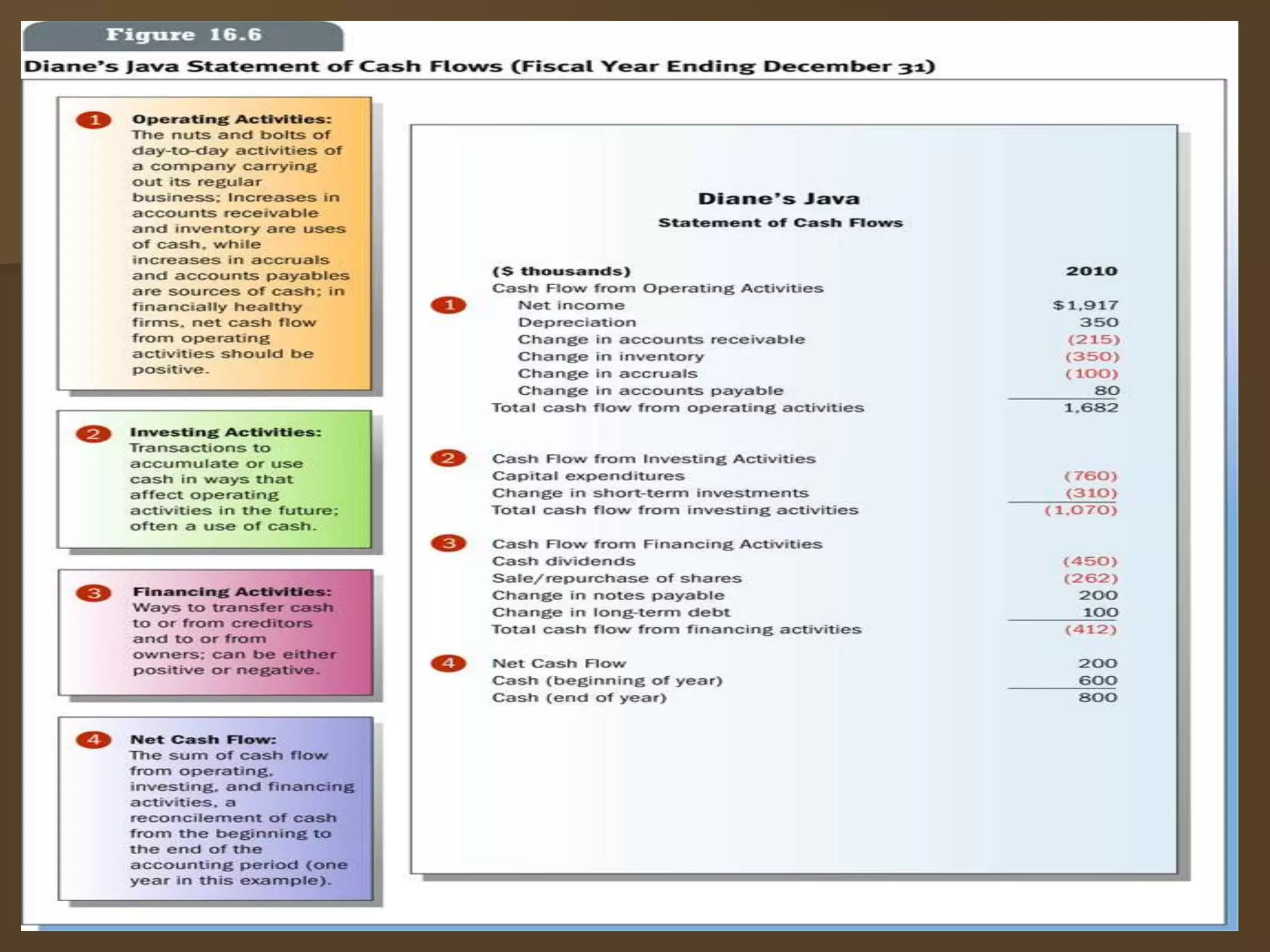

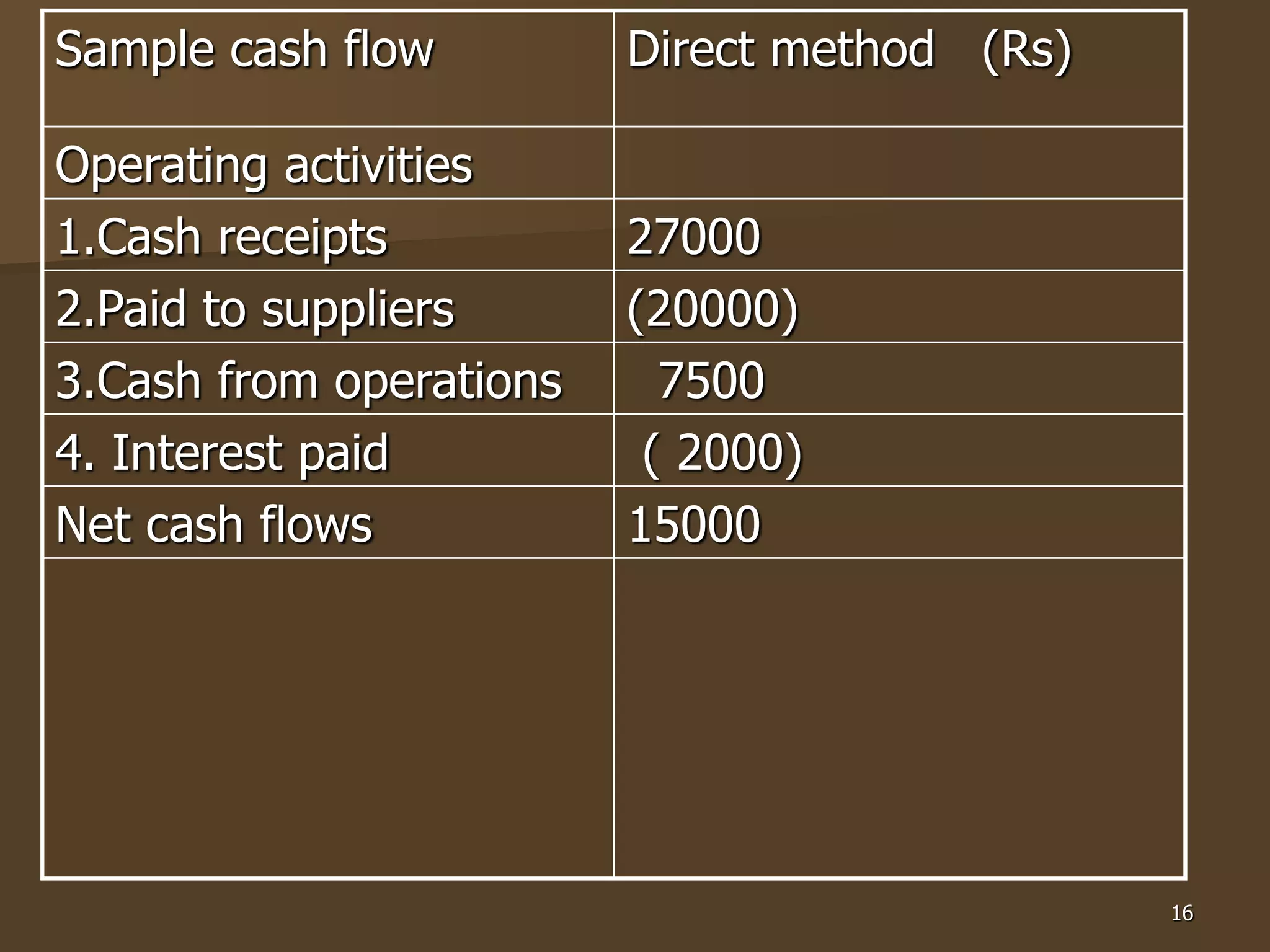

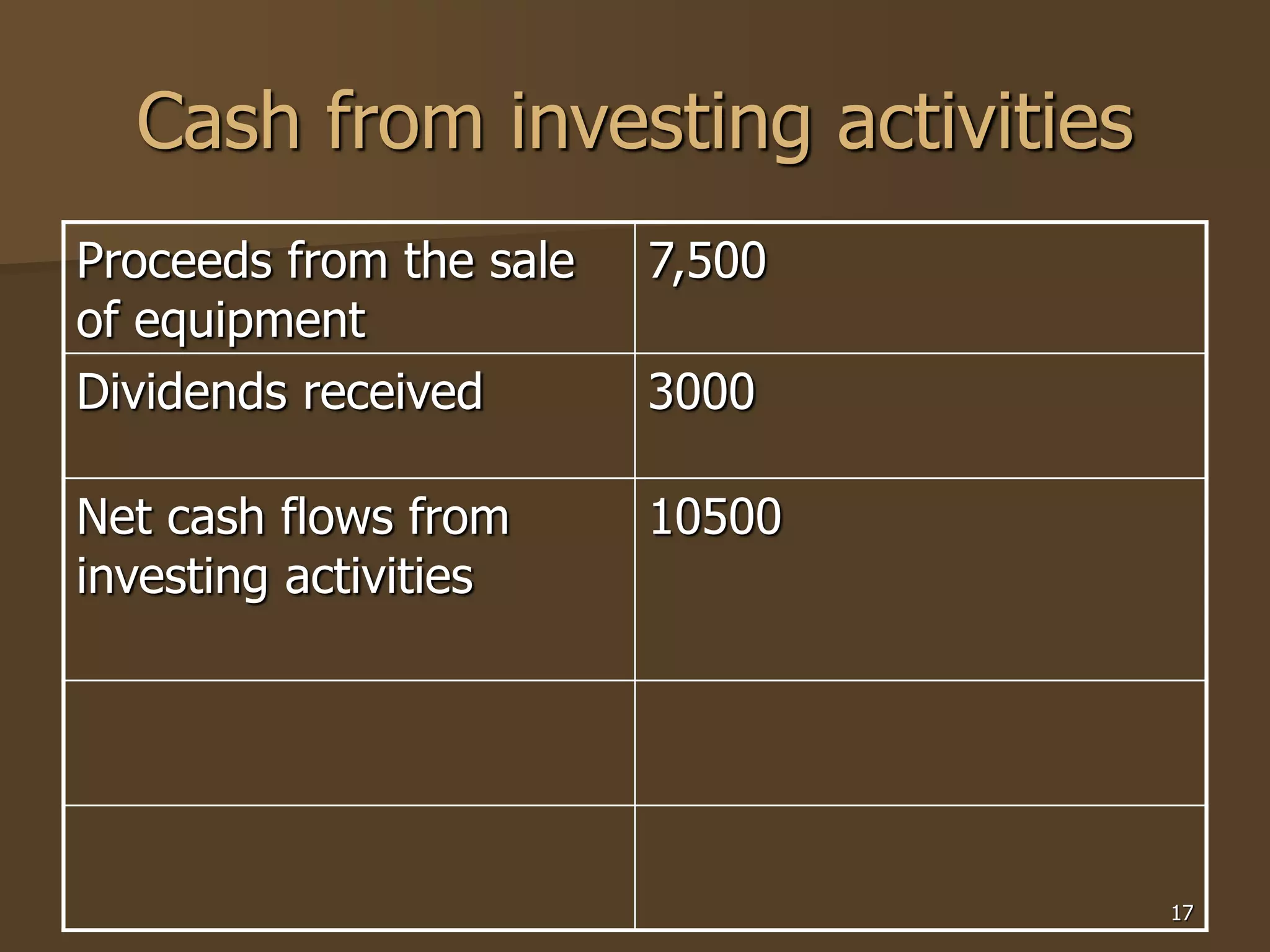

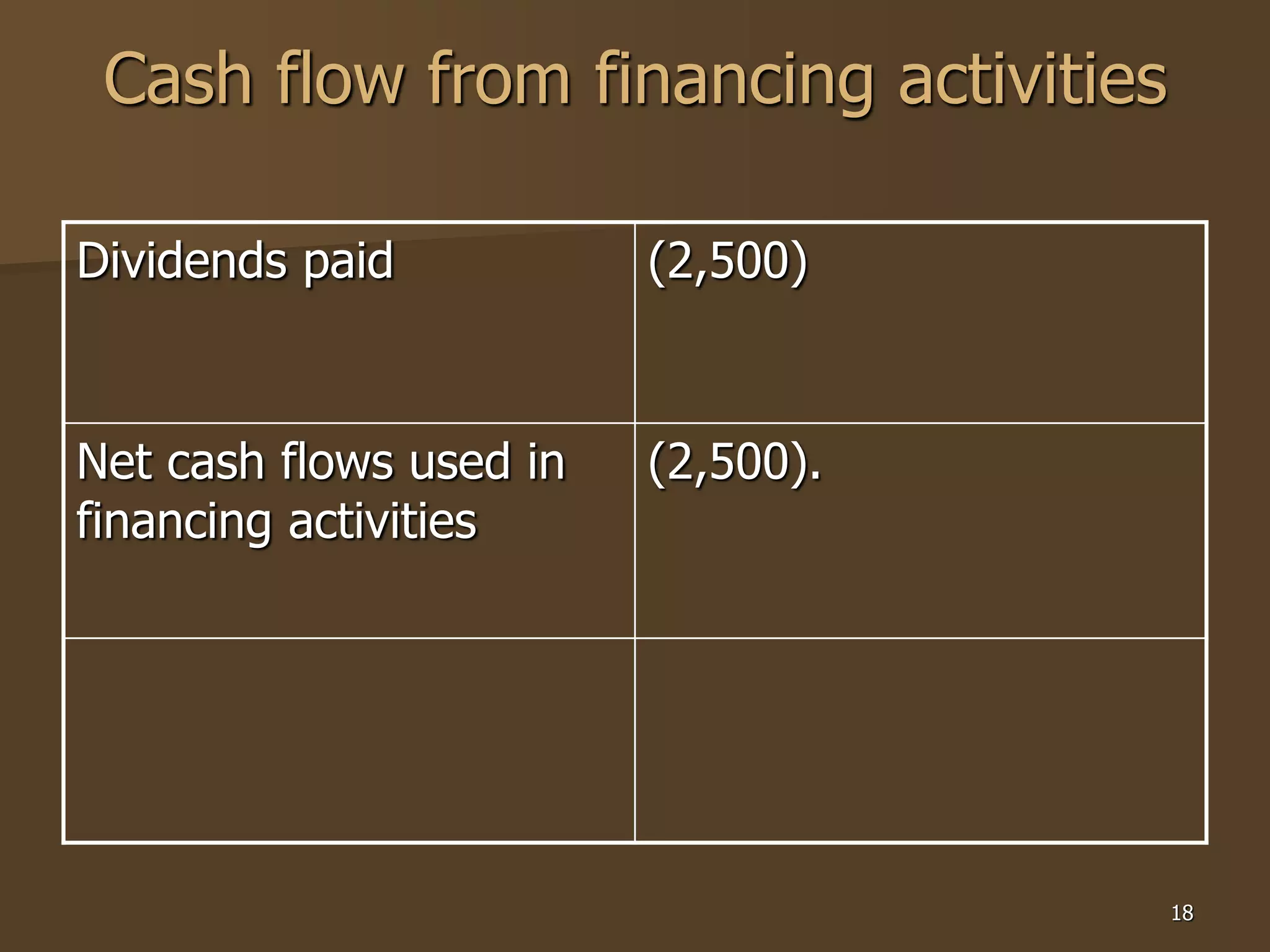

