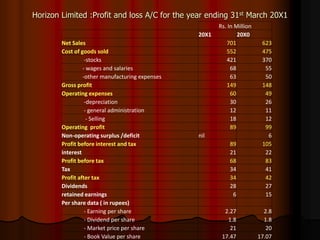

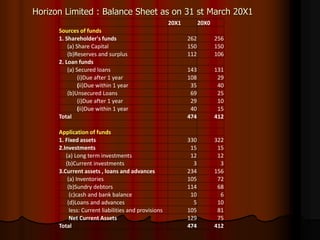

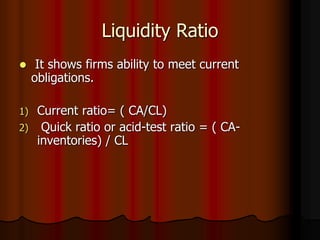

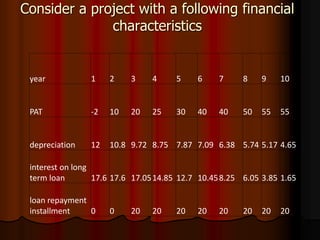

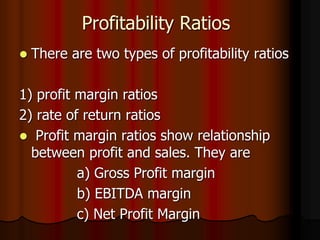

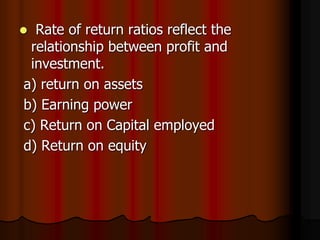

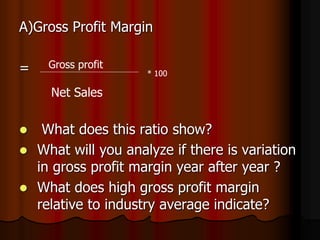

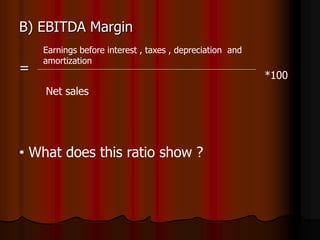

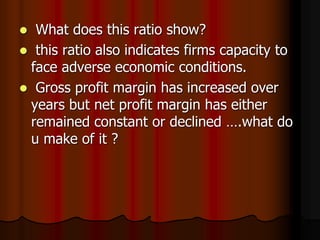

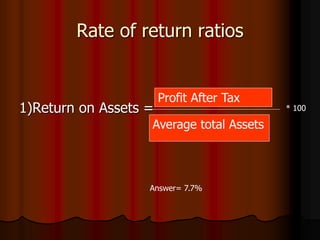

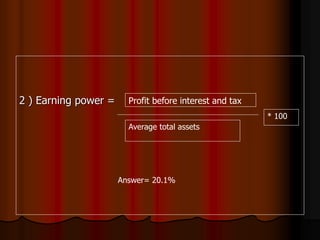

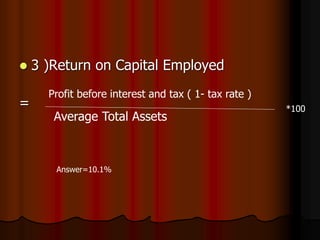

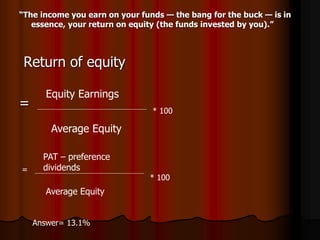

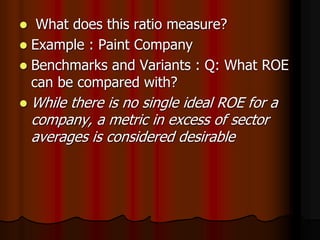

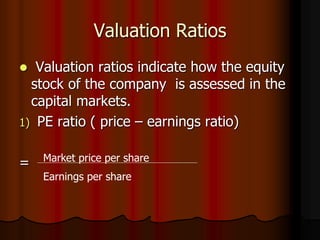

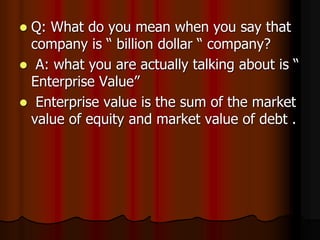

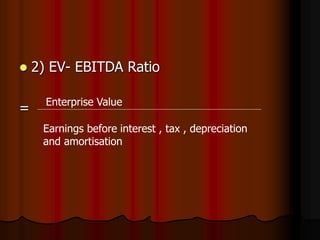

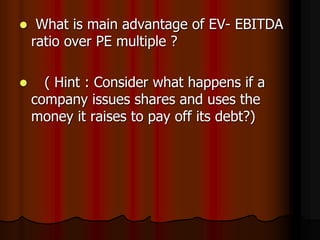

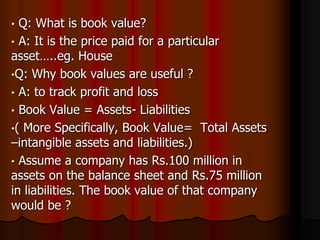

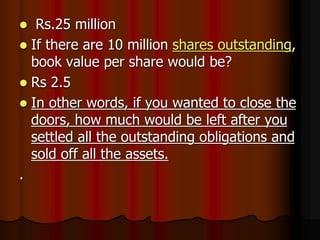

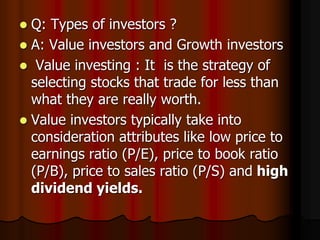

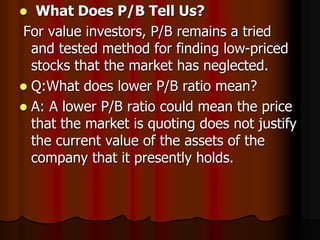

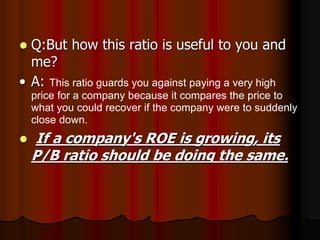

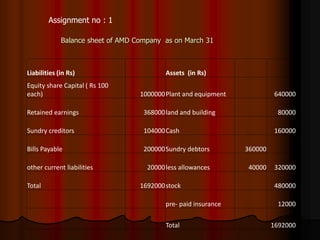

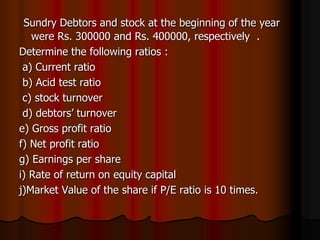

The document explains the importance of ratio analysis in comparing financial statements and overcoming size discrepancies between companies. It includes detailed profit and loss accounts, balance sheets, and calculations for various financial ratios such as liquidity, profitability, and valuation ratios. Additionally, it provides examples and definitions for important financial metrics relevant for assessing company performance and investment valuation.