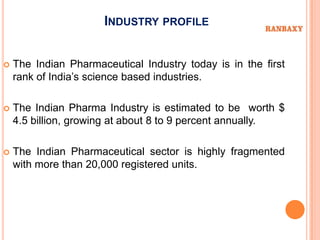

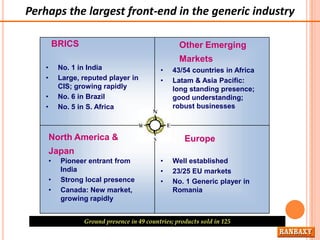

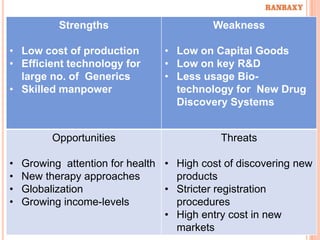

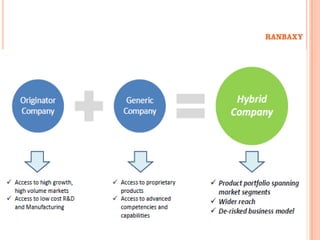

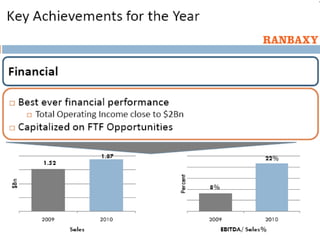

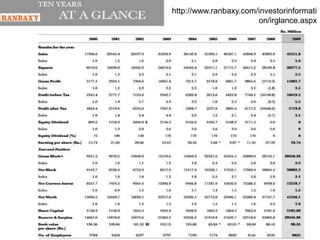

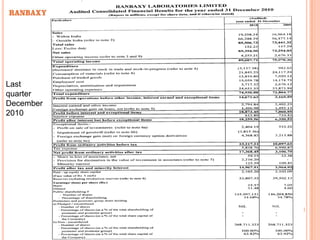

This document provides information about Ranbaxy Laboratories Limited, including its group members, industry profile, company profile, vision, mission, and key areas like marketing, HR, finance, and recent news. It discusses that Ranbaxy is India's largest pharmaceutical company, ranked 8th globally in generics. It has manufacturing in 11 countries and a presence in 49 countries. The company aims to achieve customer satisfaction and be a responsible corporate citizen.