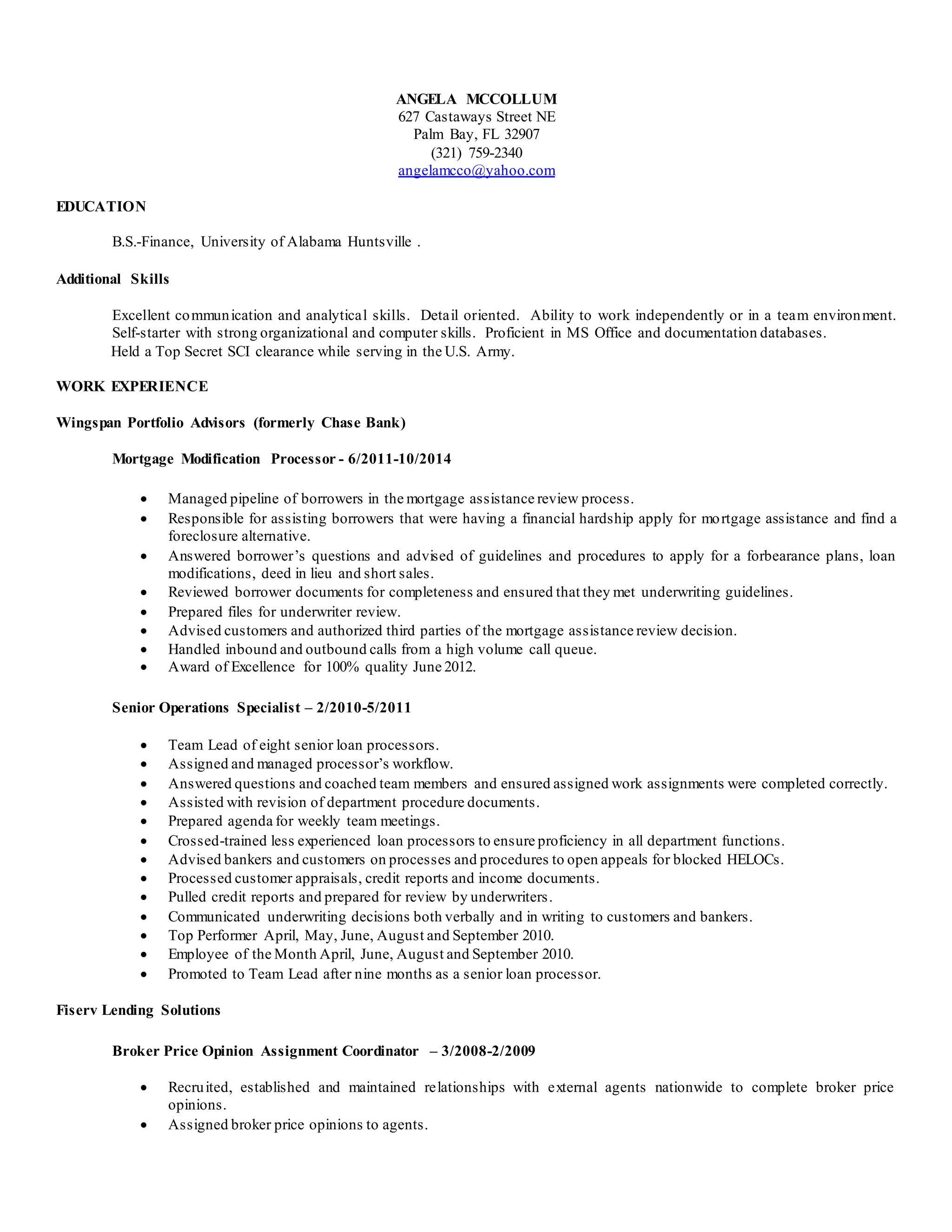

Angela McCollum has over 15 years of experience in mortgage lending and financial services. She has held roles as a mortgage modification processor, senior operations specialist, mortgage loan processor, and broker price opinion coordinator. Her experience also includes contract support, geospatial analysis for the U.S. Army, and she holds a B.S. in Finance.