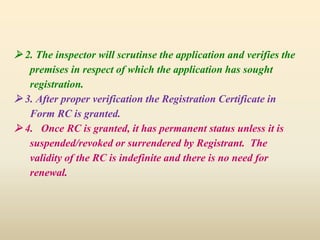

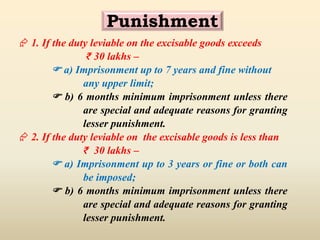

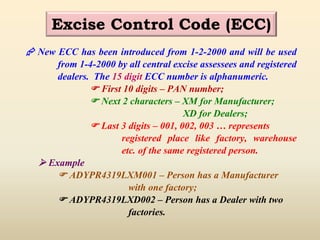

This document discusses registration requirements and procedures under the Central Excise Act. It states that manufacturers, dealers, importers and others must register if their turnover exceeds a certain threshold or they engage in other specified activities. The penalties for non-registration include confiscation of goods, fines, and imprisonment. It provides details on the registration application process, separate registration requirements for multiple premises, and introduces the new 15-digit Excise Control Code used for identification.