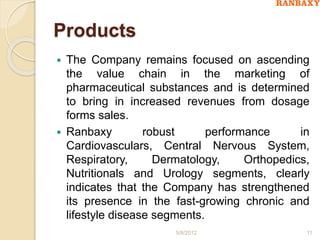

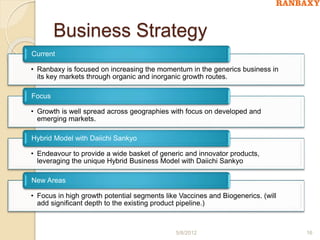

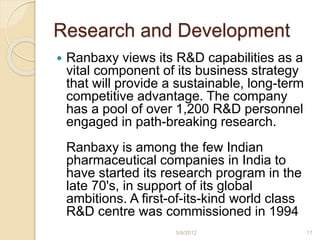

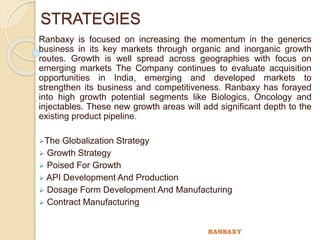

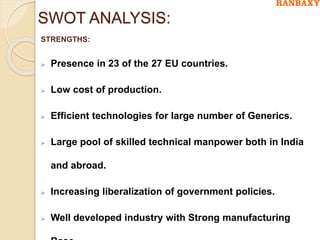

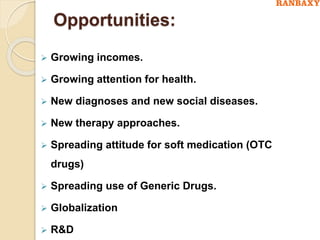

Ranbaxy is India's largest pharmaceutical company with a global footprint in 43 countries. It has a diverse product portfolio and strong R&D capabilities. In 2011, Ranbaxy recorded global sales of $2.1 billion, with emerging and developed markets each contributing around 47% and 46% respectively. Ranbaxy aims to grow organically and inorganically, focusing on high-growth areas like biologics and injectables. It also has a hybrid business model through its alliance with Daiichi Sankyo to create an innovator and generic powerhouse. Ranbaxy emphasizes R&D as a strategic priority and has over 1,200 personnel dedicated to research.