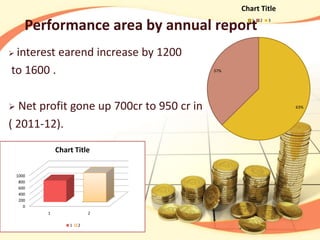

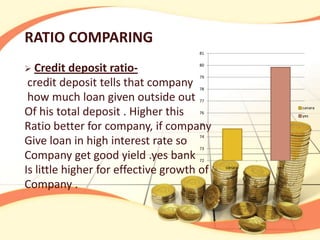

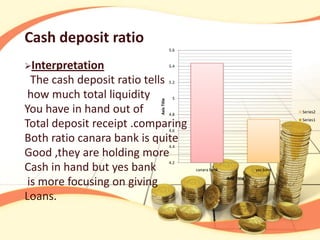

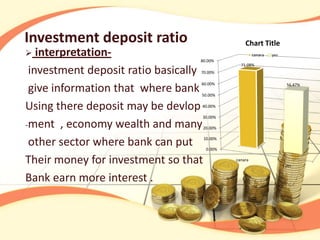

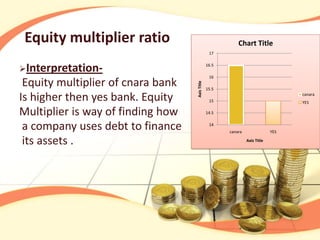

This document compares the performance of Canara Bank and Yes Bank over 2011-2012 based on various financial ratios. Canara Bank's total deposits grew 11.5% to over Rs. 327054 crores in 2012. Yes Bank focuses on establishing 900 branches and over 2000 ATMs by 2015. Canara Bank has a higher credit deposit ratio and cash deposit ratio, indicating more loans given and liquidity held. Yes Bank has a higher investment deposit ratio, focusing more on investments. Canara Bank has a higher equity multiplier ratio, using more debt to finance assets. Overall, both banks are growing their core businesses while focusing on deposits and long-term investments.