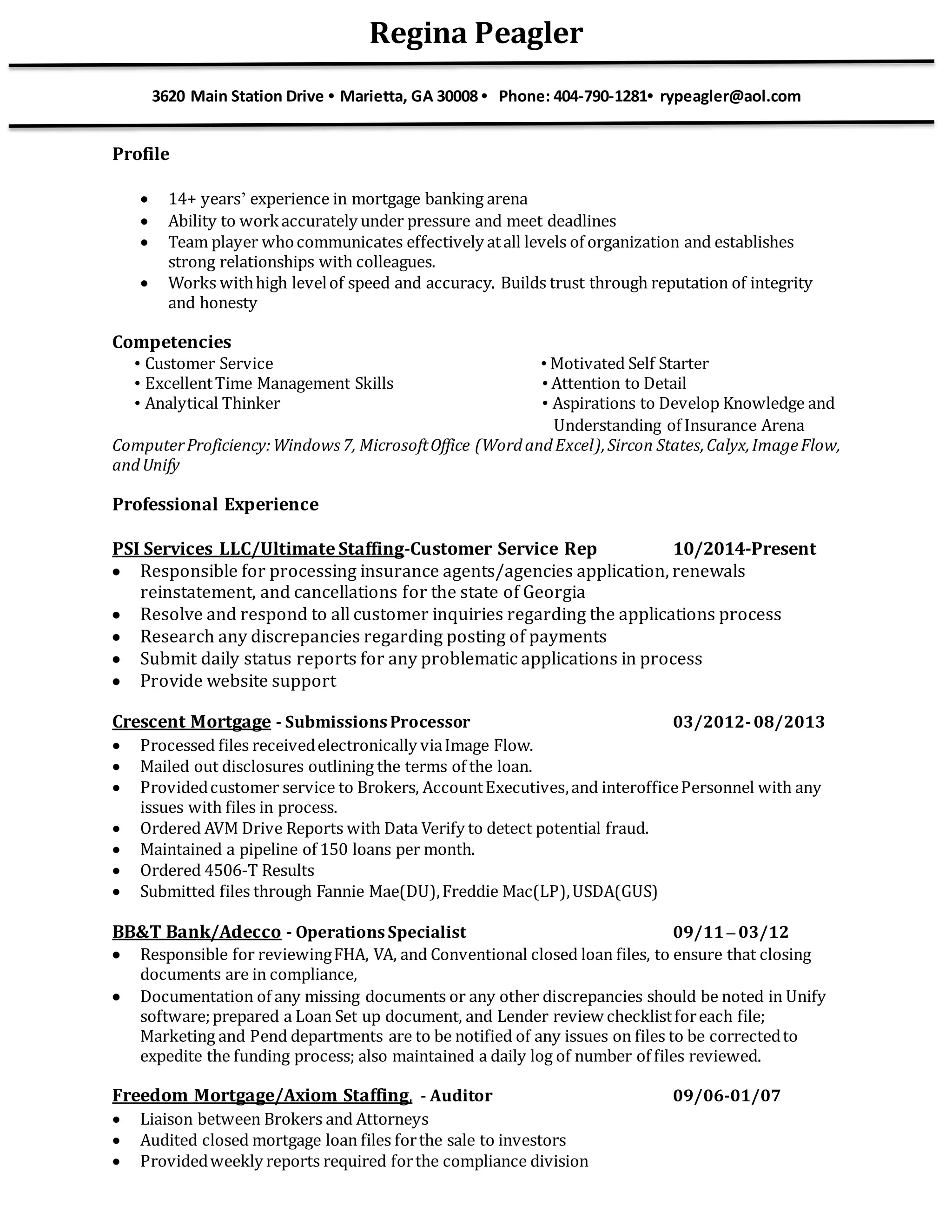

Regina Peagler has over 14 years of experience in mortgage banking and insurance processing. She has a proven track record of meeting deadlines and working accurately under pressure as a team player. Her skills include customer service, time management, attention to detail, and analytical thinking. Her resume details employment history processing loans and insurance applications with companies like Crescent Mortgage, BB&T Bank, and Freedom Mortgage. She has a Bachelor's degree in Business Management from Alabama A&M University.