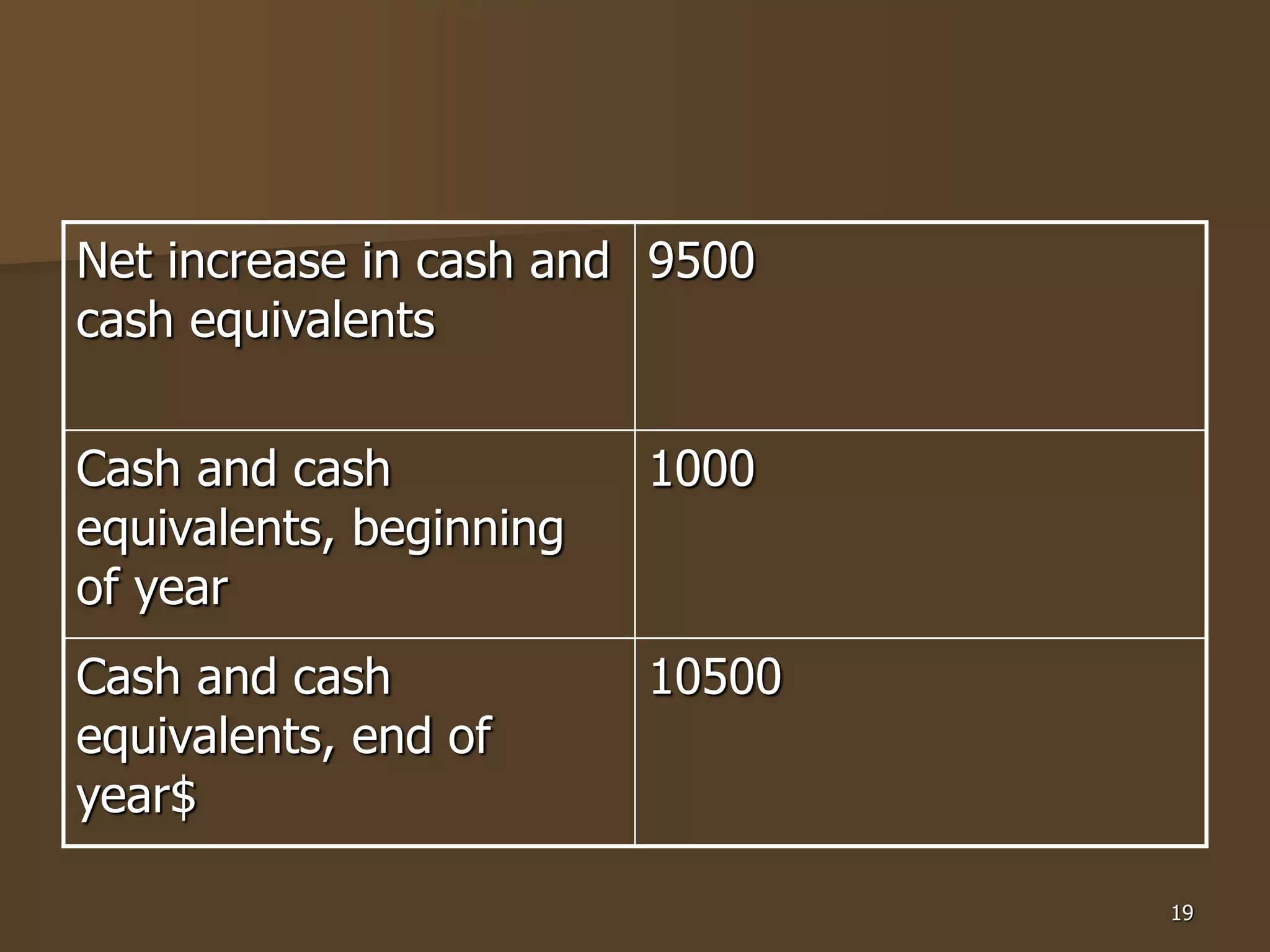

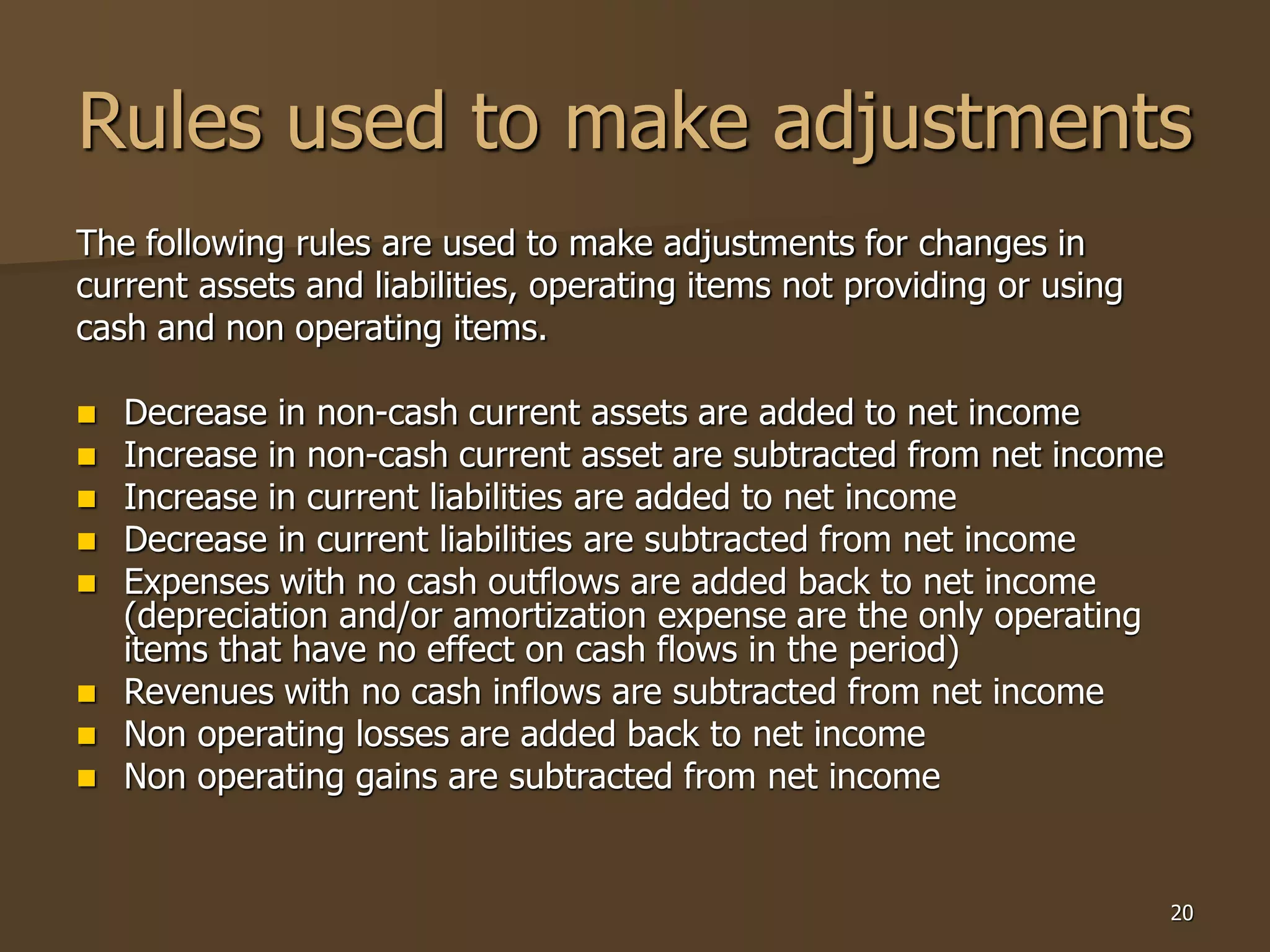

This one-day seminar on assessing borrower's financial position through cash flow analysis will be held on September 23, 2010. It will be presented by Khalid Sultan Anjum from Habib Bank Ltd. The objective is to establish awareness of the importance and purpose of cash flow analysis, how to classify cash transactions in a statement of cash flows, and how to compute major cash flows relating to investing, financing, and operating activities using the indirect method. The seminar will cover topics such as the definition of cash flow, cash flow analysis, the cash flow cycle, cash flow forecasting, the cash flow statement, uses of the cash flow statement, and liquidity and solvency ratios for assessing financial position. Early