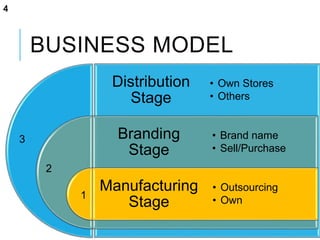

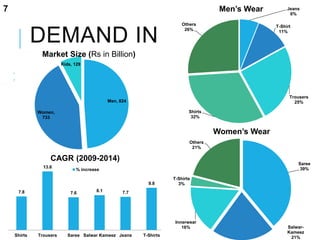

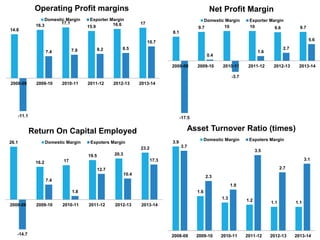

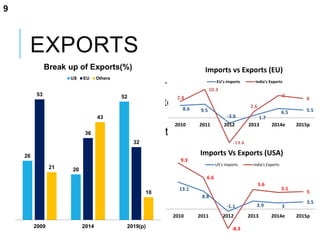

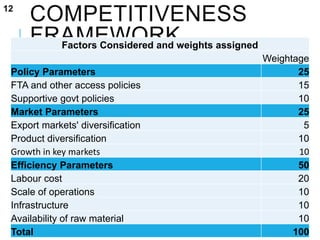

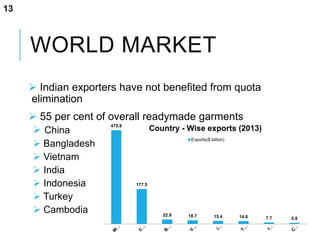

The document discusses the ready-made garments industry in India. It provides an overview of the industry, including business models, distribution channels, demand trends, financial performance, exports, manufacturing process, and policies. It analyzes factors influencing competitiveness such as labor costs, scale of operations, and trade agreements. While India is a major garment exporter, its market share has stagnated as countries like China and Bangladesh have more competitive cost structures and preferential trade agreements. To increase exports, the document recommends diversifying products and markets, expanding scale, improving labor costs through reforms, and entering new trade agreements.